2 Funds Offer 7%-Plus Yields, 8%-Plus One-Year Asset Appreciation

By: Ned Piplovic,

Two income-focused funds reward their investors with 7.2%-plus dividend yields to go along with their respective one-year asset appreciation of 8.1% and 14.7%.

Over the past five years, the two funds increased share prices by more than 70%. Since 2013, the funds also hiked their annual dividend distribution at average growth rates exceeding 5.5% per year.

The ex-dividend dates are just around the corner early next week on July 17, 2017 and July 20, 2017. If you want to collect the next dividend payment, buy the shares before the ex-dividend date for each fund.

Cohen & Steers REIT and Preferred Income Fund Inc (NYSE:RNP)

Cohen & Steers REIT and Preferred Income Fund is a closed-end fund. The fund’s primary investment objective is high current income through investment in real estate and diversified preferred securities. Real estate securities include securities of any market capitalization issued by real estate companies – including real estate investment trusts (REITs) – and preferred securities issued by U.S. and non-U.S. companies. As of March 31, 2017, the fund had $1.4 billion of assets under management spread across nearly 200 individual holdings. The top five holdings were Simon Property Group Inc. (NYSE:SPG), Prologis Inc. (NYSE:PLD), Equinix Inc. (NASDQ:EQIX), Extra Space Storage Inc. (NYSE:EXR) and Vornado Realty Trust (NYSE:VNO). While apartment and office securities were the top two sectors represented among REIT holdings, banking and insurance were the top two sectors representing non-REIT holdings.

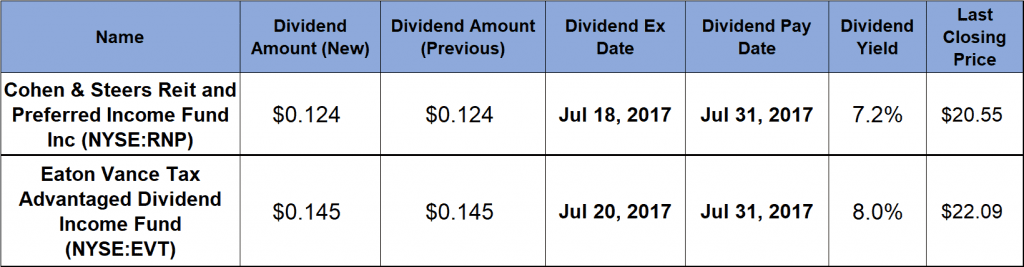

The fund’s current $0.124 monthly dividend converts to a $1.488 annual payout and a 7.2% dividend yield. The fund started paying a dividend in 2003 and doubled its annual payout just four years later. After that promising start, the company cut its annual payout three years in a row – 2007, 2008 and 2009 – and then distributed a flat dividend between 2008 and 2012. However, since the fund resumed boosting dividends in 2013, the annual dividend grew at an average annual rate of 5.5% for the last four years.

The share price experienced an unusual 16.5% spike between April and July 2016. However, the share price fell back to April levels by the beginning of November 2016. Since November 1, 2016, the share price rose 6% to close at $20.55 on July 12, 2017. Over the last five years, the share price experiences a 71% asset appreciation.

Eaton Vance Tax Advantaged Dividend Income Fund (NYSE:EVT)

The Eaton Vance Tax Advantaged Dividend Income Fund is a closed-end fund that invests primarily in dividend-paying common and preferred stocks and seeks to distribute a high level of dividend income that qualifies for favorable federal income tax treatment. As of March 31, 2017, more than 70% of the fund’s $1.6 billion in net assets were invested in U.S. common stocks, about 10.5% in preferred stocks, almost 9.5% in high yield corporate bonds, 3.5% in exchange-traded funds (ETFs) and about 1.2% in foreign common stocks. More than one-third of fund’s assets are in financials, energy, health care and industrials. They combine to account for approximately 9% each. Additionally, the fund’s geographic representation features almost 91% of securities from North American, 6.5% from Europe and 2.5% from the rest of the world.

The fund offers a $1.74 annualized distribution through $0.145 monthly payments, which convert to an 8% yield. This yield is 8.05% higher than the 7.29% straight average yield for the entire REITs sector. After boosting its annual dividend payout 45% from $1.29 to $1.868 between 2003 and 2008, the fund cut its dividend back to the $1.29 level in 2009 and kept it at that level for the following five years. The fund resumed its dividend enhancements in 2013 and hiked its annual payout over the following three years at a 10.5% average annual growth rate.

Following an initial 3.7% drop between mid-July and the end of October 2016, the share price recovered to gain almost 21% and reach its new 52-week high on March 1, 2017. Since the March peak, the share price pulled back about 0.8% and closed at $22.09 on July 12, 2017. However, that closing price is almost 16% above the July 2016 share price and 94% higher than five years ago.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic