3 Best Dividend Stocks to Buy Now

By: Ned Piplovic,

Always on the lookout for the best dividend stocks for portfolio diversification, income investors should consider equities with a history of reliable dividend growth that also offer continued or renewed asset appreciation.

Investing a substantial share of a portfolio in a “hot” sector to capture the upward momentum can certainly offer strong gains. However, this strategy typically works mostly for institutional investors and frequent traders. Long-term investors generally should diversify their portfolio across equities that are not only in different sectors but equities that are also at different stages in their business cycle.

To find these best dividend stocks for their port portfolio, investors must look beyond the main performance metrics when conducting their stock analysis. A high yield might be a result of a slumping share price. However, the additional step would be to determine whether that share price decline is caused by major long-term deficiencies in the share price’s fundamentals or just a temporary pullback. A share price decline driven by underlying fundamental issues would be a good reason to pass on a particular equity. However, a temporary pullback could be an opportunity to take a long position in an equity at discounted prices and reap the benefits of capturing the capital gains from any potential share price rebound.

The three best dividend stocks on this list have multiple characteristics that make them worthy of consideration right now. All three equities have dividend yields in excess of 3% and all three equities have ex-dividend dates in the second half of October. Therefore, investors interested in establishing eligibility to receive the next round of dividend distributions in late October or early November should make sure to claim ownership in these best dividend stocks to buy now before these ex-dividend dates in the next two weeks.

In addition to their above-average yields, all three equities have boosted their annual dividend payouts for at least the past few years. Also, the 12-month total return of these three best dividend stocks to buy now is higher than the current dividend yield, which indicates that the share prices have posted gains over the trailing 12-month period.

3 Best Dividend Stocks to Buy Now: #3

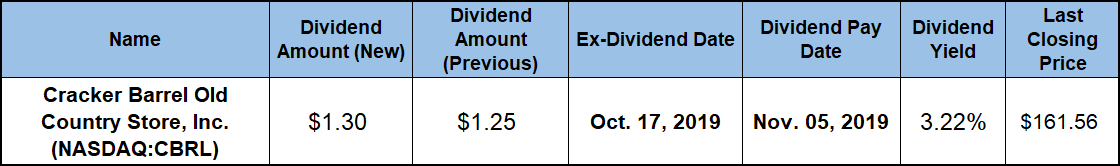

Cracker Barrel Old Country Store, Inc. (NASDAQ:CBRL)

Headquartered in Lebanon, Tennessee, and founded in 1969, Cracker Barrel Old Country Store, Inc. operates the Cracker Barrel Old Country Store concept. The concept consists of a restaurant with a gift shop, which offers various decorative and functional items, such as rocking chairs, holiday and seasonal gifts, toys, apparel, music CDs, cookware and various other gift items. Additionally, the shop sells food, such as candies, preserves, pies, cornbread mixes, coffee, syrups and pancake mixes.

The company’s current $1.30 quarterly payout is 4% higher than the $1.25 distribution from the same period last year. This new quarterly amount corresponds to a $5.20 annual dividend payout and a 3.2% forward dividend yield. Rapid share price growth over the past five years suppressed the company’s current yield 28% below the company’s own 4.46% five-year yield average.

However, CBRL’s current yield outperformed by 72% the 1.87% average yield of the overall Services sector, as well as outperformed the 1.42% simple average of the Restaurants industry segment by more than 125%. Additionally, even excluding companies in the Restaurants segment that do not pay dividends raises the simple average yield only to 2.19%. Cracker Barrel’s current yield is still more than 51% above the average yield of the segment’s only dividend-paying companies.

In addition to the $5.20 regular annual dividend, CBRL paid a $3.75 special dividend in August 2018. The $8.65 combined annual dividend payout yielded shareholders a 5.2% dividend income in 2018. The 2018 special dividend was the fourth consecutive year that the company rewarded its shareholders with a special dividend equivalent to at least 70% of the regular annual dividend payout.

Over the trailing 12 months, the dividend distributions and capital gains combined for a total return of 16.4% and 42% over the past three years. Additionally, CBRL shareholders nearly doubled their investment with total returns of 94% over the past five years.

3 Best Dividend Stocks to Buy Now: #2

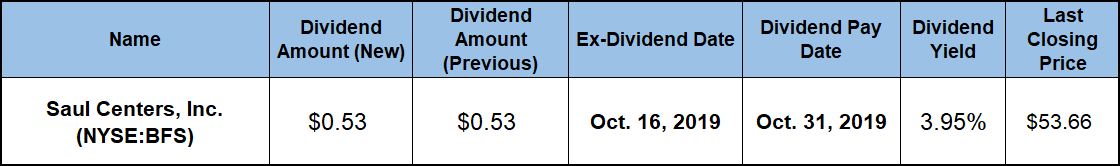

Saul Centers, Inc. (NYSE:BFS)

Founded in 1993 and based in Bethesda, Maryland, Saul Centers, Inc. is an equity real estate investment trust (REIT). The company operates and manages nearly 60 shopping centers and office properties in six U.S. states and the District of Columbia, totaling more than 9 million square feet of leasable space. The REIT generates approximately 85% of its cash flow from properties in the metropolitan Washington, D.C./Baltimore area.

The company’s current $0.53 quarterly dividend distribution is nearly 2% higher than the $0.52 quarterly payout from the same period last year. This new quarterly dividend amount corresponds to a $2.12 annualized dividend distribution and a 4% forward yield, which is nearly 15% higher than the company’s own 3.44% average yield over the last five years.

In addition to exceeding its own average over the past several years, the REIT’s current yield is almost 31% higher than the 3.02% average yield of all companies in the Financial sector. Additionally, Saul Centers’ current 4% yield also outperformed the 3.15% simple average yield of the company’s peers in the Real Estate Development market segment by more than 25%.

After cutting its annual dividend payout in two subsequent years following the 2008 financial crisis, the company paid a flat $1.44 annual dividend amount for three years before resuming annual dividend hikes. After six consecutive annual boosts, the total annual payout rose nearly 50%. This advancement corresponds to an average dividend growth rate of 6.7% per year.

Despite experiencing moderate volatility over the trailing 12-month period, the share price still advanced more than 17% above its 52-week low from late-December 2018, including a gain of 9% since the end of August 2019. This asset appreciation combined with the dividend income to deliver total returns of more than 8% over the last year. While slightly negative over the last three years, the total returns over the five-year period were nearly 35%.

3 Best Dividend Stocks to Buy Now: #1

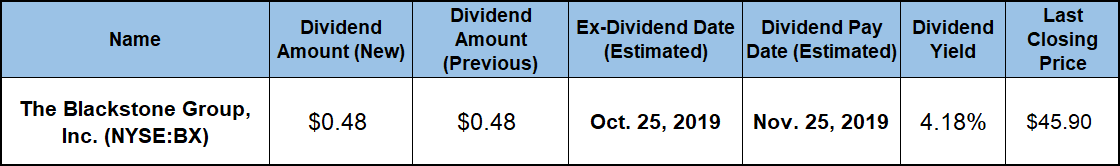

The Blackstone Group, Inc. (NYSE:BX)

Based in New York and founded in 1985, The Blackstone Group, Inc. is an alternative asset management and financial advisory services company. The company operates in four business segments — Corporate Private Equity, Real Estate, Marketable Alternative Asset Management and Financial Advisory. Between its inception in 1985 and July 2019, the firm grew its amount of assets under management from $88 billion to nearly $550 billion. In April 2019, Blackstone announced its intention to convert its operational structure from a limited partnership to a corporation. The company completed the conversion on June 30, 2019. Blackstone believed that the partnership structure had limited the market for the company’s shares. The conversion to a corporation should unlock opportunity for equity value appreciation by removing ownership restrictions and expanding share access to global investors. Additionally, a significant benefit to the shareholders is that all forward dividend payouts will be qualified distributions. As such, dividend income will be subject to the lower capital gains tax rates, which will deliver tax savings to shareholders and result in higher total returns.

Blackstone’s quarterly dividend payout amounts fluctuated because of its partnership structure, which passed all earnings through the company to the holders of partnership units.

As a newly created corporation, Blackstone distributed its first dividend of $0.48 in the first week of August. This quarterly payout amount corresponds to a $1.92 annualized distribution and currently yields 4.2%. Share price growth of nearly 60% over the last five years pushed the current yield more than 35% below the company’s own five-year yield average of 6.7%.

However, despite trailing its own five-year average, Blackstone’s current yield is nearly 40% higher than the 3.02% yield average of the overall Financial sector. Furthermore, Blackstone also outperformed the 3.54% average yield of its peers in the Asset Management industry segment by nearly 20%.

The firm cut its total annual dividend payout by two-thirds in the aftermath of the 2008 financial crisis. After the cut in the first quarter of 2010, the company paid a flat regular payout for the next two years. Since resuming annual dividend hikes in 2012, Blackstone boosted its annual payout seven times in the last eight years, including the last three consecutive years. Over the eight-year period, Blackstone enhanced its total annual dividend distribution nearly 270%. This advancement corresponds to an average growth rate of nearly 18% per year.

The share-price growth and the robust dividend distributions combined for a total return of more than 30% over the past 12 months. A share price correction of nearly 50% in late 2015 limited the five-year total return to less than 90%. However, because of a brisk share-price recovery since late 2016, Blackstone shareholders more than doubled their investment with a 113% total return over the past three years.

Related Articles:

The 6 Best Dividend Stocks That Yield More Than 5%

Fidelity’s 5 Best Dividend ETFs

5 Best Dividend Mutual Funds to Buy Now

6 Best Dividend ETFs to Buy Now

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic