Best Dividend Stocks: Atmos Energy Corporation (ATO)

By: Ned Piplovic,

The Atmos Energy Corporation (NYSE:ATO) has leveraged the expansion of the natural gas exploration in the United States over the past decade to take its place among the best dividend stocks.

Investors with different approaches and investment goals might debate which equities constitute best dividend stocks. However, a simple and high-level definition of best dividend stocks includes a long streak of consecutive annual dividend hikes and a steady asset appreciation with low volatility over extended time horizons. Under those terms, the Atmos Energy stock is definitely a contender for the best dividend stocks label.

Like many securities that investors consider best dividend stocks, the Atmos Energy share price has been rising relatively steadily since the 2008 financial crisis. Except for two noticeable pullbacks — one in mid-2016 an the other in late 2017 — Atmos Energy’s stock experienced only moderate volatility. Unlike before the 2008 crisis, when the stock traded flat for nearly a decade, the share price advanced more than five-fold during the last 10 years.

Best Dividend Stocks: Atmos Energy Financial Results

On May 8, 2019, the Atmos Energy Corporation experienced a double-digit operating revenue decline. However, despite the revenue decline, the positive impact of lower gas purchasing costs increased the company’s operating income advanced nearly 10% year over year. Earnings advanced more than 20% compared to the same period last year. Adjusted earnings per share (EPS) advanced nearly 14% year over year and beat analysts’ expectation of $1.69 per share by 7.7%. On the positive quarterly results, the company tightened its earnings guidance for full-year 2019. Atmos Energy increased its lower end of the expected earnings range from $4.20 to $4.25. The $4.35 upper limit remains unchanged.

Atmos Energy Corporation (NYSE:ATO)

Headquartered in Dallas, Texas, and founded in 1906, the Atmos Energy Corporation and its subsidiaries engage in the regulated natural gas distribution, pipeline and storage businesses in the United States. The company currently operates through two business segments — Pipeline & Storage and Distribution. The Distribution segment is involved in the regulated natural gas distribution and related sales operations in eight states — Texas, Louisiana, Mississippi, Kentucky, Tennessee, Kansas, Colorado and Virginia. The company distributes natural gas to approximately three million residential, commercial, public authority and industrial customers. This segment owns and operates more than 70,000 miles of underground distribution and transmission pipeline mains.

The Pipeline and Storage segment engages in the pipeline and storage operations. This segment transports natural gas for third parties, manages five underground storage reservoirs in Texas and provides additional support services to the pipeline and gas distribution industries. This segment adds almost 5,700 miles of gas transmission lines. The company traces its roots to 1906. However, the company became an independent business entity in its current form when the Pioneer corporation spun off its natural gas division in 1983 under the Energas name. Energas changed its name to Atmos Energy Corporation and its stock began trading on the New York Stock Exchange in October 1988.

Best Dividend Stocks: Atmos Energy Dividends

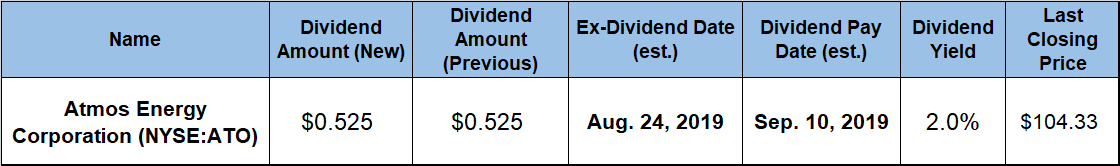

Atmos Energy’s current $0.525 quarterly dividend distribution is 8.2% higher than the $0.485 dividend distribution from the same period last year. This new quarterly dividend payout is equivalent to a $1.40 annualized dividend amount and currently yields 2%. The current yield is more than 20 below the company’s own 3.41% average dividend yield over the past five years because of the share price advanced faster than the quarterly dividend distributions over that period. While substantially lower than Atmos Energy’s five-year yield average, the current yield within acceptable tolerance levels of the 2.07% average yield of the entire Utilities sector.

Atmos Energy has paid 140 consecutive quarterly dividend distributions and has hiked its annual dividend payout every year since the first dividend payout 35 years ago in 1984. Just over the past two decades, Atmos Energy nearly doubled its annual dividend payout amount, which corresponds to a 3.3% average annual growth rate. However, the company accelerated its dividend growth over the past few years. The average growth rates over the past three and five years exceed 7% per year. Furthermore, the company’s current dividend payout ratio of 47% indicates that Atmos Energy’s dividend distributions are well covered by the earnings and that investors should maintain confidence that the company will be able to continue its streak of rising dividend payouts.

Best Dividend Stocks: Atmos Energy Share Price

Discounting a brief pullback in late 2017, the share price has maintained a steady uptrend over the past two years. Riding this uptrend, the share price hit its 52-week on the second day of the trailing 12-month period. After bottoming out at $84.58 on June 13, 2018, the share rose more than 17% by mid-December 2018. The overall market correction pushed down the share price 10% in just two weeks. However, the share price reversed direction immediately and reclaimed its December losses by early March 2019. The share price continued to rise until it reached its new all-time high of $104.33 on June 11, 2019. This closing price was 22.3% higher than one year earlier, as well as 23.4% above the 52-week low from mid-June 2018 and nearly twice its level from five years ago.

This combination of steady dividend income growth and robust asset appreciation rewarded the company’s shareholders with a 23.7% total return on investment in just the past 12 months. Over the past three years, the total return reached nearly 43%. However, with a total return of more than 121%, Atmos Energy’s shareholders more-than doubled their investment over the past five years.

Related Articles:

3 Best Dividend Stocks to Buy Now

The 6 Best Dividend Stocks That Yield More Than 5%

Fidelity’s 5 Best Dividend ETFs

5 Best Dividend Mutual Funds to Buy Now

6 Best Dividend ETFs to Buy Now

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic