2 Manufacturers Offer Above-Average Dividend Yields and 15%-Plus 12-Month Asset Appreciation

By: Ned Piplovic,

Two manufactures of diversified machinery increased their share prices more than 15% over the past 12 months and offer dividend yields that are more than twice the sector average.

Both companies have rewarded their shareholders with long-term growth of annual dividend payouts and their current dividend yields exceed their respective average dividend yields over the past five-years. Steady asset appreciation has complemented the rising dividend income over the past several years for each company.

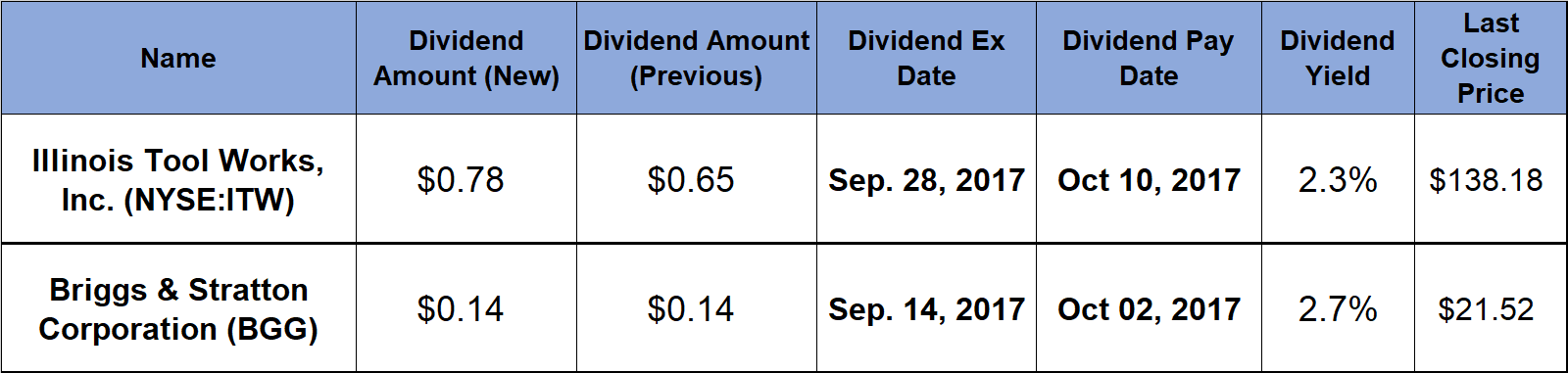

The ex-dividends for these stocks are in mid-to-late September with pay dates following closely thereafter in early October.

Illinois Tool Works, Inc. (NYSE:ITW)

Headquartered in Glenview, Illinois and founded in 1912, the Illinois Tool Works Inc. manufactures and sells industrial products and equipment through seven business segments: Automotive OEM, Test & Measurement and Electronics, Food Equipment, Polymers & Fluids, Welding, Construction Products and Specialty Products. The company’s portfolio of products includes plastic and metal components for automotive-related applications, equipment, consumables and related software for testing and measuring of materials and structures, as well as commercial food processing, cooking, and refrigeration equipment. Additionally, the company produces adhesives, sealants, lubrication and cutting fluids, arc welding equipment and engineered fastening solutions. The company distributes its products directly to industrial manufacturers, as well as through independent distributors.

The Illinois Tool Works Inc. has been raising its annual dividend distributions for the past 53 years, which makes it a member of the Dividend Aristocrats. Dividend Aristocrats is an exclusive group of about 50 S&P 500 stocks that boosted dividends for at least the past 25 consecutive years and have a market cap of at least $3 billion.

The company’s current $0.78 quarterly dividend is 20% higher than the previous quarter’s $0.65 payout. On an annualized basis, the total dividend payout of $3.12 converts to a 2.3% yield. While the 2.3% yield might be on the low end among the dividend yields for the entire market, it is 115% higher than the straight average yield for all companies in the Diversified Machinery Industry sector.

Additionally, the current yield is 14% higher than the company’s 2.0% average of the company’s dividend yilelds over the past five years. Over the past two decades, the dividend grew at an average annual rate of 13.7% and rose 13-fold in the last 20 years. The company’s current dividend payout ratio of 42% is a good indication that ITW will be able to continue hiking its annual dividend distributions in the long run.

In addition to providing a steady dividend income, the company has rewarded its shareholders with stable assets growth for decades. While the share price dropped 8% since its 52-week high of $150.29 in mid-June 2017, the price rose 19.3% over the past 12 months. In the past five years, the share price grew 125%.

Briggs & Stratton Corporation (NYSE:BGG)

Founded in 1908 and headquartered in Wauwatosa, Wisconsin, the Briggs & Stratton Corporation designs, manufactures and sells gasoline engines for outdoor power equipment to the original equipment manufacturers through its Engines and Products segments. The Engines segment offers four-cycle gasoline engines that are used primarily by the lawn and garden equipment industry. The company’s Products segment provides a line of portable and standby generators, pressure washers, snow throwers, lawn and garden power equipment, turf care and job site products. In addition to selling products under its own Briggs & Stratton, Simplicity, Snapper, Snapper Pro, Ferris, PowerBoss, Allmand, Billy Goat, Murray, Branco and Victa brands, BGG also provides Craftsman and Troy-Bilt branded products under licensing and partnership agreements. While the United States is company’s largest market, Briggs & Stratton also exports its products to customers in Canada, Asia Australia and the European Union.

Currently, the company pays a $0.14 quarterly dividend, which translates to a $0.56 annual distribution and a 2.7 dividend yield. This yield rates exceeds the company’s five-year average yield by 3.6%.

The Briggs & Stratton Corporation started paying a dividend back in 1929. Between 2006 and 2008 the company did not raise its annual dividend and then had to cut the dividend in half over the subsequent years. However, since the dividend cuts in 2009 and 2010, the company hiked its dividends for the past six consecutive years. In that period, the company boosted its annual dividend payout at an average rate of 4.1% per year.

While the company’s share price experienced considerable volatility and grew only 9% over the past five years, it rose more than 15% over the past 12 months. In mid-April 2017, the share price dropped 12% in a single trading session following a release of quarterly financial data, which revealed that the company missed its estimates. Since that significant drop, the share price increased 2% and closed on September 7, 2017, at $21.52, which is 15.2% higher than it was 12 months ago.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions, changing dividend yields and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic