4 Dividend Allstars Average Double-Digit Dividend Growth Rates

By: Ned Piplovic,

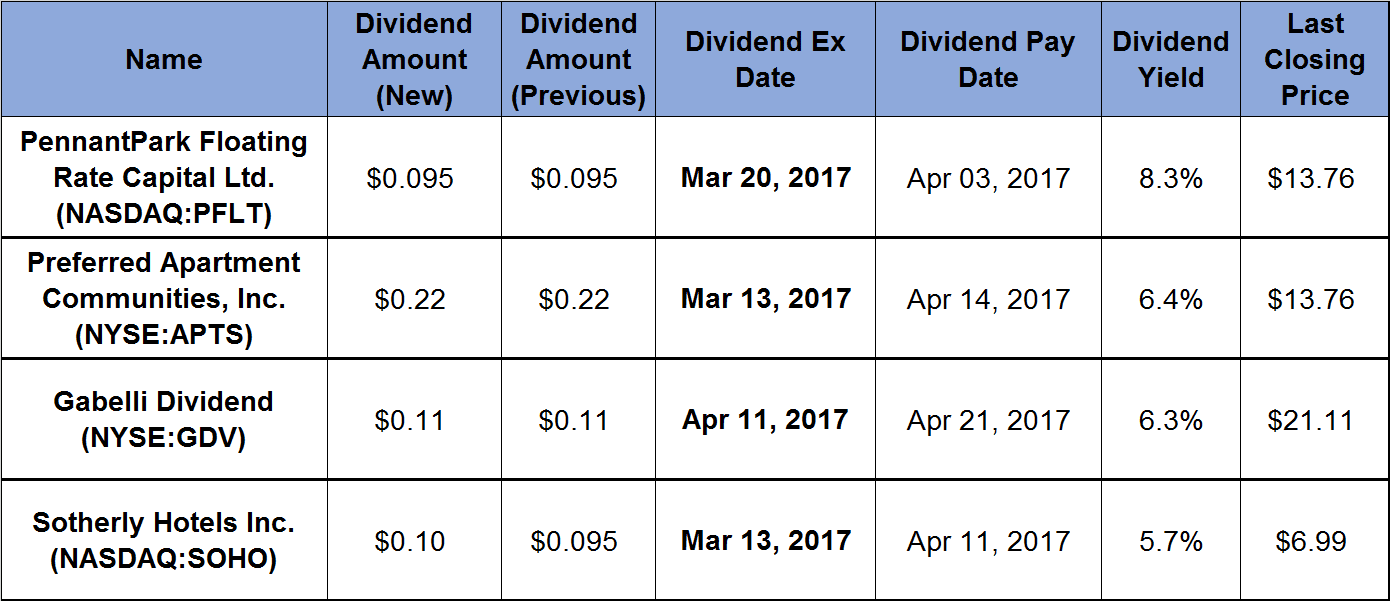

Four securities with ex-dividend dates coming up in the next few weeks have been averaging double-digit dividend growth rates for five-plus years.

Dividendinvestor.com confers its proprietary Allstars™ designation to securities that show sustained dividend growth. All four of these securities meet that criteria and are designated as three-star Dividend Allstars™.

In addition to the increasing dividends, these four investments have rewarded their shareholders with double-digit capital appreciation, as the current share prices of these securities are at least 11% higher than they were a year ago.

While two of the ex-dividends are only 10 days away, there is still enough time to take advantage of these cash income-generating opportunities.

PennantPark Floating Rate Capital Ltd. (NASDAQ:PFLT)

PennantPark Floating Rate Capital Ltd. is a closed-end, externally managed investment company. The company provides first lien secured debt and other opportunistic financings to middle market sponsors and companies. Its investments include direct investments in the equity securities, options to buy minority interests in portfolio companies and investments in sectors like aerospace, defense, consumer services, healthcare, etc.

The company’s current $0.095 monthly dividend is equivalent to a $1.14 annual payout and an 8.3% yield. Since it started paying a dividend in 2011, the company has increased its annual payout every year. Over the last five years, the average annual dividend growth of 24% resulted in tripling of the monthly distribution compared to the initial payment on July 1, 2011.

The share price grew steadily since January 2016. In the last year, the share price rose 25.6% between the year’s low price on March 8, 2017, and the 52-week high of $14.22 on January 4, 2017. Since the beginning of 2017, the share price pulled back 8% and closed at $13.76 on March 2, 2017, which is 22% above the low from March 2016.

Preferred Apartment Communities, Inc. (NYSE:APTS)

Preferred Apartment Communities, Inc. is a real estate investment trust (REIT). The company acquires and operates multifamily apartment properties in the United States. The REIT owns approximately 20 multifamily communities with more than 6,000 units in eight states and more than 30 grocery-anchored shopping centers across the Sunbelt states.

The most recently declared quarterly dividend of $0.22 converts to a $0.88 annual distribution and a 6.4% yield. Since 2011, when the REIT started paying a dividend, the annual distribution grew at an average rate of 23%, which is why the current dividend is 3.5 times higher than the initial payout in 2011. The next dividend is scheduled to be paid on April 14, 2017, with the ex-dividend date on March 13, 2017.

The share price hit its 52-week low in Mach 2016 and rose 38% to reach its 52-week high on June 20, 2016. After the June peak, the price dropped 21% by early-October but recovered again and reached near-high levels by December, 2016. The share price pulled back slightly and has been trading flat around $14 in 2017. On March 2, 2017, the price closed at $13.76, which is about 11% short of the June 2016 high and 23% higher than the March 2016 price low.

Gabelli Dividend (NYSE:GDV)

The Gabelli Dividend & Income Trust is a diversified, closed-end management investment company. Approximately half of the company’s assets are dividend paying securities. The company invests in sectors like financial services, food and beverage, health care, energy, oil, etc.

The current monthly distribution of $0.11 is equivalent to a $1.32 annual distribution and a 6.3% yield. The company has been paying a dividend since 2004. After a few years of rising dividends, the trust cut its distribution for three consecutive years between 2008 and 2010. However, the 10% average annual dividend growth since 2010 has almost doubled the annual distribution amount.

The share price rose 13.6% from its 52-week low in March to $20 by July 2016. However, the price dropped back to March 2016 levels by November 4, 2016. Since the November dip, the share price recovered and reached its new 52-week high of $21.25 on March 1, 2017, which is 20% above the 52-week low from March 2016.

Sotherly Hotels Inc. (NASDAQ:SOHO)

Sotherly Hotels Inc. is an equity real estate investment trust (REIT). The trust focuses on acquisition, renovation and upbranding of upscale, full-service hotels in the southern United States. Its portfolio consists of approximately 10 hotels with more than 3,000 rooms and approximately 160,000 square feet of meeting space. These hotels are independently owned and operate under various brand names, such as Hilton, Crowne Plaza, DoubleTree and Sheraton.

The company boosted its current dividend 5.3% higher than the previous period. The annualized payout of $0.40 equates to a 5.7% dividend yield. This current dividend boost is the company’s sixth consecutive increase since 2011. During that time, the annual distribution grew at a remarkable average rate of 64% every year. The current annual dividend is 20 times higher than the 2011 annual payout of $0.02.

The share price rose 13.6% between March and mid-July 2016. After reversing course, the price declined 26%, dropped below the March 2016 level and reached its 52-Week low of $4.65 on November 8, 2016. However, shareholders who did not panic and held their positions in this stock were rewarded with a 50% price increase between the November low and March 2, 2017, when the price closed at its 52-week high closing price of $6.99. The stock price reached as high as $7.66 during trading on March 1, 2017, but closed at $6.97 at the end of the day.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic