2 Utilities Pay 3% Dividend Yields and Offer Multi-Year Dividend Boosts

By: Ned Piplovic,

Two utility companies have rewarded their investors with dividend yields of around 3% and average dividend growth rates of more than 5.5% over the past eight-plus years.

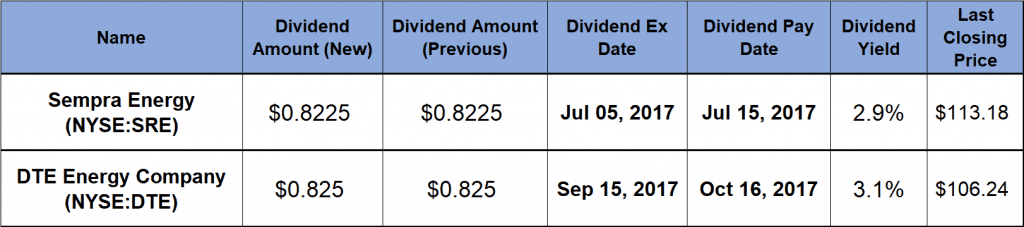

In addition to the considerable dividend income, the two equities have increased their share prices by more than 85% over the past five years. Sempra Energy’s (NYSE:SRE) ex-dividends is coming up shortly on July 5, 2017 and has a July 15, 2017 pay date, while DTE Energy Company’s (NYSE:DTE) ex-dividend date is not until September 15, 2017, and has a mid-October pay date.

Sempra Energy (NYSE:SRE)

Sempra Energy engages in distribution of natural gas, as well as generation and distribution of electric power. The company operates through two business segments – Sempra Utilities and Sempra Infrastructure. Through its Southern California Gas Company, San Diego Gas & Electric and Sempra South American Utilities, SRE distributes electricity and natural gas to approximately 32.5 million customers in Southern California, Chile and Peru. The Sempra Infrastructure segment consists of Sempra Renewables, Sempra LNG & Midstream and Sempra Mexico, which engage in generation and distribution of electricity from renewable sources, as well as generation, storage and transmission of liquefied natural gas (LNG) in the United States and Mexico. Sempra Energy has its headquarters in San Diego and was created in 1998 by a merger of the Enova Corporation and the Los Angeles-based Pacific Enterprises.

The current quarterly dividend of $0.8225 converts to a $3.29 annual distribution and a 2.9% dividend yield. That yield is 7.2% above the company’s five-year average yield of 2.7%. Sempra Energy has been paying a dividend since its creation in 1998 and has paid ts shareholders a raising dividend since 2005. For the past 13 years, the company boosted its annual distribution by an average of 9.6% every year.

The share price dropped almost 17% between late June and early November 2016. However, the price recovered completely by early March 2017 and continued to rise 5.7% above the June 2016 share price to reach its new 52-week high in late May 2017. Since the peak, the share price pulled back a little and closed on June 28, 2017, 1.5% above the June 2016 share price.

DTE Energy Company (NYSE:DTE)

DTE Energy is a Detroit-based diversified energy company that develops and manages energy-related businesses and services. The company operates an electric utility serving 2.2 million customers in Southeastern Michigan and a natural gas utility serving 1.2 million customers in Michigan. DTE Energy’s electric business segment generates electricity through fossil-fuel, hydroelectric pumped storage, nuclear plants, as well as wind and other renewable assets.

Additionally, DTE Energy operates non-utility energy businesses focused on power and industrial projects, natural gas pipelines, gathering and storage. In addition, the Power and Industrial Projects segment provides metallurgical coke, pulverized coal and petroleum coke to the steel, pulp and paper and other industries.

The company’s $0.825 distribution is equivalent to an $8.30 annualized payout and yields 3.1%. That yield is more than 25% above the utility’s sector average yield of 2.47%. Over the past eight consecutive years, the company hiked its annual payout at an average rate of 5.7%. The company, founded in 1903, started paying dividends 108 years ago in 1909.

After a 6.6% share-price drop between June and early September 2016, the stock price grew more than 24% to reach a new all-time high durring trading on June 20, 2017. The share price closed on June 28, 2017, at $106.24, which is about 4.5% below the recent peak price. However, the current share price is 10.7 % higher than it was at the end of June 2016 and 105% higher than it was five years ago.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic