ARMOUR Residential REIT Offers 8.9% Dividend Yield (ARR)

By: Ned Piplovic,

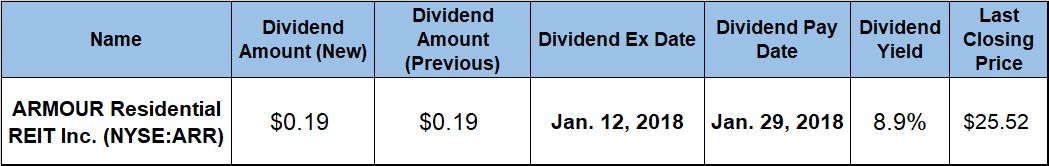

ARMOUR Residential REIT, Inc. (NYSE:ARR) has distributed more $1.3 billion in dividends since its inception in 2008 and currently offers an 8.9% dividend yield.

In addition to the high dividend yield, which is distributed monthly, the real estate investment trust (REIT) rewarded its shareholders with double-digit percentage asset appreciation over the past year and a total return of almost 30% over the same period.

The company’s upcoming ex-dividend date is on January 12, 2018, with the pay date following just a little more than two weeks later, on January 29, 2018.

ARMOUR Residential REIT Inc. (NYSE:ARR)

Founded in 2008 and based in Vero Beach, Florida, ARMOUR Residential REIT, Inc. invests in residential mortgage-backed securities in the United States. ARMOUR Capital Management LP is the REIT’s external management company. The company invests primarily in fixed-rate residential, adjustable-rate and hybrid adjustable-rate residential mortgage-backed securities, which are issued or guaranteed by United States Government-sponsored enterprises (GSEs) or guaranteed by the Government National Mortgage Association (GNMA). Additionally, the company invests in other securities backed by residential mortgages for which the payment of principal and interest is not guaranteed by a GSE or other government agencies.

As of November 30, 2017, the REIT’s holdings were comprised of 61.5% assets in agency securities and 38.5% in credit risk and non-agency securities. The portfolio of holdings was well diversified, with just three individual holdings accounting for more than 5% of total assets each — Wells Fargo Securities (6.0%), ABN AMRO Bank N.V. (5.9%) and Mitsubishi UFJ Securities (USA), Inc. (5.2%).

The REIT continues to pay the same $0.19 monthly dividend distribution that it paid throughout 2017. This monthly amount converts to a $2.28 annualized distribution and an 8.9% yield at the current share price. This is a positive development after the REIT reduced its distribution amount for years following its switch from paying quarterly dividends to monthly distributions in January 2011.

In addition to stopping the dividend distribution cuts, the company’s current dividend payout ratio is 85%, which means that the REIT can easily continue its current dividend distribution level, as well as support potential future distribution boosts to keep up with share price growth and maintain its yield level.

The company’s share price rose slightly in the first nine months after founding and then went on a sharp downward trend. However, that trend reversed in mid-2016 and the share price has been slowly regaining its value.

The share price fell 4.6% between the beginning of January 2017 and its 52-week low of $21.02, which it reached on January 31, 2017. After the year’s bottom price at the end of January 2017, it rose sharply and grew almost 31% to reach its 52-week high of $27.48 on June 26, 2017. Unfortunately, the peak level did not last long, as the share price dropped more than 10% in just four days following the June peak.

After recovering most of those four-day loses over the subsequent four-month period, the share price plunged more than 10% yet again in mid-October 2017. However, since that latest drop, the share price has been rising again. On January 2, 2018, the share price closed at $25.52, which was just 7.1% percent below the June 2017 peak and 15.8% higher than it was one year earlier, as well as 21.4% higher than the 52-week low from the end of January 2017.

While the company generated a total loss of 10.4% over the past five years, the more recent performance has been much better. The current three-year total return on shareholder investment of 17.3% is a significant improvement over the five-year total return. The most recent total return was 28.8% over the past 12 months. A steady dividend distribution and a rising share price were the drivers behind the recent total return turnaround.

Want more? Read our related articles:

The Ultimate Guide to Investing in REITs

Why Do REITs Have High Dividend Payout Ratios?

The 13 Types of REIT Stocks and How to Invest in Them

Investing in REITs: Pros and Cons

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

Connect with Ned Piplovic

Connect with Ned Piplovic