2 Guggenheim Investments Funds Pay Monthly Dividends and Offer 9%-Plus Yields

By: Ned Piplovic,

Two mutual funds from Guggenheim Investments reward their shareholders with enticing 9%-plus dividend yields and monthly dividend distributions.

In addition to the outstanding dividend income, both funds increased their share prices by double-digit percentages over the last year.

If either of the funds fits into your investment portfolio strategy, you should act quickly to collect the next dividend payment since the ex-dividend date for both funds is April 11, 2017.

Guggenheim Credit Allocation Fund (NYSE:GGM)

Guggenheim Credit Allocation Fund is a closed-end fund that seeks investment returns through a combination of current income and capital appreciation. Aside from 2.21% of net assets allocated to common stocks, the fund’s assets are invested in several types of fixed income securities. As of January 31, 2017, the three security types with the highest concentrations were high-yield corporate bonds with a 53.15% share, bank loans with a 29.66% share and asset-backed securities with a 10.36% share. Commercial mortgage-backed securities, investment grade corporate bonds, preferred securities and private placements account for less than 5% share. The portfolio’s weighted average duration is currently 2.05 years.

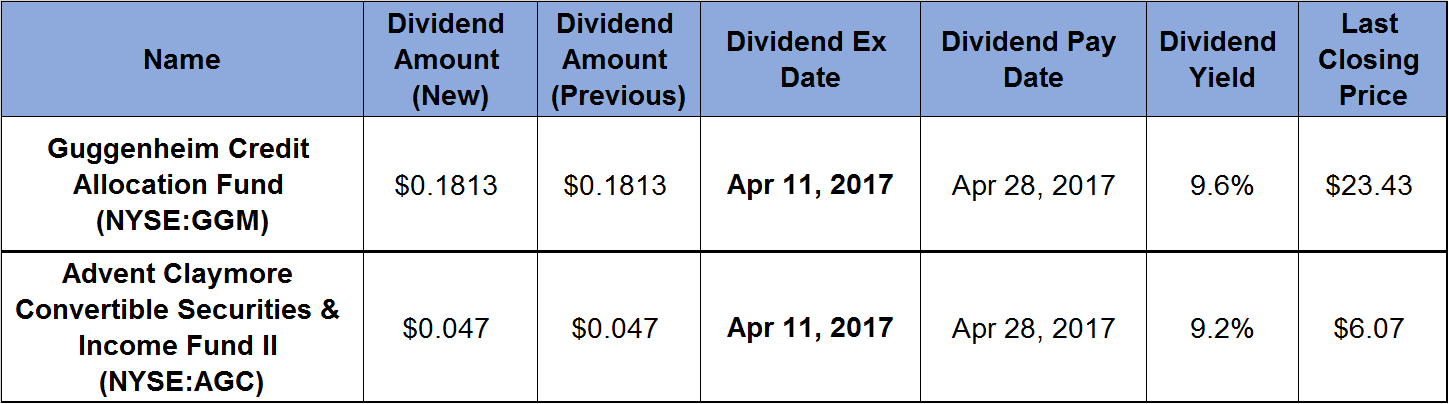

The fund has been paying the current monthly dividend of $0.1813 since August 2014. The annual $2.18 payout translates to a 9.6% yield.

After rising 24% between April and the beginning of October 2016, the share price dropped 13% by mid-November. After the November drop, the share price recovered and rose 4% above the early-October levels to reach its 52-week high by the end of February 2017. The price pulled back slightly since February and is currently trading about 2% lower than the 52-week high and almost 22% higher than the price from April 2016.

Advent Claymore Convertible Securities & Income Fund II (NYSE:AGC)

Advent Claymore Convertible Securities & Income Fund II is a closed-end fund that invests in domestic and international debt securities. As of January 31, 2017, the fund had two-thirds of its $336 million net assets invested internationally and one-third domestically. Most of the fund’s assets were split between two types of investments – convertible corporate bonds with 46.67% share and high yield corporate bonds with 37.64% share. Health Care, technology and financials were the top three sectors represented in the portfolio. These three sectors combined accounted for almost half of total net assets. The top 10 holdings include corporate bonds of Frontier Communications Corporation (NASDAQ:FRT), Dish Network (NASDAQ:DISH), Chesapeake Energy Corporation (NYSE:CHK), Teva Pharmaceutical Industries Ltd. (NYSE:TEVA) and Air France – KLM (Euronext:AF).

The fund has been paying a consistent dividend over the last five years. The $0.047 monthly dividend converts to a $0.564 annual payout per share and a 9.2% yield.

The share price traded between $5.35 and $5.90 with some volatility from April to mid-November 2016 when it dropped to its 52-week low. After the November low, the share price rose almost 20% to reach its 52-week high by the middle of February. Since the February peak, the price dropped a little and is currently trading about 6% below its February high. However, the current share price is still 12.6% higher than the share price in April 2016.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic