Eight day-trading benefits for income investors to make morning moves in the market can produce potent profits.

The eight day-trading benefits for income investors to make early-morning moves have been shown in the DayTradeSpy Trading Room advisory service led by two seasoned traders. One highly effective strategy is the “out-of-the-morning-gate” (OMG) trade,” said Hugh Grossman, founder and senior partner of the DayTradeSpy Trading Room.

Those eight day-trading benefits for income investors offer alternatives to the market volatility that can come from longer-term equity investing. As geopolitical risk rises with Russia’s unrelenting invasion of Ukraine and the Middle East conflict becoming a cauldron of combat in the wake of the murderous Oct. 7 attack of Israeli villages by Hamas militants who invaded from neighboring Gaza, the short-term nature of option trading is gaining increased interest, Grossman told me.

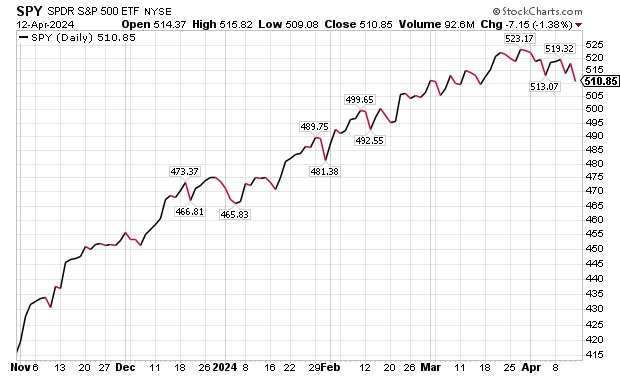

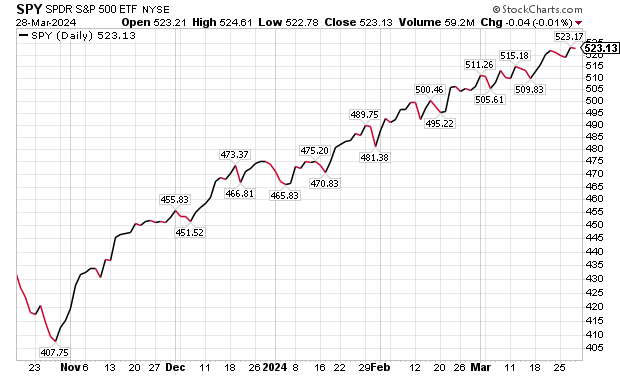

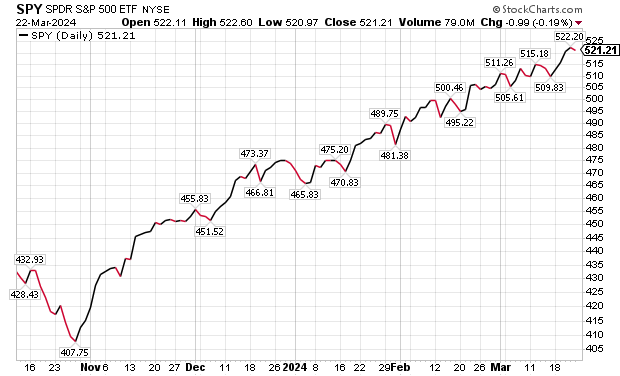

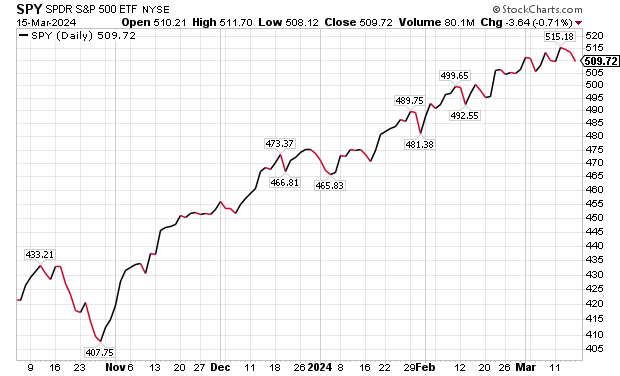

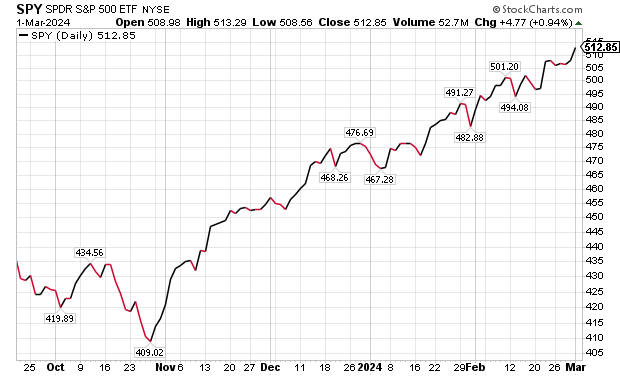

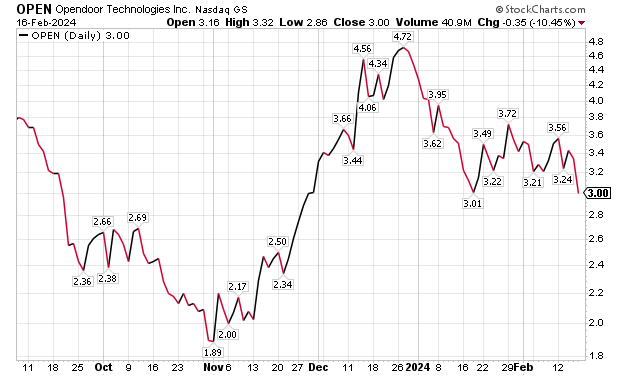

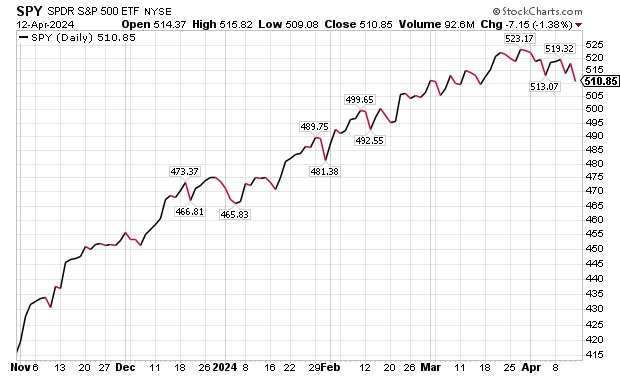

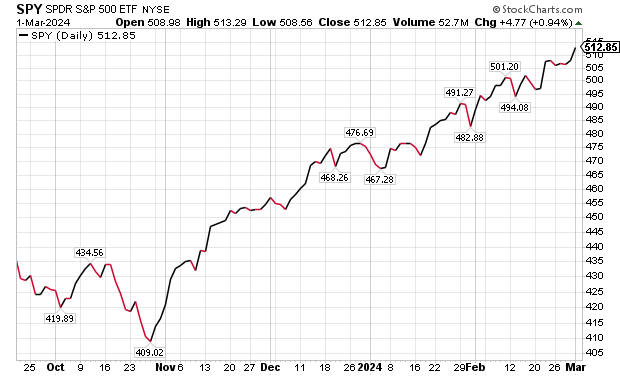

The DayTradeSpy Trading Room bases its recommendations on the SPDR S&P 500 ETF Trust (SPY), a highly liquid and diversified exchange-traded fund (ETF) that follows the top 500 stocks in America. The fund is familiar to many investors due to its sheer volume, and is resistant to market manipulation, Grossman said.

Hugh Grossman leads DayTradeSpy Signal, Trading Room and Ultimate Training Workshop.

Eight Day-Trading Benefits for Income Investors: 1. Profitable Track Record

The out-of-the-morning-gate (OMG) trade is sometimes overlooked but has a strong success rate, said Grossman, a seasoned options trader and trainer who founded DayTradeSpy Signal, the Ultimate Training Workshop, the Pick of the Day and the Trading Room advisory services. He described OMG as a “cool little methodology” that tends to stay in the background, making money unceremoniously for those who pay attention to its merits.

After years of analysis, Grossman determined that the market will usually deliver on a directional trade based on its breakout beyond a support or resistance level on a five-minute chart. Once the stock closes outside of either of those levels, there is a high probability that a 6% gain can be reached fairly fast, he added.

“In our live Trading Room, one of our early tasks is to establish those short-term support and resistance lines,” Grossman said. “Then, as SPY trading opens, we watch price action, triggering a trade when the price closes outside that tight range. We immediately put it up for sale for a 6% profit target.”

Eight Day-Trading Benefits for Income Investors: 2. 6% Solution

“’Why settle for just 6%?’ is a question often asked,” Grossman said. “The answer is simply a way to measure success. We need a standard by which to determine if the trade is successful or not.”

The strategy arose from witnessing how the market responded to early trading action, Grossman continued.

“When I followed other gurus in my early years of trading, many would claim success if the stock went up even a couple cents,” Grossman said. “In my reckoning, that would have been a dismal loss as I would never have sold it for a couple cent gain. It’s just not realistic.”

Eight Day-Trading Benefits for Income Investors: 3. Technical Analysis

“We use a 6% target, but many of our traders make much more than that,” Grossman said. “By using our technical analysis we provide in the morning Trading Room, you can follow the price action and walk away with greater gains. The 6% goal is a very basic level we expect to earn as a minimum, designed for even the most novice of traders.”

Trading Room participants can “score insane profits,” Grossman said.

“For example, the “OMG trade” [on April 15] triggered on the $515 puts at 9:35 a.m.,” Grossman recalled. “Entry price was $3.77 but these babies climbed to a high of $11.70 before the day was through. Of course, if anyone hits that high, it’s just a fluke, but many of our traders pull in double-digit [percentage] gains just by following our analysis.”

Not all trades will be winners, however, and it’s important to note the risks, Goldman said. Markets can and do reverse in a heartbeat, but the “OMG strategy” has proven itself to be a statistically sound system, even if, at the moment, it may seem hesitant to fill its target, he added.

Eight Day-Trading Benefits for Income Investors: 4. Avoids Heavy Lifting

“It’s another one of those ‘set it and forget it’ type trades, designed for people who may not want to do the heavy lifting,” Grossman commented.

A trader only needs to watch the early morning trading for a limited number of minutes to find a window of opportunity to pursue profits, Grossman said. If a trade is not triggered by 10:15 a.m. ET, there generally will not be one for DayTradeSpy Trading Room participants, Grossman said. But it is rare to see such “rangebound trading,” he added.

“These days, having a system such as this is invaluable,” Grossman said. “Markets change on a moment’s notice and may defy all rational premarket interpretations. Our typical day could consist of Iran attacking Israel, luring American involvement, mixed in with Israel attacking Hamas, while Russia continues its onslaught assault on Ukraine.”

Eight Day-Trading Benefits for Income Investors: 5. Seasoned Sherpas

Both Grossman and his partner Ahren Stephens service as trading sherpas. In the DayTradeSpy Trading Room, they effectively are shepherds to their flock of subscribers.

The out-of-the-morning-gate strategy generally identifies key trends that let wise traders simply go with the flow, Grossman said.

“The out-of-the-morning gate is a trade setup that we executive every day in the Trading Room, using predefined support and resistance levels,” Stephens said. “These levels provide high probability trade opportunities that we look for every morning.”

Ahren Stephens co-heads Pick of the Day and the Trading Room.

“When these levels [of 6%] are broken up or downside, we execute the trade,” Stephens said. “You can really have a nice set of winners with this breakout strategy.”

Eight Day-Trading Benefits for Income Investors: 6. Profit from Short-Term Moves

We were raised to believe that the longer you stay vested in the stock market, the more money you will make,” Grossman said. “That makes sense, perhaps, if you intend to bury your money in a mutual fund treasure chest and open it up decades later when you retire. I would consider that as a longer-term, capital-gain strategy. As an income source, however, there are better ways, something I discovered in my later years.”

Upon realizing that markets do not go in straight lines, but zig zag up and down, it was readily evident that the best way to make money was on short-term stock movements, Grossman continued. Using SPY to follow the top 500 stocks, the focus can be on assessing the economic sentiment at the moment rather than analyzing many stocks, he added.

Eight Day-Trading Benefits for Income Investors: 7. ‘Almost too Good to be Legal’

“Then, the key was to buy on a short-term breakout and sell for a relatively small gain,” Grossman said. “Using options, I also took advantage of the huge leverage, and was able to enter this trading arena for a small investment. Pay attention and you can bag a modest 6% or more gain, quite reliably on a daily basis. This was the best of all worlds. It’s almost too good to be legal.”

The Trading Room’s “out-of-the-morning-gate (OMG)” strategy determines the short-term support and resistance levels at the market’s open, then waits to pounce on the breakout, Grossman explained. The breakout usually occurs soon after the opening bell, he added.

“Buy the ‘at the money’ options after the first five minute ‘candle’ closes outside of either support or resistance, then immediately put it up for sale for a 6% gain,” Grossman said. “Set it and forget it. Come back later to collect your gains. It really doesn’t get much easier.”

This is one of the “key strategies” used each day the market is open for the Trading Room subscribers, Grossman said.

“As an income source, this system works very well,” Grossman told me. “The key is money management, as there are never any guarantees. And despite its reliability, the market will fake you out from time to time, as rare as it is. Never invest more than you can afford to lose.”

Eight Day-Trading Benefits for Income Investors: 8. Long-term Success Formula

“On a long-term basis, the OMG system has proven itself to work amazingly well, in both bull and bear markets. As an example, today (April 18) indicated a put trade,” Grossman said. “Had you acted on the alert, even if you bought at the highest price at the trigger time of 9:35, you still would have earned your 6% gain within the next two minutes. As it turned out, the value of those put options rose much higher later in the day.”

“The best way to earn a respectable income on the stock market is not by long-term holds but by daily, small increments that add up nicely,” Grossman advised. “Cash is a position I like to be in at the end of the day, especially so in these very volatile times.”

U.S. House Advances Foreign Aid Bill

The U.S. House advanced a foreign aid package of $95 billion for Ukraine, Israel, Taiwan and humanitarian support on Friday, April 19, clearing a procedural hurdle to hold final votes this weekend. The vote gained unusually strong bi-partisan support in the House, as Democrats helped Speaker Mike Johnson, a Republican, gain a decisive 316-94 margin. Final approval could be given by the House this weekend, allowing the package to go to the Senate for approval.

Meanwhile, the Middle East conflict keeps raising risk, while Russia continues to wage war against the civilian population of Ukraine. In addition, the current market mix of economic news is pushing stocks down as Fed Reserve members delay plans to cut interest rates, Grossman said.

“One would think positive bank earnings would prop up markets, but then SPY hits a major Fibonacci resistance level, falls over the edge, motivating other investors to bail out like rats jumping off a sinking ship, all while a former president takes the stand on hush money paid to a stripper… all before lunch,” Grossman said. “You can’t make this up.”

Income investors willing to try the DayTradeSpy Trading Room have recourse to the negative news that can slam the market. Trading options in SPY is a proven way to dodge the market risk, Grossman said.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Special Sale! Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for reduced pricing on multiple-book purchases.

Six reasons to day-trade for income with a signal can put people on a profitable path if they are prepped for the pursuit.

The DayTradeSpy Signal is an investment advisory service that uses indicators to provide its subscribers with roughly three to five trade recommendations per week. DayTradeSpy Signal racked up 16 profitable trades among its 17 tries in March 2024 to attain a 94.12% success rate, then turned a profit in its first five recommendations in April to enhance its performance to 21 winners in 22 attempts for an even better 95.45% win rate during the expanded time span.

“We’re going to have to do something about that one trade that got away,” said Hugh Grossman, a seasoned options trader and trainer who founded DayTradeSpy Signal, the Ultimate Training Workshop, the DayTradeSpy Trading Room and the Pick of the Day advisory services.

Six Reasons to Day-Trade for Income with a Signal: 1. Quick Cash

Investors seeking to amass cash quickly have a chance to do so by day-trading options, Grossman said. Some investors may be content to pay dividend-paying stocks and wait for the payouts, but Grossman said he prefers to try to earn income each day he trades options.

In the DayTradeSpy Signal service, Grossman bases his recommendations on the SPDR S&P 500 ETF Trust (SPY), a highly liquid and diversified exchange-traded fund (ETF) that follows the top 500 stocks in America. The fund is familiar to many investors due to its sheer volume, and is resistant to market manipulation, Grossman said. DayTradeSpy Signal recommends options in the SPDR S&P 500 ETF Trust (SPY), the largest and first U.S.-listed exchange-traded fund (ETF).

“The trader will purchase immediately upon receiving the signal through a cell phone text or email,” Grossman explained. “The alert will provide a specific option to buy, including its expiration date. Then, right after the purchase, put it up for sale with a 5% target price. If, on rare occasions, it does not fill by the end of the day, the trader needs to simply sell it for the market price at close. It’s an easy system that has proven to be highly effective and reliable.”

Naysayers may point out that a 5% gain is not a “home run,” Grossman said. But it is “relatively easy” to obtain such a small gain without needing to watch a computer screen all day, he added.

“This program is ideal for those who may still be working during market hours or out enjoying a sunny day on the boat,” Grossman said. “Simply check back on your cell phone at 4 p.m. and, if the sell order did not trigger, then proceed to sell it. These sell orders can usually be automated as well.”

Six Reasons to Day-Trade for Income with a Signal: 2. High Success Rate

Since the DayTradeSpy Signal service began in November 2023, the option trading advisory service has turned profits in 59 of its 69 trade recommendations, or an 85.5% win rate as of April 8.

“The way it works is simple enough,” Grossman said. “As a subscriber, you would receive an alert via cell phone text and email. As soon as you are notified, immediately make your purchase. Buy the suggested option, using a limit order for the ask price, within the next two minutes.

“As soon as you buy it, immediately put it up for sale for a 5% gain. In the unlikely event that it did not sell by the end of the day, sell it for the market price at the close. Should that happen, you would never drop to zero as these trades do have time built into them.”

In the case of the only losing trade in March 2024, the option did not reach the 5% profit goal by the end of the day. To adhere to the DayTradeSpy Signal strategy of closing each trade before day’s end, the order to sell the position at the market price led to a loss of about 15%.

Five Reasons to Day-Trade with a Signal: 3. ‘Excellent Strategy’

Statistically, DayTradeSpy Signal has proven to be an “excellent strategy,” Grossman said. The advisory service provides three to five algorithm-driven trades per week, he added.

“We suggest taking a mere 5% gain,” Grossman said. “But here’s the kicker: those actually watching the markets tend to do much better. They track the price up, making much higher gains. Check out the table below for April’s results.”

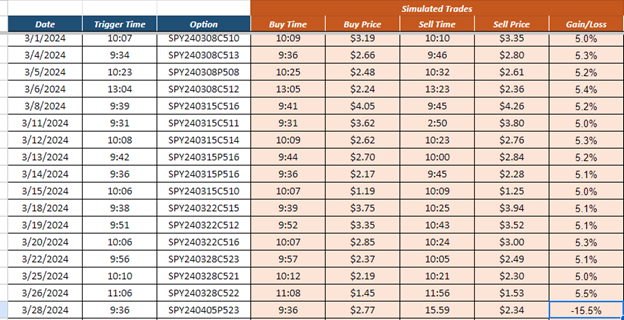

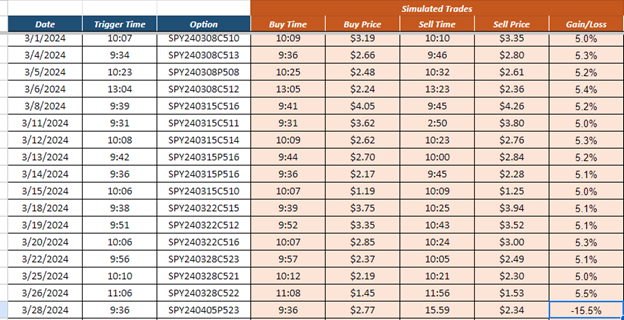

Source: Hugh Grossman

The target is at least a 5% profit on each trade, Grossman told me.

“Some traders make much more than that,” Grossman said.

DayTradeSpy Signal emails alerts to subscribers’ inboxes and texts them to their cell phones. Income investors can receive same-day payouts with successful trades, Grossman continued.

“In addition, there is some inherent excitement in placing these trades, beating the S&P 500 in its own game,” Grossman said. “When I receive the Signal, I’m pumped.”

Five Reasons to Day-Trade with a Signal: 4. Expert Analysis

This is an “ideal strategy” for those unable or unwilling to do the analysis themselves, Grossman continued.

“Many of our busy subscribers like this program, as it provides the work for them; they just have to follow through,” Grossman said. “You get three to five alerts a week, generally in the morning.”

All the March 2024 trades are detailed in the table below. Even though DayTradeSpy Signal has an 85%-plus success rate thus far, Grossman mentioned that options trading is risky and does require a certain amount of analysis.

Profitable Trades Notched in 16 of 17 Signal Recommendations in March 2024

Source: Hugh Grossman

Five Reasons to Day-Trade with a Signal: 5. Proven Formula

DayTradeSpy Signal advises its subscribers whether to pursue each trade, the market direction and strength, which option to trade and how to trade it. The DayTradeSpy Signal does the “heavy lifting” for its subscribers, Grossman said. Simply buy the recommended option, put it up for sale and come back later to reap their rewards or cut bait, he added.

As for the loss, SPY moved to the upside at about 2:45 p.m. that day, only to collapse just minutes before the close of trading, Grossman said. The market did not bid up SPY enough that day to allow traders to take the desired 5% profit on the puts, he added.

“Some days, you’re the dog,” Grossman told me. “Other days, you’re the hydrant.”

Hugh Grossman leads DayTradeSpy Signal, Trading Room and Ultimate Training Workshop.

Five Reasons to Day-Trade with a Signal: 6. Protection from Crises

Short-term trades of just minutes or hours in a single day limit the fallout from crises like wars and natural disasters. Long-term investors face those perils, but day-traders are insulated from the worst effects of those calamities.

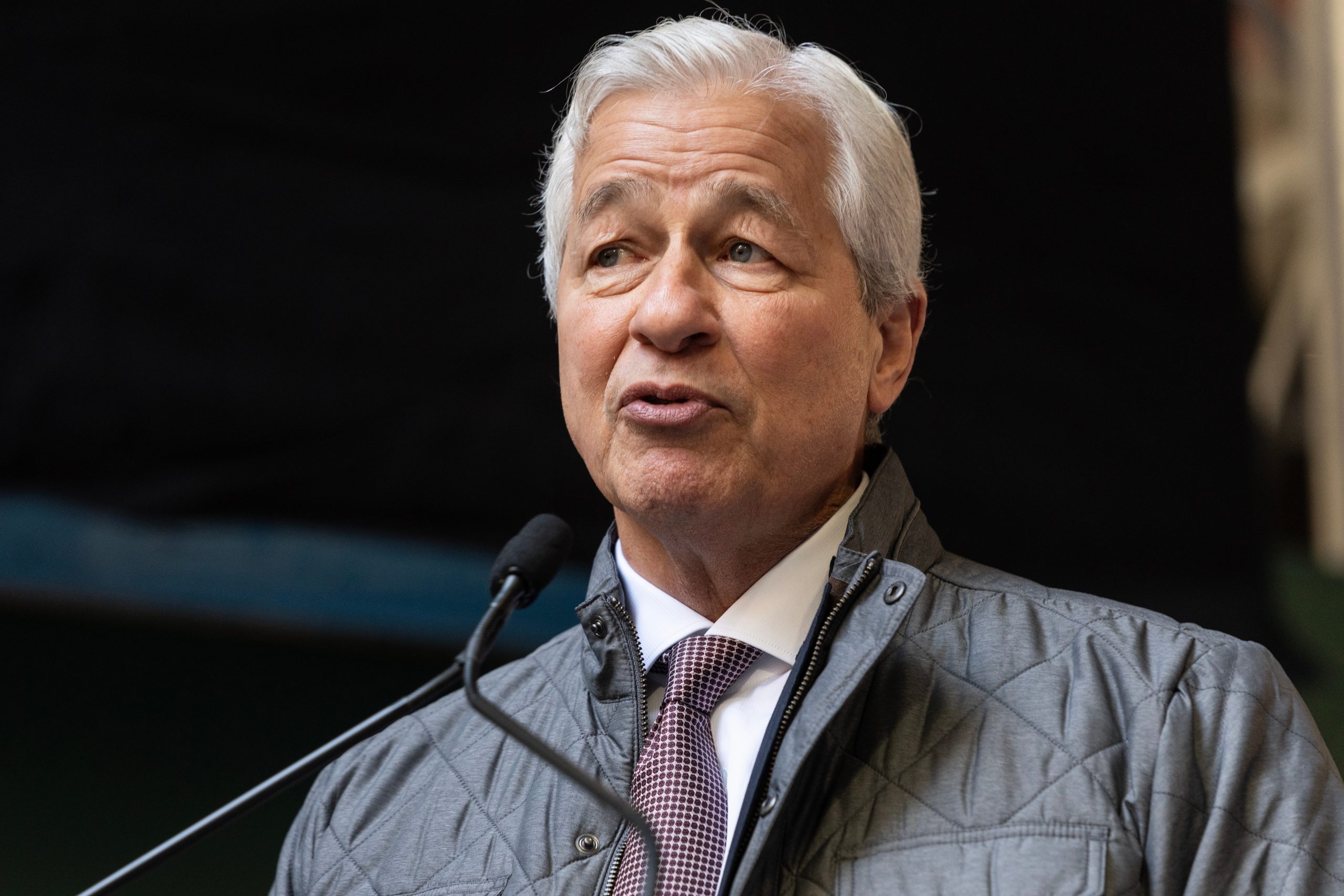

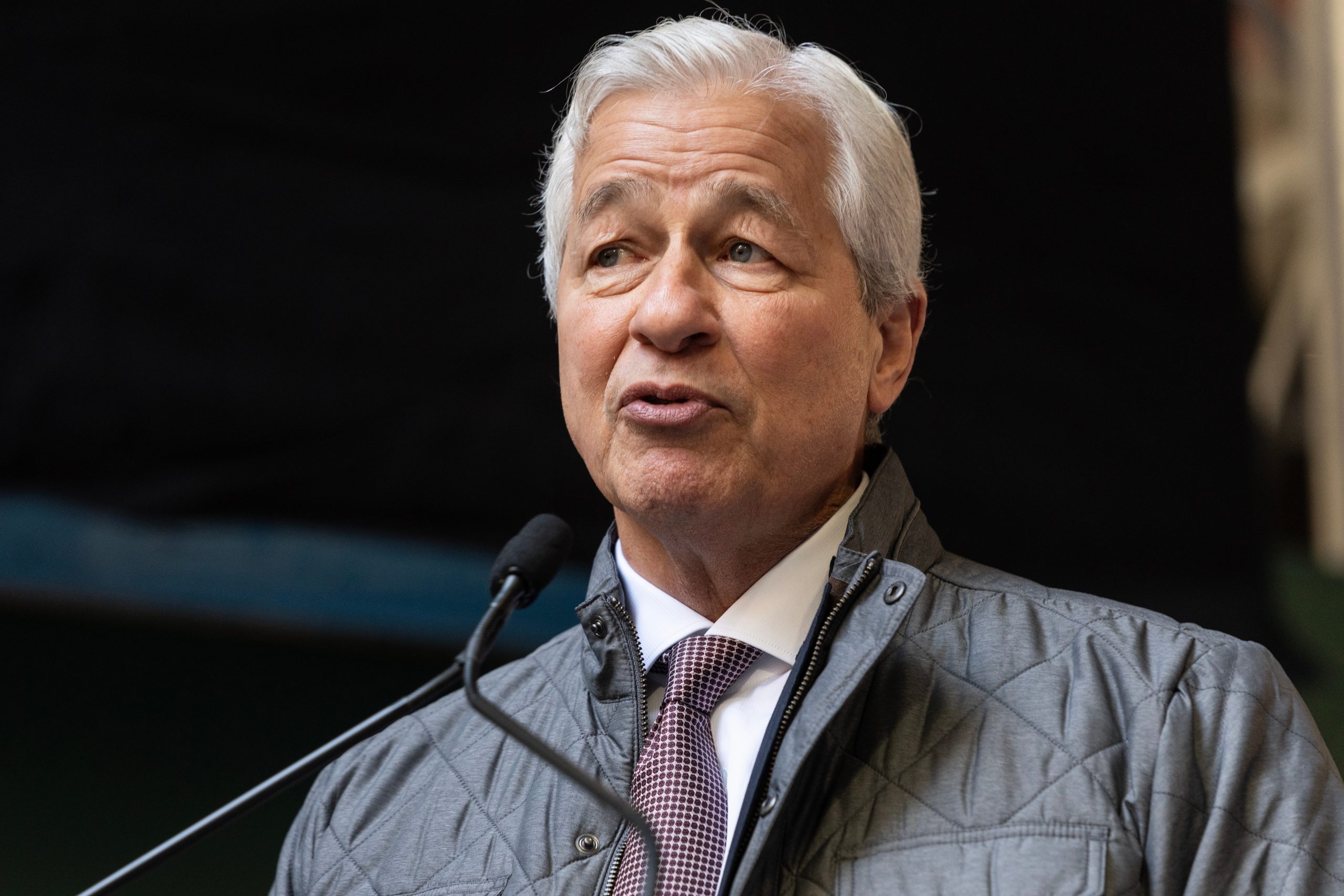

JPMorgan Chase Chairman and Chief Executive Officer Jamie Dimon warned that “significant challenges” across the globe in 2023 are carrying over into 2024 and could worsen. In a JPMorgan shareholders’ letter, Dimon wrote that the terrible ongoing war and violence in the Middle East and Ukraine, mounting terrorist activity and growing geopolitical tensions, especially with China, pose threats to investors and others.

“Almost all nations felt the effects last year of global economic uncertainty, including higher energy and food prices, inflation rates and volatile markets,” Dimon wrote. “While all these events and associated instability have serious ramifications on our company, colleagues, clients and countries where we do business, their consequences on the world at large — with the extreme suffering of the Ukrainian people, escalating tragedy in the Middle East and the potential restructuring of the global order — are far more important.”

Jamie Dimon, chairman and CEO of JP Morgan Chase.

America’s Global Leadership Role Under Threat, JP Morgan Chase CEO Cautions

“America’s global leadership role is being challenged outside by other nations and inside by our polarized electorate,” Dimon wrote in his letter to JPMorgan Chase’s shareholders. “We need to find ways to put aside our differences and work in partnership with other Western nations in the name of democracy. During this time of great crises, uniting to protect our essential freedoms, including free enterprise, is paramount.”

America, “conceived in liberty and dedicated to the proposition that all men are created equal,” serves as a shining beacon of hope to citizens around the world, Dimon wrote. JPMorgan Chase, a company that historically has worked across borders and boundaries, will do its part to ensure that the global economy is safe and secure, he continued.

Despite an “unsettling landscape,” including last year’s regional bank turmoil, the U.S. economy continues to be resilient, with consumers still spending, and the markets expecting a soft landing, Dimon wrote. However, the economy is fueled by large amounts of government deficit spending and past stimulus, he added.

“There is also a growing need for increased spending as we continue transitioning to a greener economy, restructuring global supply chains, boosting military expenditure and battling rising health care costs,” Dimon wrote. “This may lead to stickier inflation and higher rates than markets expect. Furthermore, there are downside risks to watch. Quantitative tightening is draining more than $900 billion in liquidity from the system annually — and we have never truly experienced the full effect of quantitative tightening on this scale.”

The “ongoing wars” in Ukraine and the Middle East have the potential to disrupt energy and food markets, migration, military and economic relationships, in addition to their dreadful human cost, Dimon wrote. These significant and somewhat unprecedented forces warrant caution, he added.

Solar Eclipse Could Be a Prelude to Covering up Economy Resiliency

The eclipse of the sun that occurred above much of the United States on Monday, April 8, may be symbolic of a gradual covering up of President Biden resilient economy later this year, wrote Mark Skousen, PhD, who heads the Forecasts & Strategies investment newsletter.

The U.S. Bureau of Economic Analysis (BEA) recently released its third estimate of real gross domestic product (GDP) growth at a 3.4% annual rate for the final quarter of 2023, as well as 2.5% for the full year. But BEA also reported gross output (GO), which is a much broader measure of total economic activity, including the all-important supply chain, which showed an economic slowdown, said Skousen, who also is a Presidential Fellow in economics at Chapman University.

Mark Skousen, head of Forecasts & Strategies, meets with Paul Dykewicz.

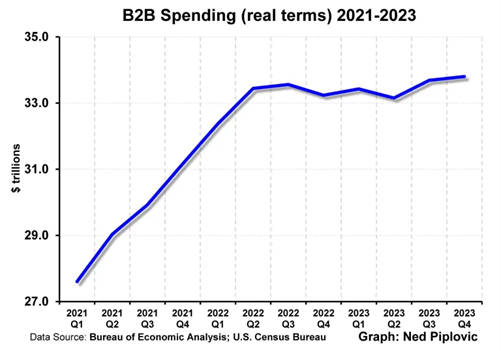

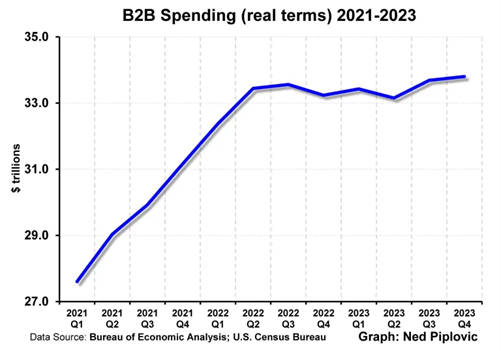

“Real GO was a full percentage point below gross domestic product in the fourth quarter, 2.4%,” Skousen reported.

“Worse, business-to-business spending actually fell slightly, by 0.3%… and has been virtually flat since the start of 2022, as this chart shows,” Skousen wrote.

“GO and business spending are leading indicators, suggesting a slowdown and perhaps even a recession in 2024,” Skousen cautioned. Click here to read Skousen’s op-ed about GO and the risk of a recession in the March 5 edition of the Wall Street Journal.

China’s Aid to Russia Adds to Mounting Geopolitical Risk Amid Increasing Danger in Middle East

Media reports indicate China has been providing machine tools, drone and turbojet engines, as well as technology for cruise missiles, microelectronics and other capabilities to help Russia make propellant for weapons to use against the Ukraine. China also has been helping Russia build drones to wage war.

China’s support is aiding Russia in sustaining its invasion of Ukraine that began in February 2022. Meanwhile, Ukraine’s forces are incurring severe shortages of weapons as the U.S. Congress has been unable to agree on a new foreign aid package.

With that backdrop, Russia’s military forces are advancing in eastern Ukraine after capturing the key town of Avdiivka in February. Ukraine’s soldiers are trying to hold their ground but struggling to do so amid long-term shortages of artillery shells.

In the Middle East, the risk of escalation is rising. Israel’s efforts to find and destroy an extensive tunnel system in neighboring Gaza that has been used to store weapons, as well as hide Hamas leaders and militants who were responsible for the Oct. 7 attack that killed an estimated 1,200 people, as well as taking 240 hostages, have led to a huge loss of life. The Gaza Ministry of Health estimates that more than 33,634 Hamas fighters and civilians have lost their lives there since the war began Oct. 7, but this month’s death toll also includes seven World Central Kitchen aid providers who perished when the vehicles that they were using to distribute food were fired upon by Israel Defense Forces (IDFs) who reportedly mistook them for hostile militants.

Chef José Andrés, World Central Kitchen’s leader, called for an independent investigation and said the vehicles were clearly marked with a sign of his charity, which reported its planned movements to the IDF in advance. The IDF announced that two senior officers were dismissed as a result of its probe of the incident.

U.S. President Joe Biden spoke by phone with Israel’s Prime Minister Benjamin Netanyahu to warn that future U.S. assistance to Israel will depend on how humanitarian interests are addressed in Gaza moving forward. Biden added that he was “heartbroken” by the deaths of the World Central Kitchen aid workers.

The number of injured people from the war in Gaza is estimated by its Ministry of Health to top 75,600 people. Israeli military officials reported that at least 256 of its soldiers have been killed since they entered Gaza to try to free an estimated 100 hostages who remain alive. Hamas or other Palestinian militants reportedly hold the remains of 30 hostages who were killed during and after the Oct. 7 raid of Israeli communities near its border with Gaza.

The use of SPY options in the DayTradeSpy Signal advisory service offers income investors an alternative to traditional stock investing, especially if a recession arises and geopolitical risk escalates.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Special Sale! Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for reduced pricing on multiple-book purchases.

Seven pluses to day-trading training workshops for income provide valuable instruction before putting one’s money at risk.

The seven pluses to day-trading training workshops give investors knowledge needed to pursue profits successfully, said Hugh Grossman, founder of the DayTradeSpy Ultimate Training Workshop. Understanding the ins and outs of day-trading can help investors reduce the risk of incurring losses due to inexperience, he warned.

To provide the needed preparation, Grossman suggested that newcomers to day-trading or those who want to aim for consistent profitability participate in the DayTradeSpy Ultimate Training Workshop that he developed with his fellow seasoned trader Ahren Stephens.

The partners teamed up to prepare a total of 11 video presentations. Each session focuses on a different aspect of option trading.

In all its ”nuances,” the market is like a spouse who has ups and downs, Grossman said. Virtually all the trades the duo recommends involve options of the SPDR S&P 500 ETF Trust (SPY), the largest and first U.S.-listed exchange-traded fund (ETF).

“You just have to know when to hang around and when to stay away,” Grossman said. “Once you master SPY’s personality, the market is your oyster.”

Grossman said he and Stephens have seen almost everything the market can “throw at them.” The Ultimate Training Workshop is intended to help investors avoid making mistakes that will cost them money, Grossman added.

Seven Pluses to Day-Trading Training Workshops for Income: 1. Ultimate Training

The Ultimate Training Workshop is foundational for understanding the basics of options for participants who want to graduate onto to the DayTradeSpy Trading Room and the Pick of the Day advisory service, Stephens told me. The Pick of the Day is easier to use initially but the Trading Room opens up a potentially vast opportunity to profit from more sophisticated options trades, Stephens added.

The consequences of starting to trade options without adequate preparation can be costly.

“Many traders jump into the options market in total ignorance; hence the reason they quickly lose their money,” said Grossman, a seasoned options trader and trainer who heads the Ultimate Training Workshop, the DayTradeSpy Trading Room and the Pick of the Day advisory service. “Because options are linked to an underlying asset, they think they are simply trading a cheaper version of that asset. Nothing could be further from the truth.”

Hugh Grossman leads DayTradeSpy’s Trading Room and Pick of the Day.

Seven Pluses to Day-Trading Training Workshops for Income: 2. Stocks Vs. Options

When a trader purchases a stock, the investor is buying a piece of that company or fund. The value of that share depends upon the net value of the company, Grossman said.

“It is an asset that can be held, traded, willed to your children and even used as collateral to some extent,” Grossman continued.

Options, on the other hand, hold no asset. An option is a contract that gives the holder the right, but not the obligation, to trade the underlying stock for a certain price by a specific date, Grossman explained.

“There are certain implications to this that are very important, and to which many traders seeking to satisfy their drive to get rich quick are oblivious,” Grossman continued.

Seven Pluses to Day-Trading Training Workshops for Income: 3. SPY Options

For those who are new to options, it is essential to know key differences from stocks and their impact on one’s account, Grossman told me. In fact, with certain strategies, an investor may become obligated to more than the money in his or her trading account, he added.

“If not careful, you may find yourself indebted to your broker for a substantial amount,” Grossman said. “This is just one reason you need to understand options trading. It is also one key reason all traders, especially newbies, should consider our DayTradeSPY Ultimate Training Workshop. We cover these important aspects of trading, along with all key points to our methodology in earning a respectable daily income.”

Many traders know how to trade and even make money, Grossman said. But only a fraction know how to keep it, he added.

Seven Pluses to Day-Trading Training Workshops for Income: 4. Money Management Module

The Ultimate Training Workshop‘s Money Management module addresses “tips, tricks and traps on capital preservation,” Grossman said.

Unless a trader is familiar and actively managing his or her money, it is only a matter of time before they “blow up their accounts,” Grossman cautioned.

The Ultimate Training Workshop addresses the number one reason traders lose: lack of emotional control, Grossman continued. The Mental Aspects of Trading session is one of the most viewed webinars, where we discuss the effects of fear, greed, ego, “fear of missing out” (FOMO) and “you only live once” (YOLO), he added.

Those emotions will rule the trading with a “race to the bottom,” for those who fail to control them, Grossman warned.

“We actually offer you simple exercises to help you hone these all-important skills,” Grossman said.

“Income investors can benefit by learning about the foundational techniques of both fundamental and technical analysis to improve their investment decisions in both the long- and short term,” Stephens said.

Seven Pluses to Day-Trading Training Workshops for Income: 5. Repairing Trades

“Any trader who tells you they never lose is lying to you,” Grossman said. “We address losers head on with our Repairing Trades Gone Bad video, a must have for any trader. It’s all there, in the Ultimate Training Workshop.

“One vital point we teach in avoiding losses: do not use stop losses. While theoretically they sound promising, in reality, they do not work for options. We invoke other methods to minimize losses.”

Certain traders may wonder how Stephens pulls lofty predictions seemingly out of the air, Grossman said. However, there is “nothing magical” about it, Grossman added.

“He shows you in his segment with the Fibonacci and Andrews’ Pitchfork combinations, enabling you to earn stunning gains,” Grossman said.

Ahren Stephens co-heads of Pick of the Day and the Trading Room.

Seven Pluses to Day-Trading Training Workshops for Income: 6. Preparation

“Every trader, from beginners to seasoned pros, would benefit from our Ultimate Training Workshop,” Grossman told me. “We recommend viewing each session in its entirety first, noting key session times and returning to review them later. The advantage about the recordings is that you can always pause, rewind and fast forward, picking up the subtle nuances that make all the differences.”

The Ultimate Training Workshop is the culmination of more than 40 years of combined market experience from two seasoned traders, Grossman said.

“You owe to yourself to invest in yourself first, before setting a single penny in the all-consuming stock market,” Grossman continued.

The Ultimate Training Workshop quickly and definitively drills right into what matters, supporting all aspects of trading with 11 fast-moving, ‘compelling video modules,” each about an hour and a half in length, Grossman explained. From building confidence to growing your trading account using “exclusive money-making strategies,” participants are taught about trading.

It is insufficient to know only enough to be dangerous; one needs to be aware of all aspects of options trading to enjoy long-term success, Grossman advised.

Seven Pluses to Day-Trading Training Workshops for Income: 7. Day-Trading Resists Recession

The U.S. Bureau of Economic Analysis (BEA) recently released its third estimate of real gross domestic product (GDP) growth at a 3.4% annual rate for the final quarter of 2023, as well as 2.5% for the full year. But BEA also reported gross output (GO), which is a much broader measure of total economic activity, including the all-important supply chain, which showed an economic slowdown, said Mark Skousen, PhD, the head of the Forecasts & Strategies investment newsletter and a Presidential Fellow in economics at Chapman University.

Mark Skousen, head of Forecasts & Strategies, meets with Paul Dykewicz.

“Real GO was a full percentage point below gross domestic product in the fourth quarter, 2.4%,” Skousen reported.

“Worse, business-to-business spending actually fell slightly, by 0.3%… and has been virtually flat since the start of 2022, as this chart shows,” Skousen wrote.

“GO and business spending are leading indicators, suggesting a slowdown and perhaps even a recession in 2024,” Skousen cautioned. Click here to read Skousen’s op-ed about GO and the risk of a recession in the March 5 edition of the Wall Street Journal.

Geopolitical Risk Rises With Death of Aid Workers and Civilians in Gaza

Israel’s efforts to find and destroy an extensive tunnel system in neighboring Gaza that has been used to stockpile weapons, as well as hide the leaders and Hamas militants who were responsible for the horrific Oct. 7 attack that killed an estimated 1,200 people and involved the taking of 240 hostages, have caused a heavy loss of life. The Gaza Ministry of Health estimates that a total of more than 33,000 Hamas fighters and civilians have lost their lives there since the war began Oct. 7, but this week’s death toll includes seven World Central Kitchen aid providers who perished when the three vehicles that they were using to distribute food were fired upon by Israel Defense Forces (IDFs) who reportedly mistook them for hostile militants.

Chef José Andrés called for an independent investigation and said the three-vehicle convoy was clearly marked with a sign of his World Central Kitchen charity, which reported the planned movements to the IDF in advance. The IDF announced that two senior officers had been dismissed as a result of its probe of the World Central Kitchen incident.

U.S. President Joe Biden spoke by phone with Israel’s Prime Minister Benjamin Netanyahu to caution that future U.S. assistance to Israel will hinge on how humanitarian interests are addressed in Gaza moving forward. Biden added that he was “outraged and heart broken” by the deaths of the World Central Kitchen aid workers.

The number of injured people from the war in Gaza is estimated by its Ministry of Health to reach 75,600 people. Israeli military officials reported that at least 256 of its soldiers have been killed since they entered Gaza to try to free an estimated 100 hostages who remain alive, along with the return of remains from 30 people who reportedly were killed during and after the Oct. 7 raid.

In another international hot spot, Russia’s military forces are advancing in eastern Ukraine after capturing the key town of Avdiivka in February. Ukraine’s soldiers are trying to hold their ground, with long-term shortages of artillery shells with the U.S. Congress unable to agree upon providing additional assistance.

The use of SPY options offers an alternative to avoid the vagaries of the market that can hurt investors, especially if a recession arises and geopolitical risk worsens.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Easter Season Sale! Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for reduced pricing on multiple-book purchases.

Six reasons for income investors to day-trade amid disasters offer ways to reduce risk.

The six reasons for income investors to day-trade during disasters warrant weighing to provide an alternative to long-term strategies that can cause worry for weeks, months or years. The goal with day-trading is to produce profits in just hours or even minutes.

The short-term nature of day-trading can mitigate the effects of continuing crises such as disasters like the collapse of the Francis Scott Key Bridge in Baltimore on March 26, ongoing wars and potential recessions. Day-trading also avoids the need to know each industry or company well enough to put one’s money at risk in narrow ways.

Six Reasons for Income Investors to Day-Trade Amid Disasters: 1. DayTradeSPY Trading Room

Novice day-traders may want to consider the DayTradeSPY Trading Room that not only features the supervision of its founder and head trader Hugh Grossman, but his fellow seasoned trader Ahren Stephens. Each of them brings his own experience and expertise to subscribers of the service, Grossman said.

Since the pair take different approaches to trading options, they are able to cross-verify whatever trend the other partner identifies. Verification of a trend is “paramount” to attaining a high degree trading success, Grossman told me. When both he and Stephens agree on the market’s direction and strength, the traders who follow their guidance generally profit, Grossman added.

“When our indicators unite, our trades ignite,” Grossman told me.

Six Reasons for Income Investors to Day-Trade Amid Disasters: 2. Sidestepping Risks

“Our daily Trading Room is unique in a number of ways,” Grossman told me.

One way is to sidestep market risks by initiating trades and exiting them within an hour or even less, Grossman told me.

Hugh Grossman leads DayTradeSpy’s Trading Room and Pick of the Day.

The Trading Room advisory service that Grossman started has “catapulted” to a new level of expertise with the addition of Stephens, who brings his indicators like Fibonacci retracements and Andrews’ Pitchfork, the senior partner said. By collaborating, they identify trades that have a high probability of success, Grossman continued.

Ahren Stephens co-heads Pick of the Day and the Trading Room.

Combined, their joint analysis offers extra brainpower for their subscribers who want to tap the guidance they offer through their DayTradeSpy Trading Room advisory service, Grossman said.

“Our Trading Room is an event that traders look forward to, earn while you learn and absorb all you can from two outstanding mentors,” Grossman told me.

Six Reasons for Income Investors to Day-Trade Amid Disasters: 3. Avoid Market Unpredictability

“Frankly, I have no idea where the market will be years from now or even a week from now,” Grossman told me this week. “There are so many dichotomies at play, it’s near impossible to predict anything anymore, if we ever truly could.”

For years, predictions have been plentiful about how a recession of unprecedented proportions is on the horizon, Grossman continued. Yet almost everyone seems to be working and making money, he added.

Another big risk widely talked about is the potential impact of global warming. Young activists such as Sweden’s’ Greta Thunberg and India’s Licypriya Kangujam have spoken publicly about the dangers of climate change and the need to take swift action to address it.

“All I hear about is global warming and how humankind will be driven into oblivion if we don’t all start driving electric cars,” Grossman said. “Yet, how many… recall talk about an ice age worry back in the 1970s?”

Right now, at least two major wars are being fought, immigration and drug problems are out of control and the world fears artificial intelligence will blow up the planet, yet the stock market continues to eke out new highs, Grossman said.

“For that reason, I cannot invest in a market fraught with anxiety and fear, having no rational reason for its exuberance,” Grossman explained.

Six Reasons for Income Investors to Day-Trade Amid Disasters: 4. Short-term Focus

“I can handle very short-term engagement,” Grossman said. “Day-trading SPY options gives me exactly that: in and out quickly after having made some money based on immediate market nuances, both financially and emotionally. Making a consistent income on the stock market is not that difficult, if you know how.”

Day-traders can stay connected to the market on a minute-by-minute basis in advisory services that specialize in quick trading, said Stephens, a co-leader of the Trading Room. Every morning, 9:20 to 10:30 a.m. ET, Stephens and Grossman host the Trading Room, a virtual meeting where training and trading converge in a live, real-time market environment.

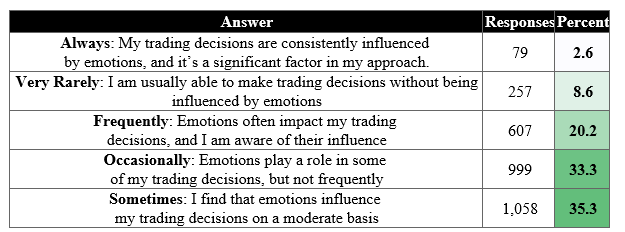

“We need to think quickly, logically and without emotion in an effort to buy and sell quickly and to be on our toes at a moment’s notice,” Stephens said. “Because of this fast execution and response time, sometimes it is possible that our emotions get involved in our trading setups. For me, I would say that occasionally emotions can play a role in our trading decisions.

“When news items come out and trades are going in your favor, as well as when you have to wait out a news event that isn’t going in your favor, that is when you need to exercise either quick exits or long-term patience.”

Six Reasons for Income Investors to Day-Trade Amid Disasters: 5. Use Trend Indicators

The pair look at fundamentals to gauge the overall market sentiment. Then they back it up with an in-depth look at Fibonacci and Andrews Pitchfork indicators, among others.

In addition, Grossman told me he likes to use short-term technical indicators such as exponential moving averages, support and resistance levels and chart patterns. With the collective strategies of both partners, the result usually is a successful trade, he added.

Six Reasons for Income Investors to Day-Trade Amid Disasters: 6. Successful Track Record

The DayTradeSpy Trading Room features a 14-year track record of success, Grossman said.

“The DayTradeSPY Trading Room is the longest running trading room that we know of… now in its 14th year,” Grossman said. “We know what works and what doesn’t in both trading and training.”

The partners also spoke favorably about the interactive chat aspect to their Trading Room, allowing real-time feedback with their subscribers.

Six Reasons for Income Investors to Day-Trade Amid Disasters Trump Emotion

“Sprinkle in some emotional control and, like magic, we have a successful trade,” Grossman said. “Repeat this process day after day, and not only is it profitable, but a lot of fun as well.”

There is something very rewarding about beating the market at its own game, Grossman continued.

“And I hold no apologies for doing so, either,” Grossman said.

Six Reasons for Income Investors to Day-Trade Amid Disasters Can Lead to Quick Profits

“Long-term investing may work for some but earning 5% annually on a certificate of deposit does not excite me,” Grossman said. “Nor can I afford to gamble on ever-changing technology stocks, meme stocks or anything affected by government policy. But pay me 5% a day on the money invested in SPY call options and I am happy.”

An average person tends to think of trading in terms of normal rules of life, Stephens said. However, that view is flawed, he added.

“If you work harder at something, you tend to get rewarded with bonuses, with promotions, or with a greater sense of purpose and accomplishment,” Stephens said. “This is not true in trading.

“People who work harder in trading often get burned out, work longer hours, or make trading mistakes because they are chasing the one that got away. If you tend to think of trading in terms of a similarity to fishing, that would be a better mindset to have. Every day you come to the ocean: there are whales – the market makers, the sharks – institutional traders, and the swordfish, mackerel and salmon – the retail traders. This is the one place in the world where the longer you last, the higher in the food chain you can go. We as traders are also the fisherman.

Income Investors Limit Time Commitment by Day-Trading

Why the entire world is not day-trading is a mystery, Grossman said. Participants in his Trading Room can accumulate small amounts of money every day, trading only options on one stock or fund for about an hour a day, he added.

The amount earned depends on one’s investment, but many people start small, build their accounts and eventually reach “epic levels,” Grossman said.

Almost all the trades involve options of the SPDR S&P 500 ETF Trust (NYSE ARCA: SPY).

“Get immediate answers, relevant answers and answers you need to hear,” Grossman said.

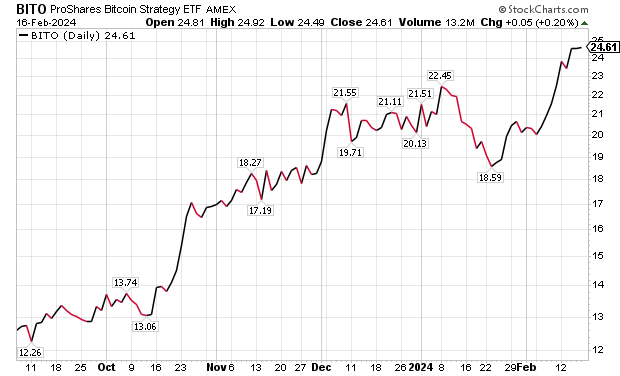

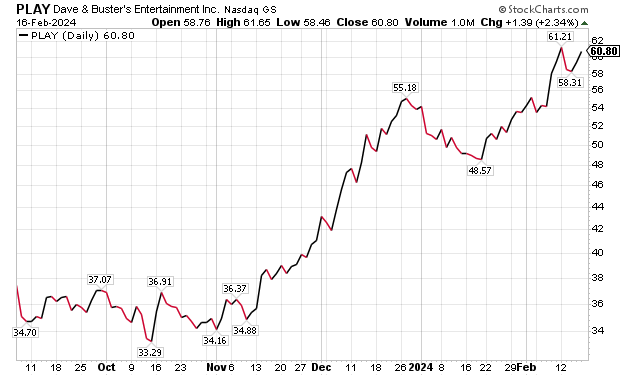

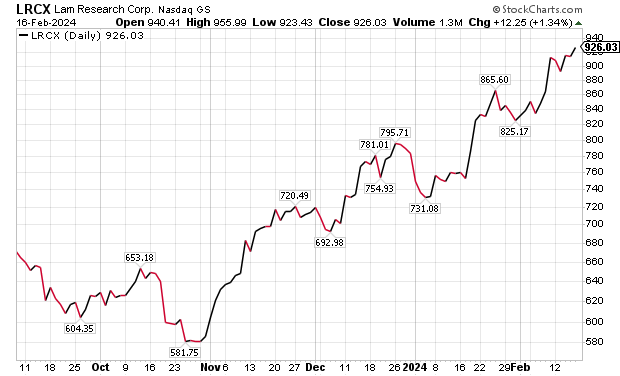

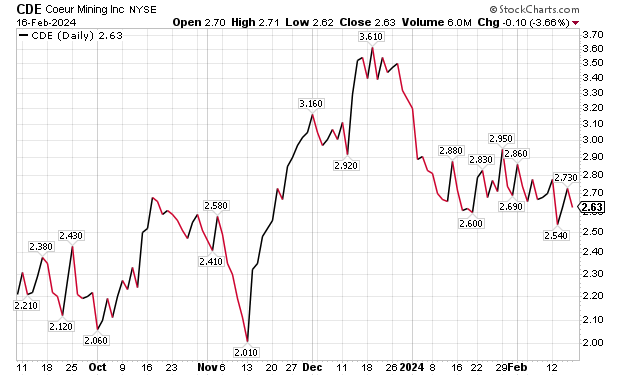

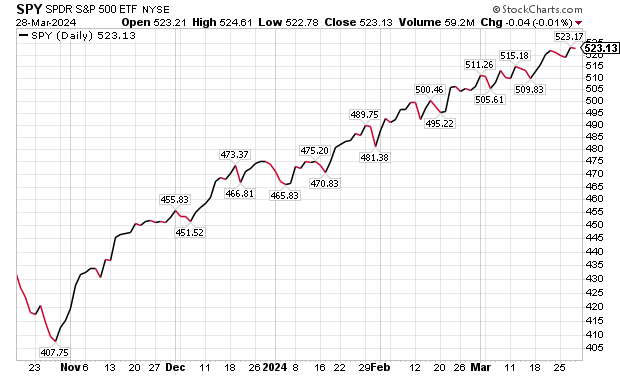

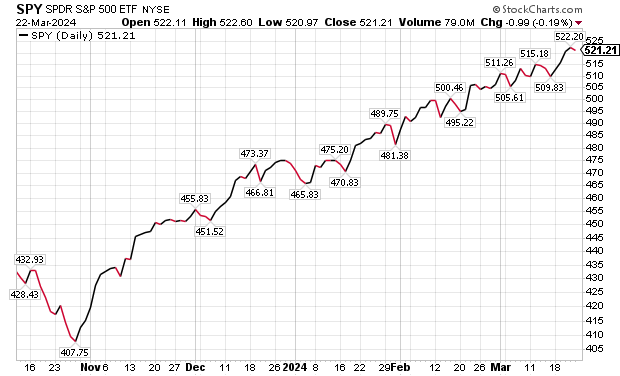

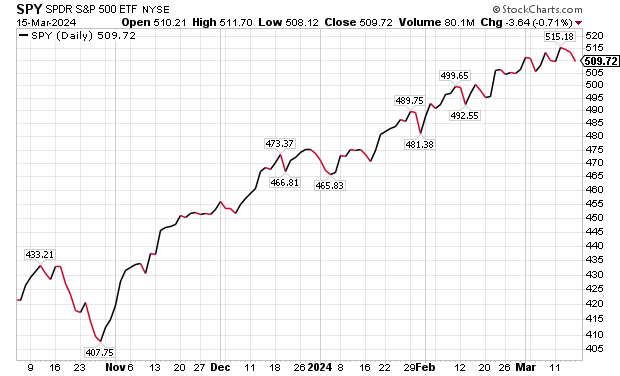

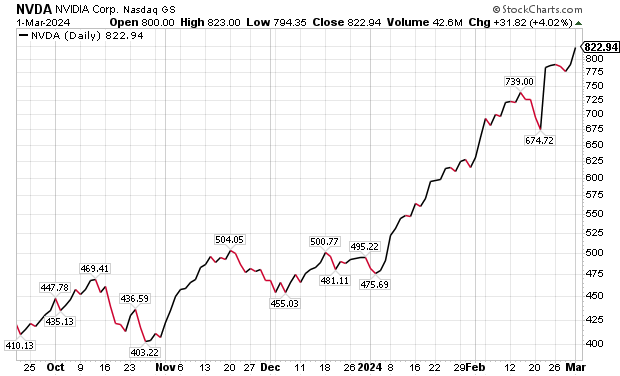

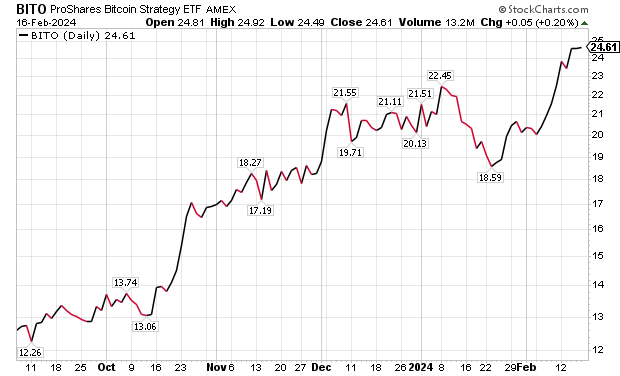

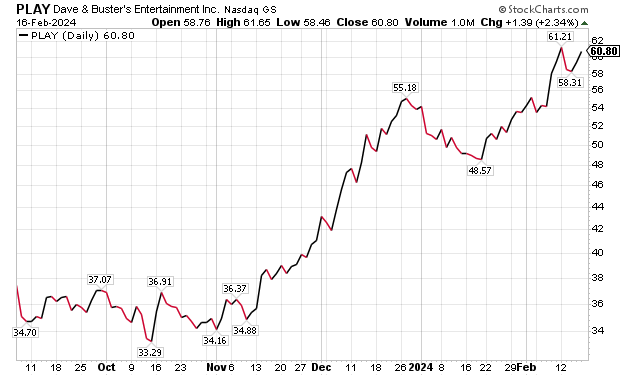

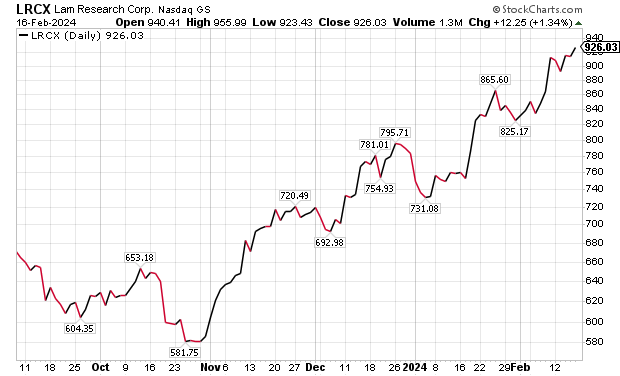

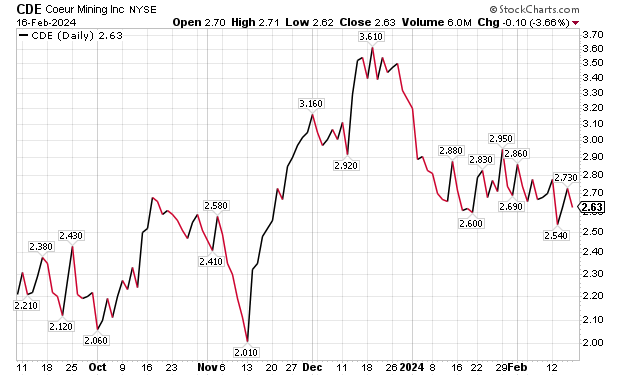

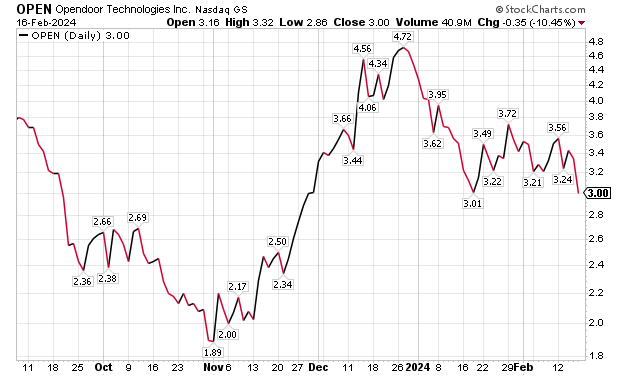

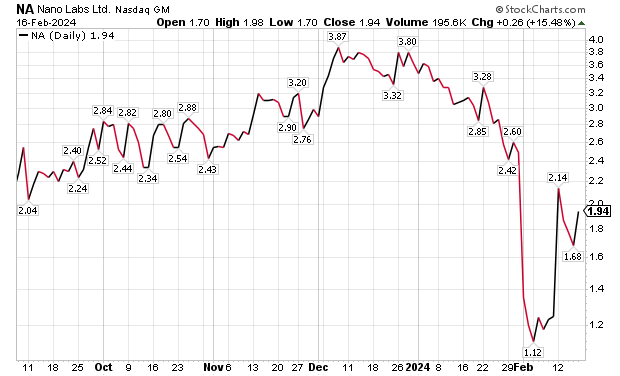

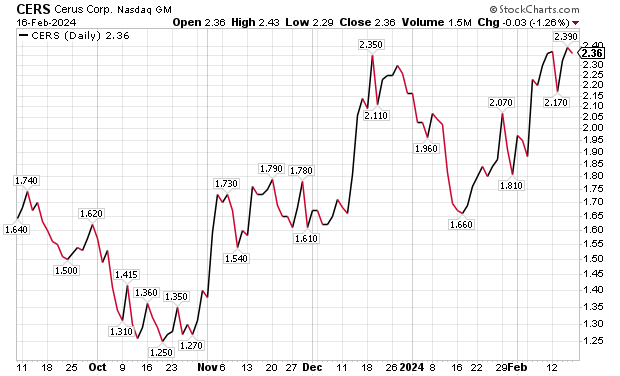

Chart courtesy of www.stockcharts.com

Alternatives Include Pick of the Day

For those not ready to try the Trading Room, Grossman suggested the DayTradeSPY Pick of the Day.

The Pick of the Day is “ideal” for traders who may not have the time to watch the market or stare at charts,” Grossman said. The Pick of the Day is sent to the inbox of each subscriber daily at about 9 a.m. ET.

Subscribers are provided with an overview of the exact trades that Grossman and Stephens are looking at before each market opens.

Day-Trading Newcomers Can Subscribe to the Ultimate Trading Workshop

Grossman and Stephens also offer their Ultimate Training Workshop to help people day trade profitably. They created videos based on a live event held a few months ago, teaching everything they thought would help day-traders.

“If you have never traded options before, this is what you need,” Grossman said. “Even if you are a seasoned trader, the nuances, tips, tricks and traps you will pick up from this series of 11 sessions, each roughly an hour and a half in length, will benefit you immensely.”

The two investment gurus share their “deep in the trenches” experience with concepts that cannot be found anywhere else, Grossman said. Key topics include setting up Schwab (formerly TD Ameritrade) Think or Swim charts to visualize patterns, identifying key indicators and strategies, “repairing trades,” money management and more, he added.

Stephens provides a deep-dive analysis that can answer many questions in the Q&A section of the Ultimate Training Workshop, Grossman said.

“It’s all there,” Grossman advised. “Of course, there may be other updated information only available through our trading room sessions, but the Ultimate Training Workshop will provide the launch pad you need to get started day-trading SPY options.”

The videos are available for at least six months and can be viewed as often as desired during that period, Grossman said.

“Fast forward, pause and rewind,” Grossman continued. “We recommend going through them at least once completely, even if you are an experienced trader. It’s the little subtleties that can make all the difference in your trading. Take advantage of 40+ combined years of Hugh and Ahren’s market participation… master the Ultimate Training Workshop.”

Geopolitical Risk Proliferates

Geopolitical risk exists both domestically and internationally. Even local disasters can disrupt trade and commerce internationally.

One example occurred on March 26 when a large cargo ship lost use of its engine, electronics and control of its steering, then careened into the famed Francis Scott Key Bridge that connected two sections of Baltimore on I-695 across the Patapsco River. The Singapore-flagged, 984-foot-long container ship called “Dali” collided with a pillar of the bridge, triggering a massive emergency response when multiple people and vehicles plunged into the water.

\Two construction workers who fell from the bridge into the water were rescued, but one remains seriously injured. The bodies of two construction workers who were in a red pick-up truck when the bridge collapsed have been found and recovered. A search is ongoing to recover other missing people, including four additional construction workers.

In 2023, the Port of Baltimore handled a record 52.3 million tons of foreign cargo worth $80 billion. That total ranked the port as America’s largest for the transport of foreign cargo. Approximately 15,000 workers are directly impacted and about 140,000 workers are indirectly impacted from the bridge’s collapse, according to state officials.

U.S. Transportation Secretary Peter Buttigieg said in post-accident press briefing that between $100 to $200 million in value of goods pass through Baltimore’s port each day, with about $2 million in wages affected on a daily basis by the closure.

“If ships aren’t moving, they’re not working,” Buttigieg said. “That’s one of our main areas of concern.

The economic impact will be huge, with cruise ships and other vessels that use the Port of Baltimore restricted from normal operations for an unknown period of time. Maryland Gov. Wes Moore requested $60 million in emergency relief funds from the federal government “for our immediate response efforts and to lay the foundation for a rapid recovery.”

The funds would be used for the state to proceed as quickly and safely as possible, with debris removal, demolition, traffic operations and other emergency needs. The request supplements funding provided by other federal partners to provide related work for the emergency response, according to the governor’s office.

Russia Suffers Attack from ISIS-K

Russia suffered a murderous attack reportedly committed by ISIS-K that killed at least 143 people, including five children, and injured more than 100 others at a concert hall near Moscow on Friday, March 22. The assault by four gunmen, who also started a fire by using incendiary devices at the building, marked the latest major incident that shows mounting geopolitical risk in the world.

U.S. government officials warned Russia’s leaders days earlier in writing that ISIS militants planned an attack in or around Moscow, but its President Vladimir Putin rebuffed the advice and called it “provocative.” The assault by the gunmen became the worst terrorist attack of Russia’s capital area in decades.

As far the ongoing invasion of Ukraine, Russian forces attacked a residential area in Kharkiv on March 27, killing one and injuring at least 19, including children. President Putin cautioned on March 18 that the membership of nearby countries in NATO could spark World War III if they interfere with his military activities.

Putin won re-election to a fifth six-year term just weeks after the mysterious death of political opponent Alexei Navalny, one of Putin’s most ardent critics in Russia. Navalny seemed fine to observers when he appeared in a courtroom the day before he died.

Navalny’s burial on Friday, March 1, drew thousands of mourners. With Navalny dead, Putin had no genuine opposition to his re-election to a new six-year term as Russia’s president during the country’s March 15-17 election.

Navalny’s family claims their loved one was fatally poisoned at the arctic prison with a nerve agent on Putin’s orders.

President Putin’s surprise attack of Ukraine with Russian forces more than two years ago has caused him to send continuing waves of soldiers into battle to gain land that is within the sovereign borders of its neighboring nation. The invasion shows no signs of waning, as Russia keeps firing missiles at civilian targets in Ukraine, with women, children and the elderly among those killed or injured.

UN Votes for Ceasefire in Gaza, But Not Release of Hostages

The United Nations Security Council voted on Monday, March 25, for a resolution demanding a cease-fire between Israel and Palestinian militant group Hamas, without requiring the release of an estimated 130 remaining hostages abducted on Oct. 7. The United States abstained from the vote, causing Israel to cancel a high-level delegation’s planned visit to Washington, D.C.

Middle East diplomacy efforts have not borne fruit as Israel seeks the return of the hostages taken from their country by Hamas militants during a murderous raid on Oct. 7, as well as to bring the perpetrators to justice. The Israel Defense Forces (IDF) entered neighboring Gaza, but the death toll there has been high, reaching more than 32,550 at press time, according to Hamas officials.

The war started on Oct. 7 when Hamas fighters invaded southern Israel in an unprecedented assault that reportedly killed 1,163. Other barbarous acts included rapes, torture and the abduction of at least 250 others at gunpoint.

A week-long truce in late November led to Hamas freeing more than 100 Israeli and foreign hostages in exchange for Israel releasing about 240 Palestinian prisoners. However, talks aimed at securing the release of additional hostages have stalled.

President Biden approved and initiated a humanitarian air drop and food distribution for beleaguered Palestinian civilians in Gaza. Roughly 130 hostages abducted on Oct. 7 by Hamas remain trapped in Gaza. But Israeli officials say about a quarter of them are dead.

Income investors worried about geopolitical risk may want to consider day-trading to limit the potential impact of disasters by taking advantage of the quick nature of such trades.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Easter Season Sale! Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for reduced pricing on multiple-book purchases.

Eight reasons for income investors to use a trading room could prove compelling, said stock sherpa Hugh Grossman, who recommended the one he offers with a fellow seasoned trader.

For income investors open to day-trading, Grossman shared seven reasons why he and seasoned trader Ahren Stephens try to distinguish their DayTradeSPY Trading Room from the rest. Since they take different approaches to trading options, they have two ways of verifying whatever trend that one identifies also is a proverbial friend to the other.

“When our indicators unite, our trades ignite,” Grossman told me.

The verification of a trend is “paramount” to achieving a very high degree of success in trading, Grossman said. When both he and Stephens concur on market direction and strength, the wise traders who follow their guidance generally enjoy successful execution, Grossman added.

Eight Reasons for Income Investors to Use a Trading Room: Gain Leverage

Imagine that you need to produce $200 a day from a starting capital base of $20,000. A standard dividend payout every month, quarter or year would not produce the needed daily income.

“Using our methodology, you should be able to generate your daily gains quite effortlessly, actually,” Grossman said.

First, options provide huge leverage, Grossman said. An investor does not need much of a move on the underlying asset to see a change in the option price, he added.

“This benefit alone enables even the most humble of traders, beginners and those who may not have overreaching wealth, to enter the foray of the market,” Grossman said. “Each option controls 100 underlying shares. ‘At the money’ options generally have a delta of 50, meaning that for every dollar the stock moves, the option moves $ .50. If the stock costs $500 per share, the option expiring a few days out might cost only $2. Therefore, it would cost you $200 — $2 x 100 underlying shares that it controls — to buy a single ‘call’ option, if you expect the market to rise.”

Eight Reasons for Income Investors to Use a Trading Room: Two Sherpas

“Our daily Trading Room is unique in a number of ways,” Grossman told me.

Most notably, Grossman said he has a set of indicators that he has used successfully for years. Exponential moving averages (EMAs), support and resistance, chart patterns and trends are among key factors that determine high probability trades, he added.

“Short-term gains can be had by following tight technical entries using the 10 and 20 EMAs,” Grossman told me. “This technique is both profitable and fun as you are actively trading, beating the market at its own game.”

It also helps if the EMAs are climbing on the five-minute chart to support the trade, Grossman said.

“That’s almost a sure profit for short-term gains, Grossman told me.

Hugh Grossman leads DayTradeSpy’s Trading Room and Pick of the Day.

Eight Reasons for Income Investors to Use a Trading Room: Partnership

The Trading Room advisory service that Grossman founded has catapulted to a new level of expertise with the addition of Ahren Stephens, who brings his own set of indicators like Fibonacci retracements and Andrews’ Pitchfork. By collaborating, they identify trades that have a high probability of success, Grossman continued.

Ahren Stephens co-heads of Pick of the Day and the Trading Room.

Combined, their joint analysis offers extra brainpower for their subscribers who want to tap the guidance they offer to the subscribers of their Trading Room advisory service, Grossman said.

“Our Trading Room is an event that traders look forward to, earn while you learn and absorb all you can from two outstanding mentors,” Grossman told me.

Eight Reasons for Income Investors to Use a Trading Room: Track Record

A second reason to consider the DayTradeSpy Trading Room is its 14-year track record, Grossman said.

“The DayTradeSPY Trading Room is the longest running trading room that we know of… now in its 14th year,” Grossman said. “We know what works and what doesn’t in both trading and training.”

The partners also spoke favorably about the interactive chat aspect to their Trading Room, allowing real-time feedback with their subscribers.

Eight Reasons for Income Investors to Use a Trading Room: Subscriber Friendly

Grossman told me that their Trading Room is “fun” and typically profitable for their subscribers. The intent is to help subscribers trade profitably and enjoy doing so, he added.

These are not “watch Hugh and Ahren” trade sessions to guide subscribers in doing so profitably, Grossman said. The focus is on the subscribers and meeting their needs, he added.

Another plus is the limited time commitment that is required each day, Grossman added. Subscribers are expected to join them virtually at 9:20 a.m. ET and usually wrap up about 10:30 a.m. ET, he added.

Eight Reasons for Income Investors to Use a Trading Room: Interactive Sessions

Another distinction between the DayTradeSPY Trading Room and its competitors is the interactive aspect, Grossman said. Subscribers are welcome and encouraged to communicate directly with the two hosts, privately, during these live sessions, he continued.

Almost all the trades involve options of the SPDR S&P 500 ETF Trust (NYSE ARCA: SPY).

“Get immediate answers, relevant answers and answers you need to hear,” Grossman said.

Chart courtesy of www.stockcharts.com

Eight Reasons for Income Investors to Use a Trading Room: Thin Time Commitment

The goal is to help subscribers profit in a short amount of time that ideally is less than an hour a day, Grossman said.

“Our events are respectful of your time,” Grossman told me. “We do not monopolize your day but try to teach you first thing in the morning from 9:20 a.m. to 10:30 am, ET, so you can carry on with the rest of your day.”

For less than an hour a day, the potential to profit is unbeatable, Grossman continued.

Eight Reasons for Income Investors to Use a Trading Room: Complementary Skills

With two seasoned traders, subscribers have double the expertise to tap, Grossman said Each is “knowledgeable” in his respective areas, he added.

Together, they have a combined 40-plus years of market participation,” Grossman told me.

“Nobody else provides such comprehensive, focused training at such an affordable price.”

Eight Reasons for Income Investors to Use a Trading Room: Entertainment Value

The last reason to use the DayTradeSPY Trading Room is that the sessions are designed to be entertaining and fun, Grossman said.

“Our members are amused by our humor and lightheartedness during the ‘off times,’” Grossman told me. “When trades are ‘on,’ they are exciting, motivating, inspiring and confidence building.”

The result typically is profits for subscribers, as well as a good time for all, Grossman said.

“It is little wonder those in our Trading Room are trading well. They know how to combine Andrews’ Pitchfork, Fibonacci, support and resistance, Exponential Moving Averages and other technicals to all but guarantee winning trades,” Grossman told me.

Trading Room Alternatives

For those not ready to give the Trading Room a try, they can consider the DayTradeSPY Pick of the Day.

The Pick of the Day is “ideal” for traders who may not have the time to watch the market or stare at charts,” Grossman said. The Pick of the Day is sent to the inbox of each subscriber daily at about 9 am ET.

Subscribers are provided with an overview of the exact trades that Grossman and Stephens are looking at before each market opens.

Ultimate Trading Workshop Preps Participants for Potential Profits

Grossman and Stephens also offer their Ultimate Training Workshop to help people day trade profitably. They created videos based on a live event held a few months ago, teaching everything they thought would help day traders.

“No stone is left unturned,” Grossman said. “If you have never traded options before, this is what you need. Even if you are a seasoned trader, the nuances, tips, tricks and traps you will pick up from this series of 11 sessions, each roughly an hour and a half in length, will benefit you immensely.”

The two investment gurus share their “deep in the trenches” experience with concepts that cannot be found anywhere else, Grossman said. Key topics include setting up Schwab (formerly TD Ameritrade) Think or Swim charts to visualize patterns, identifying key indicators and strategies, “repairing trades,” money management and more, he added.

Stephens provides a deep-dive analysis that can answer many questions in the Q&A section of the Ultimate Training Workshop, Grossman said.

“It’s all there,” Grossman advised. “Of course, there may be other updated information only available through our trading room sessions, but the Ultimate Training Workshop will provide you the launch pad you need to get started day trading SPY options.”

The videos are available for at least six months, and can be viewed as often as desired during that period, Grossman said.

“Fast forward, pause and rewind,” Grossman continued. “We recommend going through them at least once completely, even if you are an experienced trader. It’s the little subtleties that can make all the difference in your trading. Take advantage of 40+ combined years of Hugh and Ahren’s market participation… master the Ultimate Training Workshop.”

Geopolitical Risk Keeps Rising

Russia suffered an attack reportedly by ISIS that killed 40 people and injured at least 100 others at a symphony in Moscow on Friday, March 22. It is the latest major incident that shows mounting geopolitical risk in the world.

Russia’s President Vladimir Putin cautioned on March 18 that the NATO’s unwillingness to allow his efforts to proceed with his “special military operation” in Ukraine could start World War III. He won re-election to a fifth six-year term just weeks after the mysterious death of political opponent the Alexei Navalny, one of Putin’s most ardent critics in Russia. Navalny seemed fine to observers when he appeared in a courtroom the day before he died.

Navalny’s burial on Friday, March 1, drew thousands of mourners. With Navalny dead, Putin had no genuine opposition to his re-election to a new six-year term as Russia’s president during the country’s March 15-17 election.

Navalny’s family claims their loved one was fatally poisoned at the arctic prison with a nerve agent on Putin’s orders.

President Putin’s surprise attack of Ukraine with Russian forces more than two years ago has caused him to send continuing waves of soldiers into battle as human sacrifices to gain land that is within the sovereign borders of its neighboring nation. The invasion shows no signs of waning.

Middle East Fallout from Oct. 7 Mayhem

The Middle East diplomacy efforts have not borne fruit as Israel seeks the return of hostages taken from their country by Hamas militants during a murderous raid on Oct. 7, as well as bring the perpetrators to justice. The Israel Defense Forces (IDF) entered neighboring Gaza, but the death toll there has been high, reaching nearly 31,900 at press time, according to the latest media reports.

The war started on Oct. 7 when Hamas fighters invaded southern Israel in a precedented assault by Hamas that reportedly killed 1,163. Other barbarous acts included rapes, torture and the abduction of at least 250 others.

A week-long truce in late November led to Hamas freeing more than 100 Israeli and foreign hostages in exchange for Israel releasing about 240 Palestinian prisoners. However, talks aimed at securing the release of additional hostages have not produced results.

President Biden approved and initiated a humanitarian air drop and food distribution for beleaguered Palestinian civilians in Gaza. Roughly 130 hostages abducted on Oct. 7 by Hamas remain trapped in Gaza. But Israeli officials say about a quarter of them are dead.

Income investors worried about geopolitical risk may want to consider day trading to limit the potential impact of military conflicts due to the quick nature of such trades.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Easter Season Sale! Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for reduced pricing on multiple-book purchases.

Day trading for income using three strategies of Andrews’ Pitchfork offers potential for quick profits.

Income investors may be unfamiliar with the Andrews’ Pitchfork strategies but that is no reason to avoid learning how these techniques may pay off for traders. Andrews’ Pitchfork strategies may sound a bit strange, but the three key strategies have been taught to option traders who earned income much faster than by purchasing shares in a stock, then waiting to receive a dividend for three months or a year.

Invented by Alan Andrews, the technical indicator of trendlines that bear his name can help day traders to identify income opportunities, as well as what are known as “swing” possibilities.

Andrews’ Pitchfork strategies can help to assess overall cycles that affect spot price activity. Day traders may be able to time their activity to buy during brief dips and sell profitably amid upticks.

Sherpa Says Day Trade for Income Using Three Strategies of Andrews’ Pitchfork

“The Andrews Pitchfork is one of the only predictive tools available to market technicians,” said Ahren Stephens, co-leader of the Trading Room and Pick of the Day advisory services. “It is an incredibly versatile tool that originated in the golden age of technical analysis in the early 20th century.”

Ahren Stephens co-heads of Pick of the Day and the Trading Room.

Roger Babson, an entrepreneur, market forecaster and later a politician, began studying markets at an early age. After Babson’s oldest sister, Edith, drowned during the 1880s in the Annisquam River in Gloucester, Massachusetts, he sought to understand gravity.

Thus, Babson created the Gravity Research Foundation in 1960 to give awards to essays on gravity-related topics. Generally, Andrews’ Pitchfork is based on the work of Sir Isaac Newton. The famed Newtonian law that every action has an equal and opposite reaction came into play to create Andrews’ Pitchfork to help plot trend lines on financial charts, rather than hand-draw Action Reaction sets, Stephens explained.

Day Trading for Income Using Three Strategies of Andrews’ Pitchfork: Kennedy Clan

During the Depression period of the late 1920s and early 1930s, Andrews managed money for Joseph Kennedy, a prominent political family patriarch, producing more than $450 million in the stock market crash of 1929. Today, that $450 million would be worth billions of dollars, Stephens continued.

Andrews ended up working at the University of Miami and developed the Action Reaction course. When he launched his course at the university, the line of students seeking to take it was so long it wrapped around the block.

Day Trading for Income Using Three Strategies of Andrews’ Pitchfork: SPY Secrets

“Let’s make trading simple by implementing the three secrets of Andrew’s Pitchfork to help you generate income and gains on a regular basis,” Stephens said. “In our Trading Room service, we have two master sherpa traders leading their customers to the top of the mountain by helping them lock in their profits regularly. By adding some simple secrets of Dr. Alan Andrews, the famed market technician and trader, you can find your way on the road to trading for income.”

The three secrets of using Andrews’ Median Line, previously called the Normal Line by Babson, were unveiled by Stephens during his presentation at the Money Show/Traders Expo event in Las Vegas last February. Stephens told me the audience seemed especially attentive.

The word pivot also is integral in understanding the first secret of the Andrews’ Pitchfork, Stephens said. The following description should be illuminating.

By identifying the major pivots on that chart, a trader can find possible turning points in the future by using the Andrews’ Pitchfork tool, Stephens said. He and senior partner Hugh Grossman avoid complication by typically trading only options in the SPDR S&P 500 ETF Trust (SPY), a fund that seeks to provide investment results that correspond to the price and yield performance of the S&P 500 Index.

Hugh Grossman leads DayTradeSpy’s Trading Room.

The S&P 500 Index tracks a diversified group of large-cap U.S. stocks across all 11 Global Industry Classification Standard (GICS) sectors. CICS also has 25 industry groups, 74 industries and 163 sub-industries into which the S&P uses to categorize all major public companies.

Chart courtesy of www.stockcharts.com

Day Trading for Income Using Three Strategies of Andrews’ Pitchfork: Pivots

If an investor can think of ABC, the person can find the pivots that will allow one to forecast the probable path of the price of any stock or commodity, explained Stephens, who added that the technique is used when he instructs subscribers in the Trading Room advisory service.

“Many people in our Trading Room want to know how we come up with our amazing predictions in our crystal ball,” Stephens told me. “And the answer is we use tools that can find the probable path of the price.”

For starters, define the major highs and lows on higher time frames, Stephens said. By examining the pivots and market structure on higher timeframes, a trader can significantly improve his or her outlook, he continued.

Look at the time frame every day when first checking charts, Stephens said. Then identify the major trend and look for income-producing trades, whether short-term or long-term. The daily time frame is where most of the larger traders and institutions trade for the longer term. For investors buying stocks and wanting to hold, this is a great place to start, he added.

Day Trading for Income Using Three Strategies of Andrews’ Pitchfork: Secret 2

Andrews’ Pitchfork Secret #2 is to trade in the direction of the trend for enhanced profitability. That may sound easy, but it requires identifying a trend and knowing when to buy or sell.

“The old axiom, ‘the trend is your friend,’ is tried and true,” Stephens said. “We also like to think of the Andrews’ Pitchfork as your friend because it is one of the very few predictive tools using math and physics that can help you both enter and exit trades in the trend’s direction, as well as find possible turning points as they happen if you’re already in a trade.”

Plus, keep in mind, the trend is your friend “until it ends,” Stephens continued. Andrews’ Pitchfork helps to find starting and ending points. For greater returns from trades, follow a trend-following approach in the markets, he added.

“Knowing the direction of the trend will help you understand and correctly forecast and trade the probable path of the price,” Stephens said. “Are we making higher highs and higher lows? Are we making lower highs and lower lows?

“By identifying and marking the correct larger timeframe direction, specifically the Daily and 240-minute trend direction, you are able to catch the momentum of larger traders and institutions and have the wind at your back to help push you to greater profits.”

Day Trading for Income Using Three Strategies of Andrews’ Pitchfork: Secret 3

Andrews Pitchfork Secret #3 is to enter at the test and retest to gain the best entry, but exit at extremes, Stephens advised. To maximize gains, the goal is to let winning trades run, but keep losses small, Stephens advised.

“To utilize the best entries, you need to draw a fork that can contain the price,” Stephens said. “After a test of a median line, whether it’s the lower parallel, the upper parallel, or the middle median line, you need to determine if the price is going to hold that area and continue running in the trend.”

When the price continues in the trend, a trader can maximize profits by following the price to the next median line on the chart, Stephens said.