2 Equities Continue Decades of Dividend Hikes with Another 4%-Plus Payout Boost

By: Ned Piplovic,

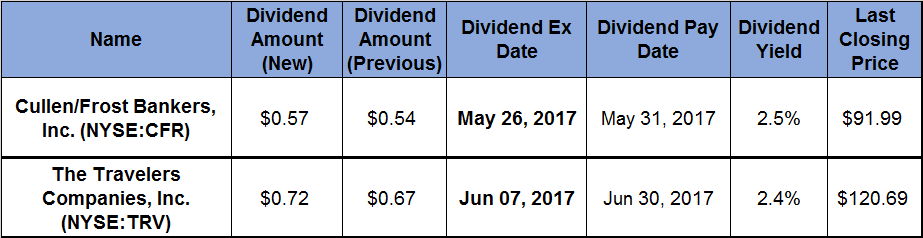

A regional bank and a global insurance provider are extending their records of boosting annual dividend payouts with announced dividend hikes of 5.6% and 7.5%, respectively, which yield around 2.5%.

The current quarterly boost is just the most recent in a long record of dividend hikes for these two companies. Over the past 20 years, there is only one dividend decrease for combined records of the two companies.

In addition to the steady dividend income, both equities have rewarded their shareholders with a stable share price growth over the past five years. With ex-dividends in late May and early June, investors have plenty of time to do their own research and consider taking a position in one or both of these equities for dividend income and asset appreciation.

Cullen/Frost Bankers, Inc. (NYSE:CFR)

Cullen/Frost Bankers, Inc. operates as the holding company for Frost Bank that offers commercial and consumer banking services in Texas. Through its two segments, Banking and Frost Wealth Advisors, the bank offers consumer and commercial banking services. The services include checking accounts, savings programs, automated-teller machines (ATMs), installment and real estate loans, home equity loans and lines of credit, drive-in and night deposit services, safe deposit facilities and brokerage services. The bank also provides international banking services, such as issuing letter of credits, handling foreign collections, transmitting funds and dealing in foreign exchange. Currently, the company operates more than 130 financial centers and approximately 1,200 ATMs in Texas. Cullen/Frost Bankers, Inc., founded in 1868, is headquartered in San Antonio, Texas.

The company boosted its quarterly dividend distribution 5.6% from $0.54 to $0.57. The current quarterly payout converts to a $2.28 annual amount and a 2.5% yield. Over the past 20 years, the bank increased its annual dividend payout six-fold by growing its dividend at an average rate of almost 9.5% every year.

The share price rose 65% without any significant volatility between May 2016 and its 52-week high in late April 2017. Over the last couple of weeks, the price dropped 5.7% and is currently trading around $92, which is still 54% above the May 2016 share price.

The Travelers Companies, Inc. (NYSE:TRV)

The Travelers Companies, Inc., provides a range of commercial, personal, property and casualty insurance products to businesses, government units, associations and individuals worldwide. Through its three main business segments, Business and International Insurance, Bond & Specialty Insurance and Personal Insurance, the company offers a big selection of insurance products, such as general liability, automobile, workers’ compensation, personal property, employers’ liability, public and product liability, professional indemnity and homeowners insurance to individuals. The company distributes its products primarily through independent agencies and brokers. Founded in 1853, the company’s global headquarters is in New York, New York.

Following the convention of boosting its quarterly dividend payouts in the second quarter, after the year-end results, Travelers increased its dividend distribution 7.5% from $0.67 to $0.72, which is equivalent to a $2.88 annual payout and a 2.4% yield. The company has been paying a dividend since 1990. Over the past 20 years, it has lowered its annual dividend only once. Since the last dividend drop in 2005, the company has hiked its annual dividend every year at an average annual growth rate of more than 10%.

After experiencing some volatility from May to December 2016, which included a 10% price drop between September and October, the stock price has traded relatively flat around $120 since January 2017. As of May 10, 2017, the price has gained 16.7% from the November low. The current share price of $120.69 is 3.8 % below the 52-week high from March 2017 and 3.2% above the May 2016 price level.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic