Andeavor Logistics Boosts Dividend 27 Consecutive Quarters (ANDX)

By: Ned Piplovic,

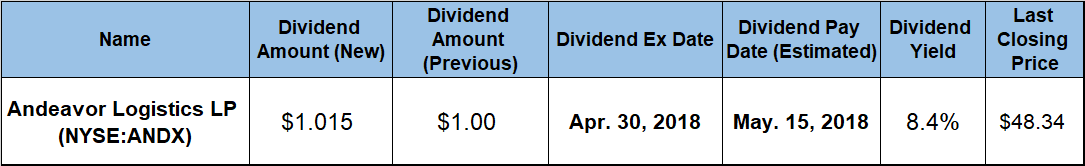

Andeavor Logistics LP (NYSE:ANDX) continues to reward its income-seeking shareholders by boosting its dividend for the 27th consecutive quarter and currently offers an 8.4% dividend yield.

The share price came down approximately one-third from its peak above $74 in 2014 and has been trading relatively flat in the $45 to $55 range with moderate volatility over the past two years. While the share price is currently approximately 10% below its level from one year ago, the rising dividend and the above-average yield are the main draw for investors looking to supplement their capital growth portfolio with an income-generating equity.

Investors looking for a stock to provide a steadily increasing income stream should review the Andeavor Logistics financial fundamentals to determine whether this stock is a good fit with their overall investment portfolio strategy. Any investors who decide to add shares of this equity to their portfolio should do so before the next ex-dividend date, which occurs on April 30, 2018. Taking a long position prior to this ex-dividend date will ensure eligibility for the next round of dividend distributions on May 15, 2018, which is the company’s next pay date.

Andeavor Logistics LP (NYSE:ANDX)

Andeavor Logistics LP (NYSE:ANDX) is a Delaware limited partnership formed in 2011 by Andeavor (NYSE:ANDV) under the name Tesoro Logistics. Headquartered in San Antonio, Texas, the partnership changed its name from Tesoro to Andeavor Logistics LP in August 2017. The partnership is a fee-based, full-service, diversified midstream logistics company, with integrated assets across the western and mid-continent regions of the United States. The company operates through three business segments. The Terminalling and Transportation segment consists of marine terminals, refined product truck terminals, rail terminals, dedicated storage facilities and transportation pipelines. Additionally, the Gathering and Processing segment consists of crude oil gathering systems and pipelines, as well as natural gas gathering pipelines, processing facilities and fractionation facilities. The Wholesale segment consists of a fee-based fuel wholesale business.

The company’s share price entered the current 12-month period on a downward trend and achieved its 52-week high of $55.50 on April 25, 2017. The share price continued its slow decline and fell almost 24% before reaching its 52-week low of $42.33 on November 29, 2017. Following the November 2017 52-week low, the share price spiked again briefly to the $54 level by mid-January 2018. Unfortunately, the rise was only temporary. The share price fell back below the $44 level to within 2% of the 52-week low by late March 2018. Since late March the share price regained 45% of its losses since January and closed on April 19, 2018 at $48.34. This closing price is 11% lower than it was 12 month earlier and almost 13% below its 52-week high from late April 2017. However, the current closing price also has gained 12% since its most recent drop and is 14.2% higher than the 52-week low from November 2017.

However, the main draw to Andeavor Logistics is its rising dividend. The company started paying dividends in the third quarter of 2011 and has hiked its dividend payout amount every quarter since then. The upcoming $1.015 quarterly distribution is 1.5% above the previous period’s $1.00 distribution and 8% higher than the $0.94 payout from the same period last year.

The current quarterly payout is equivalent to a $4.06 annualized distribution and an 8.45% forward yield, which is 47% higher than the partnership’s own five-year average yield of 5.7%. The recent share price decline did drive the current yield higher. However, even using the 52-week high price of $55.50 for the yield calculation produces a 7.3% dividend yield.

Over the past six consecutive years, the company managed to enhance its annual dividend amount by nearly 240% because of annual dividend growth at an average rate of 19% per year. Even more impressive is that the company managed to hike its dividend every quarter since 2011. Over that period the company increased its payout amount at an average growth rate of 5.4% per quarter.

In addition to the quarterly dividend boosts, the company’s current yield is competitive with industry averages. The company’s current 8.4% yield is just slightly below the 8.58% simple average yield of only dividend-paying companies in the Oil & Gas Pipelines industry and 55% higher than the 5.4% average yield of all the companies in the same industry. Additionally, Andeavor Logistics’ current yield is nearly 240% higher than the 2.5% average yield of the entire Basic Material sector.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic