Abbott Laboratories Boosts Annual Dividend Amount for 47th Consecutive Year (ABT)

By: Ned Piplovic,

Abbott Laboratories (NYSE:ABT) boosted its annual dividend for the sixth consecutive year since divesting its research-based pharmaceuticals operations in 2013 and for the 47th consecutive year since beginning its current annual dividend hikes streak in 1973.

In addition to the exceptional record of dividend income growth, the company managed to enhance its share price more than 17% over the past 12 months, which was contrary to the overall markets that declined since the beginning of 2018.

While the company has a long record of providing a reliable source of rising annual dividend income, the company’s dividend yield has been fluctuating around 2% since its divestiture of AbbVie, Inc. (NYSE:ABBV) in 2013. Furthermore, the company’s current yield of 1.85% is even 10% lower than its 2.1% average yield over the past five years. The yield has declined slightly only because the dividend’s growth rate over the past year could not match the growth rate of the company’s rising share price.

Therefore, instead of being a draw for pure income-seeking investors, the ABT stock might be a better portfolio fit for investors looking for securities that offer balanced returns from dividend income and asset appreciation. From the total return perspective, the ABT shareholders enjoyed a total return of nearly 20% over the past year when many of its industry peers and total markets suffered losses.

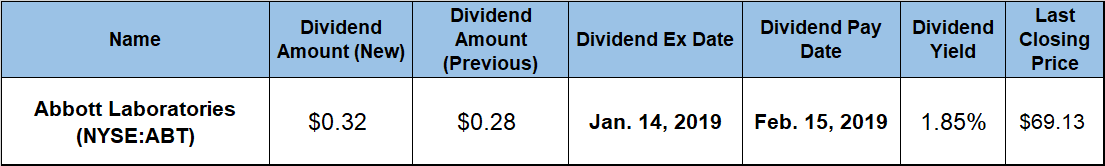

Interested investors should make sure to take a long position in the ABT stock prior to the company’s next ex-dividend date on January 14, 2019. Abbott Laboratories will distribute its next round of dividend payouts on the February 15, 2019, pay date to all investors who attain the shareholders of record status prior to the ex-dividend date in January.

Abbott Laboratories (NYSE:ABT)

Headquartered in Abbott Park, Illinois, and founded in 1888, Abbott Laboratories discovers, develops, manufactures and sells health care products worldwide. The company’s Established Pharmaceutical Products segment offers branded generic pharmaceuticals and its Diagnostic Products segment offers core laboratory systems for immunoassay, clinical chemistry, hematology, molecular diagnostics applications. Additionally, the company’s Nutritional Products segment provides pediatric and adult nutritional products. The company’s Cardiovascular and Neuromodulation Products segment offers rhythm management, electrophysiology, heart failure, vascular and structural heart devices, as well as neuromodulation devices for the management of chronic pain and movement disorders. Furthermore, the company also provides blood and flash glucose monitoring systems, including test strips, sensors, data management decision software and accessories for people with diabetes. Abbot Laboratories distributes its products under multiple brand names, including Pedialyte, Similac, PediaSure, Brufen, Ensure and FreeStyle.

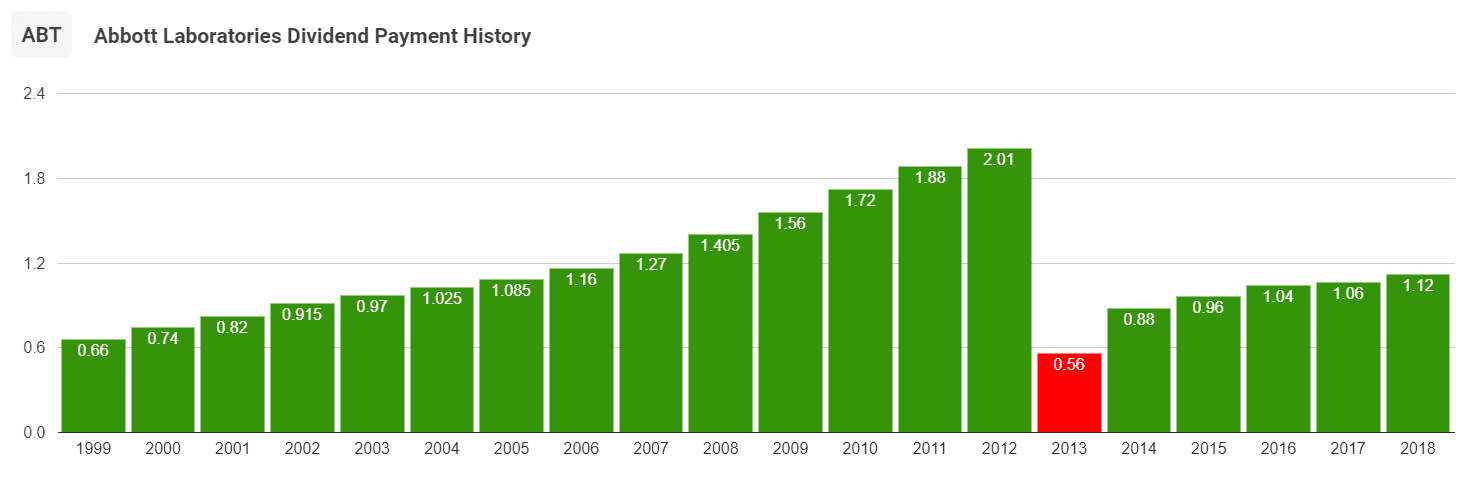

Prior to spinning off its research-based pharmaceuticals operations into AbbVie, Inc., Abbot labs rewarded its shareholders with 41consecutive annual dividend hikes. The chart of the company’s total annual dividend payouts shown below seems to indicate a dividend cut in 2013. However, Abbot Labs merely transferred a apportion of its annual dividend payout to the AbbVie, Inc entity, which paid a $1.66 annual dividend for 2013. Both entities paid a combined $2.16 annual dividend in 2013 which is higher than the $2.01 dividend paid by the parent entity in 2012. Since both new companies continued to boost their respective annual dividends every year since the split in 2013, Abbot Labs and AbbVie have effectively continued the parent company’s streak of consecutive annual hikes.

This includes Abbot Labs current 14.3% dividend hike from the $0.28 quarterly amount paid out in 2018 to the $0.32 amount for the first distribution in 2019.

The company’s new quarterly payout corresponds to a $1.28 annual payout and a 1.85% forward yield. While this yield might seem low compared to some sectors with traditionally high yields, Abbot Labs current dividend yield is nearly 185% higher then the 0.65% average yield of the overall Health Care sector. The company’s current yield trails the 2.04% average yield of the Major Drug Manufacturers industry segment by more than 9%. However, ABT has the highest yield among its peers in the Medical Instruments & Supplies segment, exceeds the segments 0.43% average yield by more than 340% and is more than 35% higher than the second highest yield in the segment – 1.41% by Becton, Dickinson and Company (NYSE:BDX)

Even with the apparent dividend reduction in 2013, the company nearly doubled its annual dividend payout amount over the past two decades, which is equivalent to an average growth rate of 3.4% per year. However, because the company’s $0.56 annual payout in 2013 was lower than the $0.66 payout in 1999, the average annual growth rate over the past six years is 14.8% per year. The company’s record of 47 consecutive annual dividend hikes places the ABT stock into the exclusive group of Dividend Aristocrats.

The company’s share price bottomed out at its 52-week low of $56.27 in early February 2018. After this low, the share price gained more than 30% before peaking at its 52-week high of $74.27 on December 3, 2018. The share price pulled back nearly 7% from the December peak and closed on January 7, 2019 at $69.13. This closing price was 17.5% higher one year earlier, nearly 23% above the 52-week ow and 75% higher than it was five years ago.

The dividend income growth and the rising share price rewarded ABT’s shareholders with a 19% total return over the past 12 months, as well as total returns of 74% and 91% over the last three and five years, respectively.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic