Abbott Laboratories Doubles Annual Dividend Amount in Five Years (ABT)

By: Ned Piplovic,

After divesting its research-based pharmaceuticals operations in 2013, Abbott Laboratories (NYSE:ABT) continued rewarding its shareholders with reliable dividend income by doubling its annual dividend amount in five years.

The company has been distributing dividends since 1926 and has increased its annual dividend payout for the past 45 consecutive years. In addition to the exceptional record of dividend income growth, the company has complemented the rising annual dividend payouts with equally steady asset appreciation.

While the company’s current dividend yield of 1.84% is on the low end of what income-seeking investors would deem desirable, the company’s share price growth more than compensated for the dividend yield shortfall and provided steady double-digit-percentage total returns over the past five years. Therefore, investors might be interested in this stock as a source of asset appreciation supported by a small but reliable income flow.

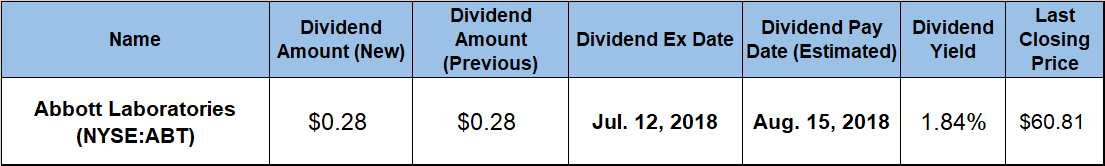

Abbott Laboratories set its next pay date for August 15, 2018. On that date, the company will distribute its next instalment of dividends to all shareholders of record before the July 12, 2018, ex-dividend date.

Abbott Laboratories (NYSE:ABT)

Headquartered in Abbott Park, Illinois, and founded in 1888, Abbott Laboratories discovers, develops, manufactures and sells health care products worldwide. The company’s Established Pharmaceutical Products segment offers branded generic pharmaceuticals and its Diagnostic Products segment offers core laboratory systems for immunoassay, clinical chemistry, hematology, molecular diagnostics applications. Additionally, the company’s Nutritional Products segment provides pediatric and adult nutritional products. The company’s Cardiovascular and Neuromodulation Products segment offers rhythm management, electrophysiology, heart failure, vascular and structural heart devices, as well as neuromodulation devices for the management of chronic pain and movement disorders. Furthermore, the company also provides blood and flash glucose monitoring systems, including test strips, sensors, data management decision software and accessories for people with diabetes. Abbot Laboratories distributes its products under multiple brand names, including Pedialyte, Similac, PediaSure, Brufen, Ensure and FreeStyle.

While it may appear that Abbott Laboratories cut its annual dividend in 2013, the company only transferred a portion of its annual dividend distributions to the AbbVie, Inc. (NYSE:ABBV) company created by the divestiture of Abbott Labs’ research-based pharmaceuticals operations.

Abbot Labs paid rising dividends for 41 consecutive years prior to the 2013 divestiture. The company paid a $0.56 annual dividend amount in 2013, which was lower than the $2.01 total annual dividend amount paid in 2012. However, the new business entity — AbbVie — distributed $1.66 in total dividends in 2013. The combined annual dividend payout of $2.16 for both companies exceeded Abbot Labs’ 2012 distribution of $2.01. Since 2013, both companies have continued to grow their annual dividends. Therefore, Abbott Labs effectively has a record of boosting its annual dividend for the past 46 consecutive years. As a component of the S&P 500 Index with that record of consecutive annual dividend hikes and a market capitalization of more than $3 billion, Abbott Labs is one of the 53 companies currently designated as Dividend Aristocrats.

The company’s current $0.28 quarterly dividend is almost 5.7% higher than the $0.265 payout from the same quarter last year. This new quarterly amount yields 1.84% and is equivalent to a $1.12 annual dividend distribution. Even with the dividend reduction in 2013, the company enhanced its total annual dividend 87% over the past two decades, which corresponds to a 3.2% average annual growth rate. However, the company’s actual dividend distribution of $0.56 in 2013 was lower than the $0.60 payout in 1998. Therefore, the company’s dividend growth over the past five years is even more impressive. Over that period, the company doubled its annual dividend payout by growing its annual dividend at an average growth rate of nearly 15% per year.

The rising share price started the trailing 12-month period from its 52-week low of $47.94 on July 7, 2017. From there, the share price ascended nearly 33% before reaching its 52-week-high of $63.62 on March 12, 2018. After peaking in mid-March, the share price initially declined slightly and then rose back to a near-peak level of $63.54 by early June 2018, before dropping again and closing at $60.81 on July 3, 2018. That closing price was almost 27% above the 52-week low from July 2017 and 72% higher than it was five years earlier.

The steady capital growth and the moderate dividend income rewarded shareholders with a 27% total return over the past 12 months and a total return of nearly 30% over the past three years. Over the last five years since the AbbVie divestiture, the shareholders nearly doubled their investments with a 92% total return.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic