Amgen, Inc. Boosts Quarterly Dividend Amount Nearly 15% (AMGN)

By: Ned Piplovic,

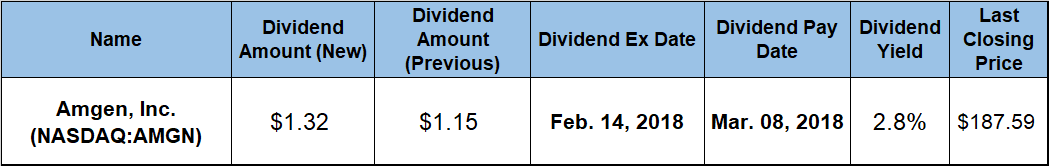

Amgen Incorporated (NASDAQ:AMGN) enhanced its current quarterly dividend payout nearly 15% versus the previous quarter and rewarded its shareholders with a 2.8% dividend yield.

In addition to the extraordinary dividend hike and the healthy yield, the company provided its shareholders with a 20%-plus asset appreciation for a total return of more than 25% over the past 12 months.

As a rare dividend-paying biotech company, Amgen, Inc. will distribute its next dividend payments on March 8, 2018, to all its shareholders of record prior to the company’s ex-dividend date, which will occur on February 14, 2018.

Amgen Incorporated (NASDAQ:AMGN)

Founded in 1980 and headquartered in Thousand Oaks, California, Amgen Inc. develops and manufactures medications, drugs and other products for the treatment of illness. With research and manufacturing presence in more than 100 countries, the company focuses its research and development efforts primarily in six therapeutic areas — cardiovascular disease, oncology, bone health, neuroscience, nephrology and inflammation. The company has collaborative agreements with Pfizer Inc., UCB, Inc. and Bayer HealthCare Pharmaceuticals Inc.

The company boosted its quarterly dividend payout 14.8% from previous quarter’s $1.15 distribution to the current $1.32 amount. This new payout amount converts to a $5.28 annualized distribution and a 2.8% forward yield. Amgen’s current 2.8% yield is more than 40% above the company’s own 2% average yield over the past five years.

The company managed to enlarge its annual dividend payout at an average rate of almost 25% per year over the past seven consecutive years. Over that period, the company’s total annual dividend payout amount rose more than 370% from $1.20 in 2011 to the $5.28 annualized payout for 2018.

As already mentioned, Amgen, Inc. is one of only few companies in the biotech sector that pays dividends. The company’s 2.8% forward dividend yield is currently the highest yield in the Biotech segment and is 35% higher than the 2.1% average yield of all the dividend-paying companies in the segment. Compared to the 1.65% average yield of all the dividend-paying companies in the entire Healthcare sector, Amgen’s current yield is 71% higher.

The company’s share price has been on a relatively stable rising trend since September 2011. However, the share price has experienced some volatility in the past three years and the last year was no exception. The share price reached its 52-week low of $151.85 very early in its current trailing 12-month period after falling 1.3% between January 18, 2017, and January 24, 2017.

After bottoming out in late January, the share price embarked on a general uptrend towards its 52-week high of $1.91, which it reached on September 12, 2017. However, before reaching its 52-week high, the share price experienced four double-digit-percentage swings and a 7.6% drop just one month before its peak in September 2017.

The share price first dropped 7.8% over a two-month period after the September peak and then rose 6.6% to recover 77% of its losses by January 18, 2018, when it closed at $187.59 — just 1.8% short of the 52-week high from September. The January 18, 2018, closing price of $187.59 was 22% higher than it was on year earlier, 23.5% above the 52-week low from late January 2017 and 125% higher than it was just five years before.

The blend of steeply rising dividend payouts and rapidly appreciating assets combined for a 25.28% total return over the past 12 months. While the 27% three-year total return was just marginally higher than the 12-month total return, the shareholders that took a long position in Amgen’s stock five years ago fared much better, with a 145% total return on investment over that period.

Dividend increases and decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic