2 Utility Companies Pay 10-Plus Years of Rising Dividends

By: Ned Piplovic,

Two regional utility companies have been rewarding their investors with steadily rising dividends and have matched peer dividend yields for more than a decade.

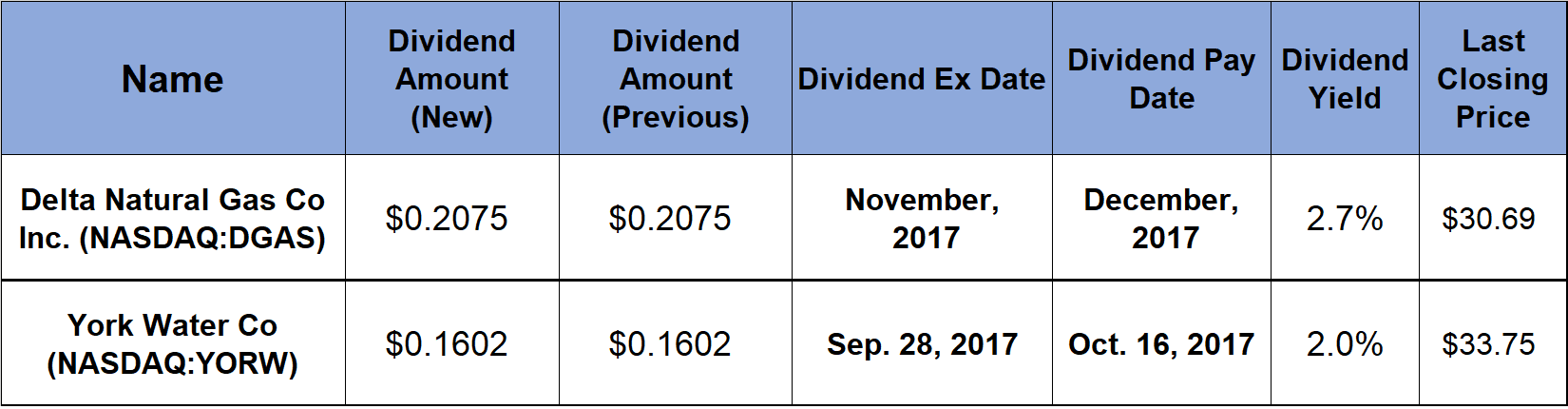

In addition to the long history of rising dividends, both utilities have enhanced their share prices to offer their shareholders even higher overall returns. In the past 12 months, York Water Co (NASDAQ:YORW) offered total returns of more than 17% and Delta Natural Gas Co Inc. (NASDAQ:DGAS) offered total returns in excess of 35%.

Over the more extended period of five years, the shareholders fared even better with total returns of 76% and 99%, respectively. The ex-dividend date for YORW is coming up shortly on Sept. 28, with a pay date of October 16, 2017. The next dividend payout for Delta Natural Gas Company, Inc. is expected in early December 2017, with an ex-dividend date in late November.

Delta Natural Gas Co Inc. (NASDAQ:DGAS)

Delta Natural Gas Company, Inc. transports and distributes natural gas in central and southeastern Kentucky to approximately 36,000 customers. The company operates through two segments – Regulated and Non-Regulated. The Regulated segment distributes natural gas to retail customers throughout Kentucky’s 23 predominantly rural counties. This segment also transports natural gas to industrial customers who purchase natural gas in the open market and transports natural gas on behalf of local producers. The Non-Regulated segment purchases natural gas in the open market, from producers in Kentucky and resells this gas to industrial customers. Additionally, this segment produces and sells natural gas and natural gas liquids in the open market. As of June 2016, the company owns approximately 2,600 miles of natural gas pipelines and holds leases for the storage of natural gas under 8,000 acres located in Bell County, Kentucky. The company serves approximately 36,000 customers. Founded in 1949, Delta Natural Gas Company’s headquarters are in Winchester, Kentucky.

For the first half of 2017, Delta Natural Gas Company followed its usual dividend distribution schedule of March, June, September and December and paid a $0.2075 quarterly dividend in March and June, which converts to a $0.83 annual distribution and a 2.7 yield. However, because of a merger with PNG Companies LLC that was announced in February 2017, the company paid another full $0.2075 quarterly dividend in July and will pay also a stub period dividend of $0.186978 per share on or before September 30, 2017. In finance, a stub period is different than the usual interval between payments – one quarter of the year in this instance.

The merger becomes effective as of September 20, 2017, and the company is expected to get back on its regular dividend payout schedule. Therefore, we can expect the next dividend declaration in mid-November, a late November ex-dividend date and an early December pay date.

The Delta Natural Gas Company’s share price rose 22.5% between mid-September 2016 and February 20, 2017, when it reached its 52-week high closing price of $30.80 right around the time that the company made the official announcement about the impending merger. The merger announcement appears to have stalled the share price growth trend. Since late February, the share price traded mostly sideways in narrow 3.5% band between its $30.80 peak price and the $29.72 price it reached on May 4, 2017. Since early May 2017, the share price has been rising slightly and it closed on September 18, 2017, at $30.69, which is only 0.4% below its May peak and 20% higher than it was one year ago.

York Water Co (NASDAQ:YORW)

Founded in 1816 and based in York, Pennsylvania, the York Water Company impounds, purifies and distributes drinking water. The company owns and operates three wastewater collection systems and two wastewater treatment systems. Additionally, the company has two reservoirs – Lake Williams and Lake Redman. In addition to the reservoirs, the company operates a 15-mile pipeline from the Susquehanna River to Lake Redman and owns seven wells. These wells supply approximately 366,000 gallons of water per day to its customers spread across 48 municipalities in Pennsylvania’s Adams and York counties. The company serves customers that manufacture furniture, electrical machinery, food products, paper, ordnance units, textile products, injectable drug delivery systems, air conditioning systems, laundry detergent, barbells and motorcycles.

The company’s current quarterly dividend of $ $0.1602 converts to a $0.6408 annual distribution and a 2% dividend yield per share. While the company started paying a dividend in 1990, the current streak of distributing consecutive rising dividends goes back 20 years to 1997. Over the past two decades, the company paid rising dividends at an average of 3.8% per year.

The share price rose more than 29% from $28.61 in mid-September and exceeded $39.50 by early December 2016. However, after December 2016, the share price experienced some volatility and three swings of more than 20% before it reached its 52-week high of $39.86 by mid-June 2017. Since the June peak, the share price dropped 15% and closed at 33.75% on September 18, 2017, which is almost 10% above the share price from mid-September 2016.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions, rising dividends and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic