2 Real Estate Equities Offer 20%-Plus One-Year Asset Appreciation and Steady Rising Dividends

By: Ned Piplovic,

Two non-residential Real Estate Investment Trusts (REITs) have rewarded their investors with asset appreciation of more than 20% over the past year, rising dividends and dividend yields around 3%.

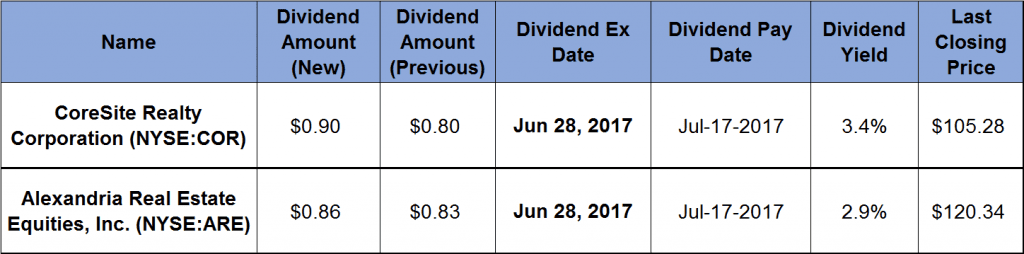

In addition to the one-year share price growth, both stocks have performed well over the past five years with share price increases of 64% and 295%, respectively. The ex-dividend date for these equities is June 28, 2017, followed by the same July 17 pay date for both stocks.

CoreSite Realty Corporation (NYSE:COR)

Headquartered in Denver and founded in 2010, the CoreSite Realty Corporation builds, owns and manages networking, storage and communications technology infrastructure data centers. The company serves telecommunications carriers, content and media entertainment providers, cloud providers, enterprise customers, financial organizations, educational institutions and government agencies.

CoreSite Realty Corporation operates data centers in Los Angeles, San Francisco’s Bay area, Chicago, Boston, New York City, Miami and northern Virginia. As of June 2017, the company’s property portfolio included almost 20 operating data center facilities. The company is qualified as a real estate investment trust (REIT) under the Internal Revenue Code.

The current quarterly dividend rose 12.5% from $0.80 to $0.90. Assuming another $0.90 dividend per share in the fourth quarter, the annual dividend amount is on track to be $3.60 for 2017, which is equivalent to a 3.4% yield at the current price of around $105 per share.

CoreSite has increased its dividend once every year in the first quarter since it started paying a dividend in 2010. However, the current quarterly dividend boost is the second hike this year, after the company already hiked its quarterly payout 51% in the first quarter.

Since 2010, the company has boosted its annual dividend payout by an average rate of 38% every year, increasing the annual distribution amount almost 600% over the past seven years.

The share price dropped 22% between June and November 2016 when it reached its 52-week low. However, the price rose more than 62% since early November 2016. It currently is trading at an all-time-high level of around $105, which is 27% higher than the June 2016 price and almost 300% higher than the price from five years ago.

Alexandria Real Estate Equities, Inc. (NYSE:ARE)

Alexandria Real Estate Equities, Inc. is a real estate investment trust (REIT) that develops, owns, operates and manages properties specifically for the life sciences industry. Its properties consist of buildings containing scientific research and development laboratories.

The company offers its properties for lease primarily to universities and independent not-for-profit institutions. Additionally, the REIT provides facilities to pharmaceutical, biotechnology, medical device, life science product, service and biodefense research entities, as well as governmental agencies.

As of March 2017, the company owned and managed more than 150 facilities in the United States and three facilities in Canada with a combined available floor space of more than 30 million square feet. Founded in 1993, Alexandria Real Estate Equities, Inc. is headquartered in Pasadena, California.

The company continued its rising dividends record with a 3.6% hike from $0.83 to $0.86 to its quarterly distribution. This quarterly payout translates to a $3.44 annual dividend distribution and a 2.9% yield. The REIT started paying a dividend in 1997 and has lowered its annual distribution only twice over the past two decades. Since the last dividend drop in 2009, the company has enhanced its annual dividend for the past seven years at an average growth rate of 13.7% every year.

The share price grew without major volatility since June 2016 and is currently trading above $120 per share, which is 22% higher than the June 2016 price and 64% over the past five years.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic