Arrow Financial Corporation Offers Nearly Three Decades of Annual Dividend Boosts (AROW)

By: Ned Piplovic,

The Arrow Financial Corporation (NASDAQ:AROW) recovered from a recent share-price pullback and combined the asset appreciation with dividend income distribution to reward investors with a total return of nearly 25% over the past 12 months.

In addition to performing well over the past year, the company had boosted its annual dividend payout for the past 20 consecutive years and enhanced its share price 50% over the past five years. While the company’s current 2.6% dividend yield lags slightly behind the Financials sector average, it outperforms the average of the company’s peers in the Northeast Regional Banks segment by a wide margin.

Because of the company’s recent share-price pullback, the 50-day moving average (MA) came very close to crossing below the 200-day MA in a bearish manner but reversed direction in mid-April and has continued to pull away since then.

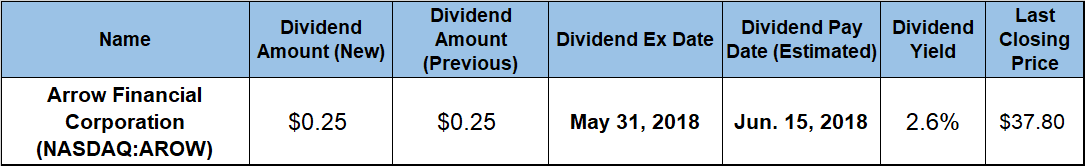

With the company’s share price on the rise and no obvious signs that would jeopardize the rising dividends streak, interested investors should consider acting before the company’s May 31, 2018, ex-dividend date. On the June 15, 2018, pay date, the company will distribute the next round of dividend distributions to all shareholders of record prior to the ex-dividend date.

Arrow Financial Corporation (NASDAQ:AROW)

Headquartered in Glens Falls, New York, and founded in 1851, the Arrow Financial Corporation operates as the bank holding company for Glens Falls National Bank and Trust Company, as well as the Saratoga National Bank and Trust Company. The company provides customary commercial and consumer banking, as well as other financial products and services. In addition to the basic banking services, the company offers indirect lending through sponsorship of automobile dealer programs, under which it purchases dealer paper and it sells residential real estate loan originations into the secondary market. Further, the company offers insurance agency services specializing in selling and servicing group health care and insurance policies through its Upstate Agency LLC. The Arrow Financial Corporation operates approximately 40 branch banking offices, two residential loan origination offices and five additional offices for insurance agency operations primarily in the Warren, Washington, Saratoga, Essex, Clinton and Albany counties of northeastern New York state.

The Company’s share price declined 3.3% at the beginning of its trailing 12-month period and closed on July 11, 2017, at its 52-week low of $30.15. After bottoming out in mid-July 2017, the share price reversed its five-month-long decline and gained nearly 27% before peaking at $38.25 on November 29, 2017. Unfortunately, the peak price level did not last long, and the share price dropped 17% by the first week of February.

However, the share price reversed direction once more, recovered 93% of its most recent losses and closed on May 22, 2018, at $37.80, which was merely 1.2% below the 52-week high from the end of November 2017. Additionally, the $37.80 closing price was 21.3% higher than it was 12 months earlier, 25.4% above the 52-week low and nearly 70% higher than it was five years ago.

The company’s current $0.25 quarterly dividend payout is nearly 3% higher than the $0.243 dividend distribution from the same period last year. This current quarterly dividend is equivalent to a 2.6% forward yield and a $1.00 annualized distribution per share for 2018. The company’s current 2.6% dividend yield is slightly lower than the average yield of the overall Financials sector. However, Arrow Financial Corporation’s current yield is 46% higher than the 1.81% simple average yield of all the companies in the Northeast Regional Banks market segment and 17.6% higher than the 2.25% average yield of the segment’s only dividend-paying companies.

Since starting to distribute dividends in 1990, the bank managed to raise its annual dividend every year. Just over the past 20 years, the company advanced its total annual dividend amount three-fold, which is equivalent to an average growth rate of 5.7% per year.

After a loss on investment for calendar 2017, the company’s shareholders saw a reversal of fortune and enjoyed a total return of nearly 25% over the past 12 months. The recent share- price recovery also contributed to a 67.6% total return over the past three years and a total return of nearly 92% over the past five years.

Dividend boosts and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic