ADP Boosts Quarterly Dividend Nearly 10% Again (ADP)

By: Ned Piplovic,

Featured Image Source: http://investors.adp.com/overview/default.aspx

Automatic Data Processing, Inc. (NASDAQ:ADP) continued it record of more than four decades of annual dividend hikes with its current boost to its quarterly dividend payout of nearly 10%.

While the company’s 2.1% dividend yield has been suppressed by the rising share price, the current yield still out performs the average industry yield of the Technology sector and the average yield of the Business Software & Services industry segment.

ADP’s current quarterly dividend hike raised the company’s streak of annual dividend hikes to 42 consecutive years, which makes ADP a Dividend Aristocrat.

Dividend Aristocrat is a designation bestowed on approximately 50 S&P 500 companies that have boosted annual dividends for at least 25 consecutive years and have a market capitalization in excess of $3 billion.

Additionally, the rising dividend yield and the growing share price combined to provide ADP’s investors with a total return of more than 30% over the past year, as well as more than doubled shareholders’ investments over the past five years.

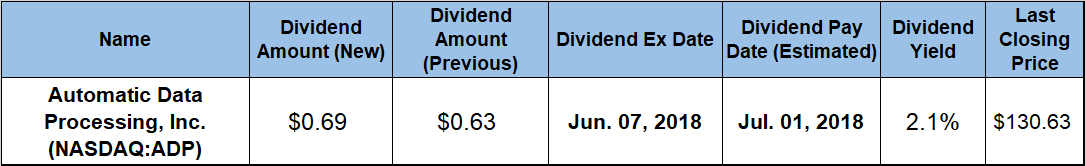

Automatic Data Processing set its next dividend pay date for July 1, 2018, when the company will distribute its next $0.69 quarterly dividend to all its shareholders of record prior to the June 7, 2018, ex-dividend date.

Automatic Data Processing, Inc. (NASDAQ:ADP)

Founded in 1949 and headquartered in Roseland, New Jersey, Automatic Data Processing, Inc. provides business process outsourcing services for more than 650,000 clients in more than 110 countries. The company operates through two segments, Employer Services and Professional Employer Organization (PEO) Services.

The Employer Services segment offers software and service-based business solutions that support human resources (HR) business processes and technology-enabled human capital management. Its offerings include payroll services, benefits administration, talent management, HR management, time and attendance management, insurance services, retirement services and tax compliance services.

The PEO Services segment offers HR outsourcing solutions through a co-employment model. This segment offers HR administration services, such as employee recruitment, payroll and tax administration, time and attendance management, benefits administration, employee training and development and employee leave administration. Additionally, this segment provides services for management of employee benefits and guidance on compliance with federal, state and local employment laws and regulations.

ADP’s current dividend boost of 9.5% from $0.63 in the previous quarter to the current $0.69 quarterly payout is the company’s second dividend hike for 2018. The company already boosted its quarterly dividend amount 10.1% for the first-quarter dividend payout in January 2018, as it did every year for the past two decades. This is the first time in at least 20 years that the company boosted its quarterly dividend for the second time within a calendar year.

The current $0.69 quarterly payout is equivalent to an annualized dividend amount of $2.76, which currently yields 2.1%. While this yield is not as high as dividend yields in some other sectors, ADP’s current yield is identical to the 2.1% average yield of the entire Technology sector. However, compared to the peers in the Business Software & Services industry segment, ADP’s current yield is the third highest, 117% above the segment’s average yield and 22% higher than the average yield of only dividend-paying companies in the segment.

Since the onset of the company’s current streak of consecutive annual dividend hikes in 1976, ADP enhanced its total annual dividend amount more than 10-fold by maintaining an average growth rate of 12.5% per year for more than four decades.

In addition to the steadily rising dividend income and second dividend hike for 2018, ADP has rewarded its shareholders with a significant share price growth over the past few years. The share price hit its 52-week low of $100.11 just eight trading days into the trailing 12-month period, on June 9, 2017. After this low, the share price ascended for the remainder of the 12-month period with just a few spikes and drops of 10% to 15%. The share price gained nearly a third of its value by the time it closed at its new 52-week high of $130.63 on May 30, 2018.

This current closing price is 31% above the 52-week low from June 2017, 29% higher than it was one year earlier and nearly 120% higher than it was five years ago. The strong asset appreciation and the rising dividend income combined to reward the company’s shareholders with a 31.25% total return just over the past 12 months. The total return over the past three years was 61% and shareholders more than doubled their investments with a 130% total return over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic