Alexandria Real Estate Equities Offers 2.8% Yield, Eight Years of Dividend Hikes (ARE)

By: Ned Piplovic,

Alexandria Real Estate Equities, Inc. (NYSE: ARE) has been paying out consistent dividends for over 20 years and currently offers a 2.8% yield in addition to a growing share price.

While the company’s current yield lags slightly behind its own five-year average, the payout is still impressive, especially when you consider that the rising dividend payouts have come in tandem with a quickly rising share price, which is up 80% in the last five years alone.

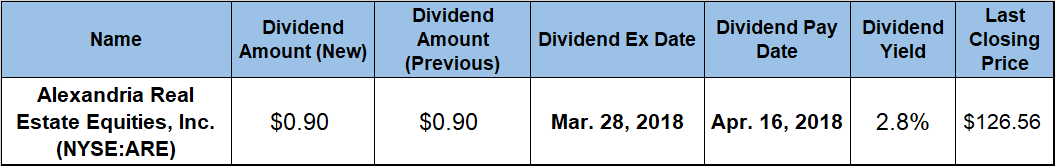

Alexandria Real Estate’s next scheduled dividend pay date is April 16, 2018. The quarterly dividend distribution will be paid to all shareholders of record prior to the March 28, 2018 ex-dividend date.

Alexandria Real Estate Equities, Inc (NYSE:ARE)

Headquartered in Pasadena, California, Alexandria Real Estate Equities, Inc. (NYSE: ARE) is an urban office real estate investment trust (REIT) that is uniquely focused on collaborative life science and technology campuses. The company owns 213 properties with almost 30 million square feet of total assets. As of December 31, 2017, the company had more than 96% of its operational 22 million square feet rented out and almost 8 million square feet of additional capacity under development.

Founded in 1994, Alexandria pioneered this niche space for itself as a REIT and has since established a significant market presence in key locations such as Boston, San Francisco, New York City, San Diego, Seattle, Maryland and Research Triangle Park in North Carolina. In addition to real estate, the company also provides strategic risk capital to transformative life science and technology companies through its venture capital arm — Alexandria Venture Investments. On January 7, 2018, the launch of the Alexandria Seed Capital Platform was announced, which will focus on promising life science startups.

The company’s current quarterly dividend of $0.90 is 8.4% higher than the $0.83 payout from this same period last year. This new quarterly distribution is equivalent to a $3.60 annualized amount for 2018 and amounts to a 2.8% yield at current levels. As ARE’s five-year average yield is 3.2%, the current yield is roughly 11% below that level. Despite a 6.5% rise in the total annual dividend for 2018 compared to 2017, the yield dropped because the share price grew almost 20% in the same one-year period.

Alexandria Real Estate has been distributing dividends for over two decades to take advantage of its favorable tax status as a REIT. Over the past 20 years, the company has cut its annual dividend only twice and has boosted the annual payout every other year. Simply put, ARE has raised its annual dividend 90% of the time in the last 20 years. After cutting its annual dividend amid the financial crisis by more than 55% between 2008 and 2010, the trust resumed annual dividend hikes in 2011. Because of its double-digit percentage annual growth rate, the total annual dividend payout recovered completely and by 2016 exceeded the reduced 2008 level. Since the most recent cut in 2010, the total annual dividend has risen almost 160%.

The share price has been on a steady uptrend over the past 24 months or so, and entered the current trailing 12 months on March 20, 2017 with an opening price of $110.45. From that point, the share price climbed nearly 22% and hit its 52-week high of $134.37 on December 19, 2017. After volatility entered the market again in early 2018, the share price declined some 15% by the first week of February. However, the share price has recovered more than half of its losses since that plunge and closed on March 16 at $128.24, which was just 4.5% below the peak price in December. The current closing price is 16% above the price from one year ago and about 80% higher than five years ago.

In short, the combination of the robust asset appreciation and the rising dividend income has given the trust’s shareholders strong total returns over the past couple of years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic