2 Utilities Offer 3%-Plus Yields and 6.3% Annual Dividend Growth Rates

By: Ned Piplovic,

Two regional utilities continue to reward their shareholders with yields of more than 3% and average annual dividend growth rates of 6.3%.

In addition to decades of dividend distributions, the companies have been raising their annual dividend payouts for at least 14 consecutive years. A share price increase of 50% over the past five years completes the investors’ trifecta of long-term dividend income, rising dividend payouts and steady assed appreciation.

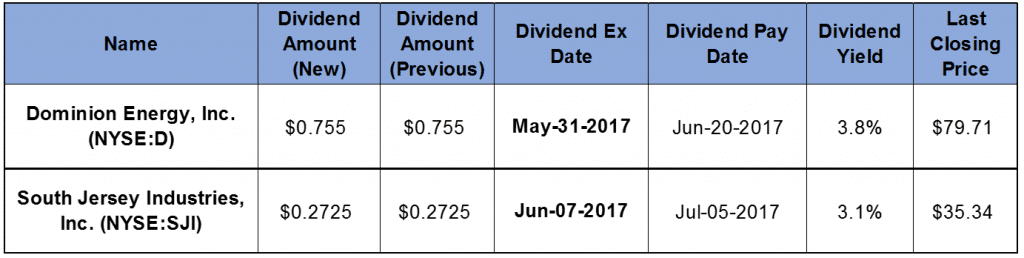

The ex-dividend date for Dominion Energy, Inc., (NYSE:D) is May 31, 2017 with a June 7 pay date, while the other stock, South Jersey Industries, Inc. (NYSE:SJI), goes ex-dividend on June 7, 2017, with a July 5 pay date.

Dominion Energy, Inc. (NYSE:D)

Dominion Energy, Inc. produces, transports and distributes energy in 13 eastern and four western states in the United States. The company operates 19 natural gas-powered plants, six coal-fired powerplants, three oil-powered plants and three nuclear powerplants.

In addition to the traditional fuel plants, Dominion Energy operates 26 renewable resource plants that generate electricity using hydro power, wind, solar and biomass. As of 2016, the company operated approximately 6,600 miles of main transmission lines, 57,600 miles of electric distribution lines, 14,900 miles of natural gas transmission pipelines and 51,300 miles of gas distribution pipelines. The company serves approximately 6 million customers and operates an underground natural gas storage systems with approximately 1 trillion cubic feet of storage capacity. Headquartered in Richmond, Virginia, and founded in 1909, the company operated as Dominion Resources, Inc. from 1983 until May 2017, when it changed name to Dominion Energy, Inc.

The current quarterly dividend of $0.755 converts to a $3.02 annual payout and a 3.8% dividend yield, which is 8.2% above the five-year average yield of 3.5%. Over the past 35 years, the company has not lowered its annual dividend payout and has increased the annual distribution for the past 14 years at an average dividend growth rate of 6.3% every year.

After rising 14.3% between late May and mid-July 2016, the share price experienced some volatility and went through several up-and-down cycles before it reached its 52-week low in early November 2017. Since the November low, the share price had one significant rise and another drop before reversing course and rising to mid-July 2016 levels by March 20, 2017. The share price rose past the previous peak level. On May 23, 2017, the share price closed at $79.71, which is just another in a series of all-time share price highs.

South Jersey Industries, Inc. (NYSE:SJI)

South Jersey Industries, Inc., provides energy-related products and services. The company buys, transmits and sells natural gas to approximately 375,000 residential, commercial and industrial customers in southern New Jersey. Additionally, the company sells natural gas and pipeline transportation capacity on a wholesale basis to residential, commercial and industrial customers on the interstate pipeline system. At the end of 2016, the company had approximately 150 miles of main pipelines and 6,600 miles of local distribution pipelines. Some of the company’s other operational interests involve natural gas storage and transportation, power plants, natural gas production in the mid-Atlantic, Appalachian and southern regions of the United States, landfill gas-fired electric production facilities and solar projects that provide cooling, heating and emergency power. Additionally, SJI owns oil, gas and mineral rights in the Marcellus Shale region of Pennsylvania. It also installs and services residential and small commercial HVAC systems. South Jersey Industries, Inc. was founded in 1910 and is based in Folsom, New Jersey.

The current annual payout of $1.09 is distributed quarterly and yields 3.1%. The company started paying a dividend in 1990 and has boosted its annual distribution at an average dividend growth rate of 6.3% for the past 18 years.

Excluding one significant price drop in early October, the share price has risen since and gained 32% by mid-April 2017 when it reached its new 52-week high. Since the April peak, the share price pulled back about 8% and is currently trading a little above $35, which is 21% above the share price from one year ago.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic