3 Investments Offer Double-Digit Dividend Yields

By: Ned Piplovic,

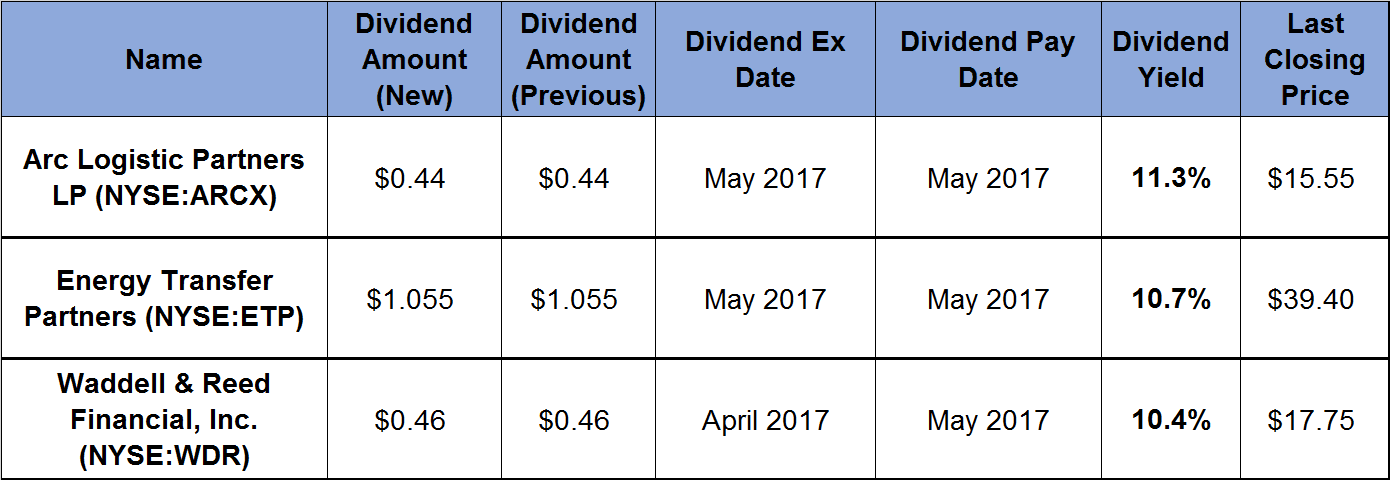

The three securities featured in this article reward their investors with double-digit yields and dividend payouts that have increased in the past few years.

With yields exceeding 10%, these picks could provide a significant cash flow for investors looking to balance out their capital growth holdings with income-generating securities. All three securities just paid out their quarterly dividend in February.

However, that payout could be an opportunity to buy them at slightly discounted prices. Dividend capture investors tend to drive stock prices higher as the ex-dividend date approaches. Therefore, anyone interested in these securities may find the next two months could be a good time to buy and avoid overpaying.

Arc Logistic Partners LP (NYSE:ARCX)

Arc Logistics Partners owns terminals and facilities that provide storage and transloading services to oil companies, independent refiners, crude oil and petroleum product marketers, distributors and various industrial manufacturers.

Its quarterly dividend of $0.44 translates to a $1.76 annual payout, which converts to an 11.3% yield. The annual dividend for 2016 was 4.5% higher than the prior year. This continues the increasing dividend strategy that ARCX has been following since it started paying a dividend in 2014.

Since the company historically has increased its quarterly payout mid-year, it is likely that the total annual dividend for 2017 will be higher than it was in 2016 and, therefore, continue the rising dividend trend.

The company’s share price appreciated 83% since the 52-week low from February 2016 to reach its 52-week high on January 25, 2017. Since the new price peak, the share price pulled back 10% and closed on February 6, 2017, at $15.55.

Energy Transfer Partners (NYSE:ETP)

Energy Transfer Partners uses its pipelines and industrial facilities to store and transport natural gas in the United States. Sunoco Logistics Partners LP (NYSE:SXL), which was recommended in a December 2016 article, announced in November 2016 that it will acquire Energy Transfer Partners in a $21 billion all-stock deal.

The current quarterly dividend of $1.055 translates to a $4.22 annual payout and a 10.7% yield. The company has increased its annual dividend payout for the last four consecutive years at an average growth rate of 4.2%.

Since the company started paying a dividend in 1996, it decreased the payout only in 2009. Over the last 20 years, the annual payout increased on average 9.5% year-over-year.

The company’s share price increased 133% between February 2016 and early August 2016 when it reached its current 52-week high. The share price pulled back 20% between August and early November, but recovered some of those losses and closed on February 6, 2017, at $39.40. While that price is still 9.4% below the August peak, it is 112% higher than the low from February 2016.

Waddell & Reed Financial, Inc. (NYSE:WDR)

Waddell & Reed Financial, Inc., which provides investment advice for institutional and private investors, underwrites and distributes registered open-end mutual fund portfolios, and sells life insurance and disability products underwritten by various carriers.

The company is currently paying a $0.46 quarterly dividend. The annual payout of $1.84 is equivalent to a 10.4% yield. Because of an 11.4% average annual growth rate over the last 18 years, the company increased its dividend payout seven-fold since 1998.

The company’s share increased 25% between February and March 2016. After that, the share price experienced some volatility and lost 55% by early November 2016 when it hit its 52-week low of $12.02. Since November, the share price improved 10% to close at $17.75 on February 6, 2017. The most recent closing price is still 33% below the March peak. However, the share price has increased 48% above the November low.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily.

To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic