7 High Dividend Yield Stocks to Buy Now

By: Ned Piplovic,

Savvy investors can turn market downturns to their advantage by investing in equities with solid fundamentals that generate robust income distributions. High dividend yield stocks fit the bill.

Because of a directly inverse relationship with the share price, a Dividend Yield increases as the share price declines. Therefore, extremely high yields can be a mere consequence of a significant share price drop. To mitigate some of the risk, investors should also analyze an equity’s history of dividend hikes, the dividend payout ratio and other metrics.

Generally, investors should also consider the stock’s share price movement and ensure that the total return over the trailing 12-month period exceeds the dividend yield. A total return that exceeds the dividend yield indicates that the share price has appreciated. However, in light of the recent market selloff, many equities will fail to meet this criterion and will require a closer examination of the movement of their share price.

The seven high dividend yield stocks below have yields in excess of 4%. Additionally, interested investors should not delay their action too long, as all seven equities below have ex-dividend dates late next week — from August 14 to August 16.

7 High Dividend Yield Stocks to Buy Now: #7

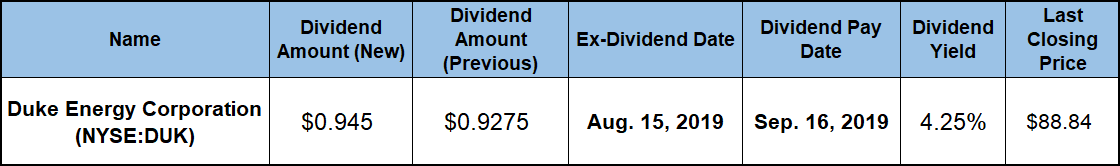

Duke Energy Corporation (NYSE:DUK)

The Duke Energy Corporation boosted its quarterly dividend nearly 2% from $0.9275 in the previous period to the upcoming $0.945 payout. This new payout corresponds to a $3.878 annual dividend and a 4.25% forward dividend yield. This yield is 2.5% higher than the company’s own 4.15% five-year yield average.

Additionally, Duke Energy’s current 4.25% yield is more than twice the 2.02% average yield of the entire Utilities sector, as well as nearly double the 2.22% yield average of Duke’s peers in the Electric Utilities industry segment. Furthermore, Duke’s current yield has also outperformed the 3.82% average yield of the segment’s only dividend-paying equities by 14.5%

Since initiating its current streak of consecutive dividend hikes in 2012, the company has enhanced its dividend payout by 24%. This advancement corresponds to an average annual growth rate of 3.1%.

7 High Dividend Yield Stocks to Buy Now: #6

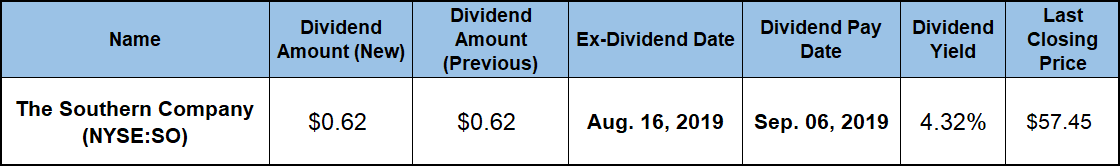

The Southern Company (NYSE:SO)

The Southern Company has boosted its annual dividend amount for the past 18 consecutive years. Over that period, the company enhanced its total annual payout by 85%, for an average annual growth rate of 3.1%. The current $0.62 quarterly dividend is 3.3% higher than the $0.60 distribution from the same period last year.

This new payout amount corresponds to a $2.48 annualized distribution and currently yields 4.32%. This yield is 4% lower than the company’s own 4.5% average yield over the last five years. In this case, this is a good indicator because it reveals that share price has advanced at a higher rate than the annual dividend payouts — 32% versus 19%.

However, Southern Company’s current yield outperformed the average yields of its peers in the overall Utilities sector and the Electric Utilities industry segment by significant margins. The Southern company delivered a 22% total return over the past 12 months and a 62% total return over the past five years.

7 High Dividend Yield Stocks to Buy Now: #5

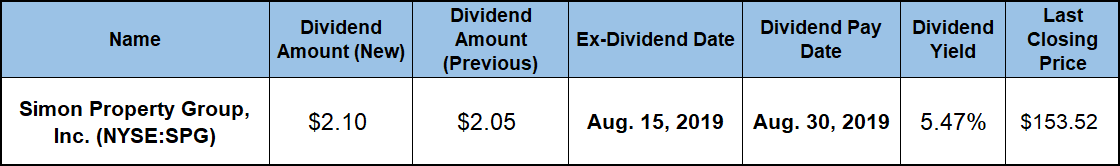

Simon Property Group, Inc. (NYSE:SPG)

Simon Property Group, Inc. — a retail properties real estate investment trust (REIT) — boosted its quarterly dividend distribution by 2.4% from $2.05 in the most recent period to the $2.10 amount for the next round of dividend distributions. This dividend payout increase, and a minor share price decline, drove the current 5.47% forward dividend yield 40% above the REIT’s own 3.9% five-year yield average.

Additionally, Simon’s current 5.47% yield is 86% above the 2.94% simple average yield of the overall Financial sector. Even compared to its peers in the Retail REITs industry segment, Simon’s current yield has outperformed the segment’s 3.48% average yield by 57%.

After a dividend cut in the aftermath of the 2008 financial crisis, Simon Properties group has since resumed hiking its dividend every year. Over the past nine years, the annual dividend has advanced more than three-fold for an average annual growth rate of nearly 14%.

7 High Dividend Yield Stocks to Buy Now: #4

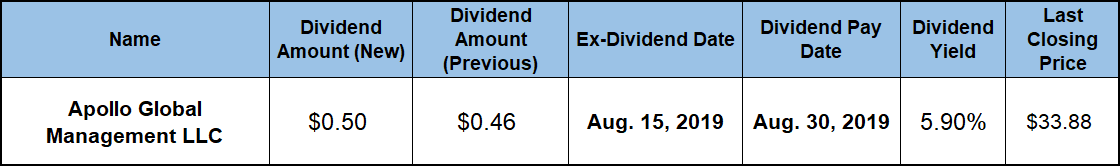

Apollo Global Management LLC (NYSE:APO)

Apollo Global Management LLC — an investment management firm — has boosted its upcoming quarterly dividend payout by 8.7%. This figure is up from a $0.46 payout amount in the previous period. This new quarterly payout corresponds to a $2.00 annualized distribution and a 5.9% forward dividend yield.

This yield is slightly lower than the firm’s 7.17% five-year average yield but double the 2.94% simple average yield of the entire Financial sector. Additionally, compared to the 4.71% average yield of its peers in the Diversified Investments industry segment, Apollo’s current yield is 25% higher.

After declining for three consecutive years, the firm’s annual dividend began rising again. Since 2016, the annual dividend has advanced 8% for an average annual growth rate of 2.6%. While its return has been flat over the past 12 months, Apollo has delivered a total return of 113% over the past three years.

7 High Dividend Yield Stocks to Buy Now: #3

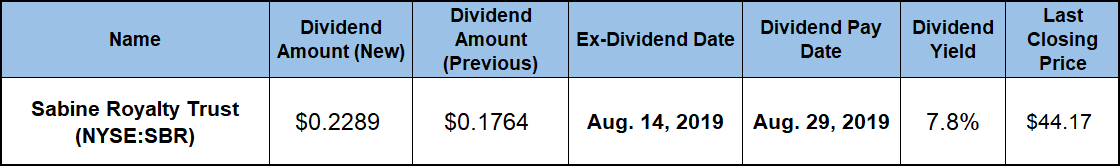

Sabine Royalty Trust (NYSE:SBR)

Sabine Royalty Trust is an express trust that was formed to receive a distribution from Sabine Corporation regarding royalties and mineral interests from oil and gas properties. The trust’s upcoming $0.2289 monthly dividend is nearly 30% higher than the $0.1764 payout from the prior month. The annual dividend payout is on track to reach $3.44 by the end of 2019. That annual dividend level would mark a third consecutive annual dividend increase. Over the past three years, the trust has enhanced its total annual dividend amount by nearly 80% for an average annual growth rate of 21.2%.

The current annualized dividend amount corresponds to a 7.8% yield, which is 5.2% higher than the trust’s five-year average yield of 7.4%. Furthermore, Sabine Trust’s current yield is 165% above the 2.94% average yield of the entire Financial sector, as well as 65% higher than the 4.71% yield average of the Diversified Investments industry segment.

7 High Dividend Yield Stocks to Buy Now: #2

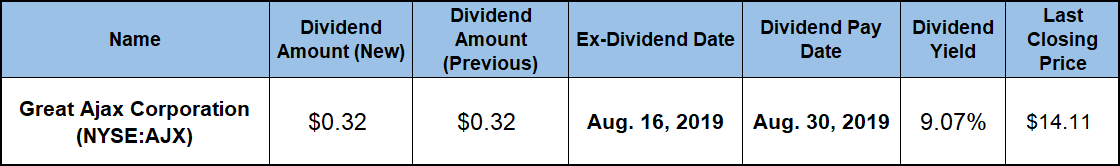

Great Ajax Corporation (NYSE:AJX)

The Great Ajax Corporation has boosted its annual dividend every year since initiating distributions in 2015. Over this four-year period, its total annual payout advanced nearly 60% for an average growth rate of 12% per year. The current $0.32 quarterly payout is 6.7% higher than the $0.30 distribution from the same period last year.

This new dividend amount corresponds to a $1.28 annualized payout and yields 9.07%. The current yield is 33.6% higher than the company’s own 6.78% five-year average. Furthermore, the current yield is also triple the 2.94% yield average of the overall Financial sector and also 122% higher than the 4.09% average of the Diversified REITs industry segment.

Combined with asset appreciation, this REIT has delivered a 15% total return over the past 12 months and a 24% total return over the last three years.

7 High Dividend Yield Stocks to Buy Now: #1

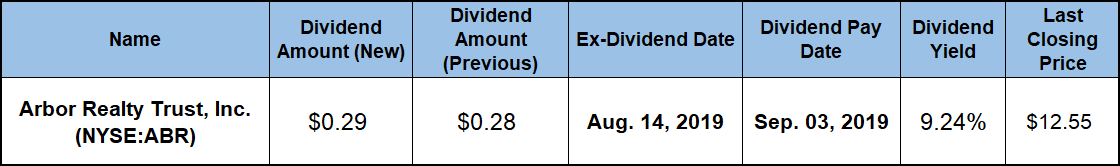

Arbor Realty Trust, Inc. (NYSE:ABR)

Arbor Realty Trust’s upcoming $0.29 quarterly dividend amount is 3.6% higher than the $0.28 dividend distribution from the previous period and 7.4% above the $0.27 distribution from the same period last year.

The current quarterly payout corresponds to a $1.16 annualized distribution and yields 9.24%. This is 11% higher than Arbor’s own 8.3% five-year yield average. Additionally, the current yield is also triple the 2.94% average yield of the overall Financial sector and double the 4.09% simple average yield of the Diversified REIT’s industry segment.

Since the onset of its current streak of consecutive annual dividend hikes in 2012, Arbor has more than tripled its annual dividend payout for an average annual growth rate of 18.2%. Additionally, the equity has offered strong asset appreciation to deliver a 21% total return over the last 12 months, as well as total returns of 110% and 134% over the last three and five years, respectively.

Related Articles:

7 High Dividend Stocks to Buy Now

25 High Dividend Stocks in 2020 to Consider Buying

The 10 High Dividend Stocks Owned by Warren Buffet

20 High Dividend Stocks Under $20

5 High Dividend Blue Chip Stocks to Buy Now

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic