Artesian Resources Corporation Offers Two Decades of Annual Dividend Boosts (ARTNA)

By: Ned Piplovic,

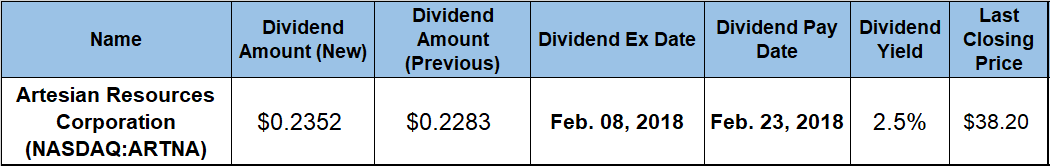

Artesian Resources Corporation (NASDAQ:ARTNA) boosted its annual dividend payout for the past two decades and currently offers its shareholders a 2.5% dividend yield.

In addition to paying dividends for 27 years and rising dividends for the last 20 years, the company has rewarded its shareholders with double-digit-percentage asset appreciation for a total shareholder return of nearly 25% in the past 12 months.

The company’s next ex-dividend date is set for February 8, 2018, and the pay date follows just a little more than two weeks later, on February 23, 2018.

Artesian Resources Corporation (NASDAQ:ARTNA)

Founded in 1905 and headquartered in Newark, Delaware, the Artesian Resources Corporation is a utility company that provides water, wastewater and other services on the Delmarva Peninsula through seven of its subsidiaries. The company distributes and sells water to residential, commercial, industrial, municipal and utility customers in the states of Delaware, Maryland and Pennsylvania. Additionally, the company offers water for public and private fire protection, contract water and wastewater services, water and sewer service line protection plans and wastewater management. As of December 2017, Artesian Resources owned and operated 68 treatment facilities with 174 million gallons storage capacity to provide more than 7.5 billion gallons of water per year to approximately 85,000 metered customers in its service territory that spans almost 300 square miles.

The company has been hiking its quarterly dividend twice per year since the second half of 2009. The current $0.2352 quarterly dividend distribution is 1.5% higher than the $0.2317 payout in the third quarter of 2017 and slightly more than 3% higher than the it was one year ago. This current dividend amount converts to a $0.94 annualized payout and yields 2.5%.

While the company has been hiking its annual dividend for two decades, the rate of increase failed to match the share price growth over the past few years. Therefore, the current 2.5% yield is approximately 23% below the company’s own 3.2% yield over the past five years. Over the past two decades, the Artesian Resources Corporation grew its annual dividend distribution at an average rate of 4% per year. Rising at 4% for two decades enhanced the total annual dividend amount by nearly 120%.

In addition to consistently improving on its own performance, the company’s current yield outperforms industry averages. The company’s current 2.5% yield is 5.25% above the average yield of the entire Utilities sector and 16% higher than the average of all the companies in the Water Utilities segment.

The share price dipped more than 6% at the onset of the current trailing 12-month period, from $31.99 on January 24, 2017, to its 52-week low of $29.99 on February 10, 2017. After bottoming out in early February, the share price rose more than 38% through some volatility and ascended to $41.56 by mid-June 2017. After that rise, the share price corrected 13.5% downward and dropped below $36 by August 23, 2017, before changing direction again and gaining 19% to reach its 52-week high of $42.66 by the end of November 29, 2017.

After peaking at the end of November, the share price pulled back again and lost more than 10% to close on January 24, 2018, at $38.20, which was 19.4% higher than it was one year earlier, 27.4% above the 52-week low from the beginning of February 2017 and 70% above its price from five years prior.

While the dividend growth rates and share price rise are moderate, the shareholders of ARTN’s stock benefit from steady compounding over extended periods. The total return on shareholders’ investment was almost 52% for the most recent 12-month period. Over the past three years, the total return was almost 83%. At 90%, the total return over the five-year period is only slightly higher than the three-year total return.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic