2 Financial Equities Hike Quarterly Dividends and Produce Double-Digit Percentage Returns

By: Ned Piplovic,

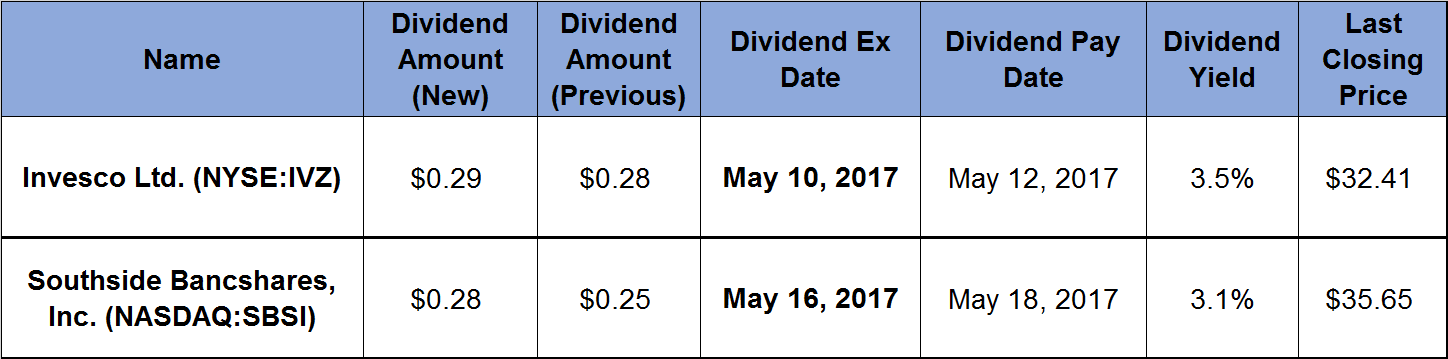

Two mid-cap financial services companies that boosted their quarterly dividends by 12% and 3.6%, respectively, offer dividend yields in excess of 3% and have boosted their share prices by more than 10% in the past 12 months.

Investors looking to add small-cap and mid-cap financial sector equities to their portfolios should take a closer look at these two companies. With a record of consistently hiking their regular dividend payout for the past eight and 19 years, as well as 40%-plus share price growth over the past five years, these securities could be welcome additions to a well-balanced portfolio.

Both equities are opportunities for a quick income payout, as Ex Dividends are on May 10, 2017, and May 16, 2017, with pay dates following just two days after each respective ex dividend date.

Invesco Ltd. (NYSE:IVZ)

Invesco Ltd. is a publicly owned investment manager that offers a variety of financial services. The firm launches and manages mutual funds, exchange-traded funds and private funds. The company invests in public equity, fixed income, commodities and currencies markets across the globe. Investco provides its services to a variety of clients, such as retail clients, institutional clients, high-net worth clients, public entities, corporations, unions, non-profit organizations, endowments, foundations, pension funds, financial institutions and sovereign wealth funds. Founded in December 1935, Invesco Ltd. is based in Atlanta, Georgia, with an additional office in Hamilton, Bermuda.

The company extended its rising dividends record by boosting its quarterly dividend 3.6% from $0.28 to $0.29 again for 2017. The annualized distribution of $1.16 converts to a 3.5% dividend yield. Since starting to pay a dividend in 2008, the company had to lower its payout only once. After the dividend reduction in 2009, the dividend has risen at an average rate of 14% every year for the past eight years.

The share price experienced a 27% drop between May 2016 and the end of June 2016. However, the price bounced back quickly and returned to May 2016 levels by August 1, 2016. Since August, the share price has been fluctuating mostly between $28 and $32. As of early May 2017, the share price is trading a little above $32, which is just 3.2% below the 52-week high and 10.7% above the share price one year ago.

Southside Bancshares, Inc. (NASDAQ:SBSI)

Southside Bancshares, Inc. operates as a bank holding company for Southside Bank. The company provides a range of common banking and financial services to individuals, businesses, municipal entities and nonprofit organizations. Its deposit products include savings, money market, interest and non-interest bearing checking accounts, as well as certificates of deposit.

In addition, the bank offers private and commercial loans, municipal loans, as well as construction loans for 1-4 family residential and commercial real estate. Southside Bank also offers trust services consisting of investment management, administration, advisory services, safe deposit services and brokerage for individuals, partnerships and corporations. With approximately $5.6 billion in assets, Southside Bank operates 60 banking facilities, 25 motor banks and 70 local ATMs throughout Texas.

The most recent regular dividend payout rose 12% from $0.25 to $0.28. The current quarterly distribution is equivalent to a $1.12 annual payout per share and a 3.1% dividend yield. In addition to its regular quarterly dividend distribution, SBSI has paid a special year-end dividend every year since 2004. Over the past 19 consecutive years, the company has increased its total annual dividend amount by an average rate of almost 15% annually.

The share price gained 34% between May and early December2016, when it reached its 52- week high. After the December peak, the share price pulled back 21% by mid-April. Since mid-April 2017, the share price has been on an uptrend and has risen 12%. As of early May 2017, the share price fell 8.3% below the December peak, but stayed 23.1% higher than the price in May 2016.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox. In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic