2 Equities Offer 3%-Plus Yields and Continue Dividend Boosts for More Than a Decade

By: Ned Piplovic,

A national baking goods producer and a regional banking services provider have been rewarding their shareholders with more than a decade of consecutive dividend boosts and currently offer yields of more than 3%.

The current yields for both companies have risen 20% to 30% above their respective average yields over the past five years because of the steady dividend boosts. While share prices for these two equities have not returned stellar performances over the past year, the long-term outlook is more positive.

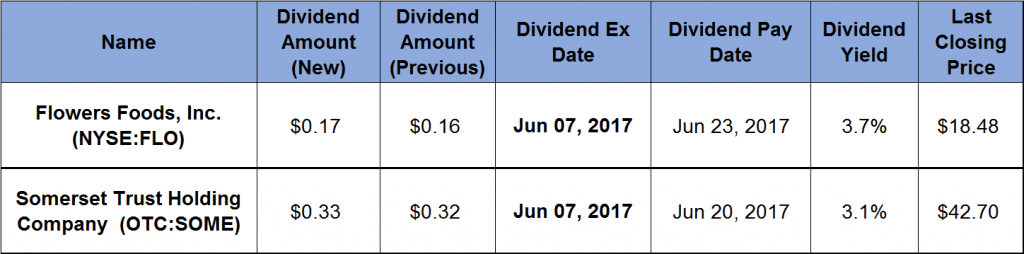

Investors interested in these two securities should waste no time, as ex-dividend dates for both companies are next week on June 7, 2017.

Flowers Foods, Inc. (NYSE:FLO)

Flowers Foods, Inc. produces and markets bakery products in the United States through two business segments, Direct-Store-Delivery (DSD) and Warehouse Delivery. The DSD segment produces and markets fresh bakery foods, including fresh breads, buns, rolls and snack cakes primarily under the Nature’s Own, Wonder, Cobblestone Bread Company and Tastykake brand names. This business segment operates 39 bakeries and sells its products through a network of independent distributors to retail and foodservice customers. The Warehouse Delivery segment produces snack cakes, breads and rolls for national retail, foodservice, vending and co-pack customers through a network of warehouse channels. This segment markets its products under the Mrs. Freshley’s, Alpine Valley Bread and European Bakers brand names and sells products under franchised and licensed trademarks and brand names, such as Sunbeam and Sara Lee. The company, known as Flowers Industries before 2001, was founded in 1919 and is headquartered in Thomasville, Georgia.

The share price lost about 23% in August and September 2016, but has recovered fully since then. At its closing on May 31, 2017, the share price is back and trading at the same level as it was in early June 2016. Over the past five years, the share price rose almost 20%.

The one-cent dividend bump from $0.16 to $0.17 for the current quarter is just the latest in a series of 14 consecutive dividend boosts to the annual payout. The current quarterly dividend converts to a $0.68 annual payout and a 3.7% yield, which is more than 30% above the company’s average yield over the past five years. Over the past 14 years of consecutive dividend boosts, the company improved its annual dividend at an average rate of 18.2% per year. Consequently, the current annual payout has risen more than 10-fold since 2013.

Somerset Trust Holding Company (OTC:SOME)

Somerset Trust Holding Company operates as the holding company for Somerset Trust Company, which provides community banking products and services in Pennsylvania. The company’s standard financial services include checking accounts, savings and money market accounts, certificates of deposit, individual retirement accounts, credit cards, debit cards and various types of loans, such as home equity loans, mortgage loans, personal loans, vehicle loans, mobile homes loans and personal lines of credit. Additionally, the company provides employee benefits services, card payment services, interim financing and agriculture lending. Founded in 1889, the company is headquartered in Somerset, Pennsylvania, and operates 32 branches.

The share price traded in the $41 to $48 range without any significant volatility and with a slight uptrend, during the past 12 months. The current price as of May 31, 2016, is 1.7% above the June 2016 levels. However, over the past five years, the share price rose more than 50%.

The dividend distribution rose 3.1% from $0.32 to $0.33 for the current quarter, which is equivalent to a $1.32 annual payout and a 3.1% dividend yield. The current yield rose over the past few years and is almost 19% higher than the company’s five-year average yield of 2.6%. The average annual dividend boost of 9.7% every year for the past 14 consecutive years enhanced the company’s annual payout by almost 270%.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic