2 Tech Giants Boost Dividend Payouts, Offer Yields More Than Double Sector Averages

By: Ned Piplovic,

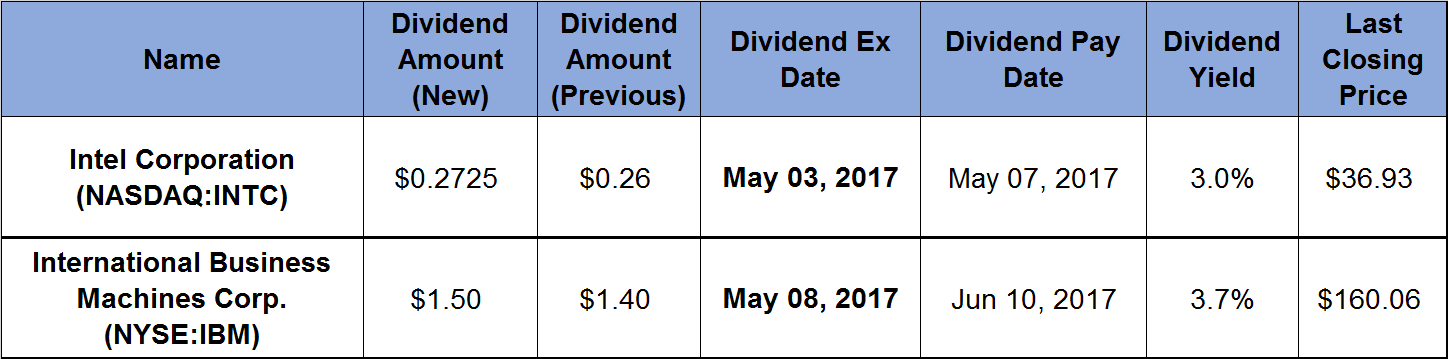

Two technology companies boosted their dividend payouts 4.8% and 7.1%, respectively, to continue growing their dividend distribution amounts over the long term.

In addition to dividend hikes, these two equities reward their investors with yields that are substantially higher than the 1.32% yield average for the technology sector. While neither of these equities will generate extraordinary returns overnight, both stocks are steady performers over the long run and should be considered for inclusion in every portfolio for a balanced benefit of steady dividend income and asset appreciation.

The ex-dividend date for one of these equities is Wednesday on May 3, 2017, with the other ex-dividend following just five days later, on May 8, 2017.

Intel Corporation (NASDAQ:INTC)

Intel Corporation (INTC) designs and manufactures microprocessors that process system data and controls, along with other devices in the system, chipsets that send data between the microprocessor and various peripherals and accessories, as well as computer, networking and communications platforms worldwide. Intel also develops and produces flash memory products primarily for use in solid-state drives, security software products, programmable semiconductors and related products for communications, data center, industrial, military and automotive market segments.

The company’s current dividend hike of 4.8% raises the quarterly dividend distribution to $0.2725. The annualized dividend payout of $1.09 is equivalent to a 3% dividend yield. For the past 20 years, the company has failed to hike its annual dividend distribution only three times. Since 1997, the payout has been compounding at an average rate of almost 20% annually. Consequently, the 2017 annual distribution is almost 40-fold larger than the 1997 payout.

While experiencing some volatility, the share price rose almost 35% between April 2016 and its 52-week high at the end of January 2017. Since the January peak, the share price dropped 4% and is currently 30% higher than the price one year ago.

International Business Machines Corp. (NYSE:IBM)

International Business Machines Corporation (IBM) provides information technology (IT) products and services worldwide. The company offers data and analytics solutions, transaction processing software, business consulting services, servers and data storage products and more. “Watson”, a cognitive computing platform that interacts in natural language, processes big data and learns from interactions with people and computers is part of IBM’s Cognitive Solutions segment.

The current quarterly dividend payout rose 7.1% versus the previous period. The $1.50 quarterly distribution converts to a $6.00 annualized payout and a 3.7% yield. IBM’s dividend yield is almost three times higher than the 1.32% average yield for the technology sector.

IBM has hiked its dividend every year for more than two decades. Over the past 20 years, the annual dividend distribution grew at an average rate of 14.5% every year. Consequently, the 2017 annual distribution is 15 times higher than the 1997 payout.

The share price grew 28.3% between the 52-week low in May 2016 and its 52-week high at the end of February 2017. Since the February peak, the share price lost half of those gains and is currently 7.6% above the price from the end of April 2016. However, the current share price pullback could be a good opportunity to take a long position in the stock and take advantage of IBM’s capital investments to meet the expanding on-demand computing needs.

As part of its continuous investment strategy to support the growing enterprise demand for cloud infrastructure that can provide access to blockchain, quantum and cognitive computing services, the company announced on April 26, 2017 the opening of four new IBM Cloud data centers in the United States.

Ginni Rometty, IBM chairman, president and chief executive officer said, “Years of investments have made IBM the world’s leader in enterprise cloud and cognitive computing. Our strong profit and cash flow performance allows us to make the investments required to drive our transformation and to return capital to shareholders.”

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox. In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic