CenterPoint Energy Offers Investors 4% Dividend Yield (CNP)

By: Ned Piplovic,

CenterPoint Energy, Inc. (NYSE:CNP) – a domestic energy delivery company – offers its shareholders a 4% dividend yield after boosting its dividend payout every year for more than a decade.

Unfortunately and unlike the company’s steady and reliable dividend income distribution, the company’s share price struggled in the first half of the trailing twelve months. However, the share price stopped the decline in late April, resumed its recent uptrend and recovered nearly 60% of its losses by early November 2018. As of the end of trading on November 6, 2018, the current share price was still almost 6.5% below the analysts’ average target.

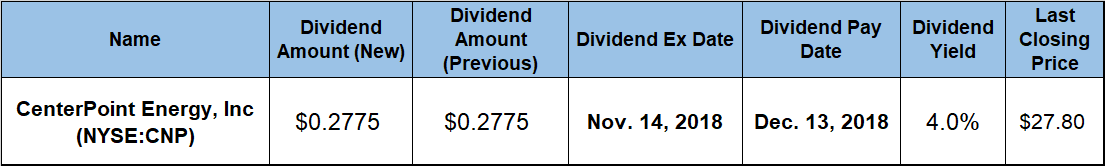

Investors convinced that the share price’s current uptrend might continue a little longer should do their research and act prior to the company’s next ex-dividend date on November 14, 2018. Taking a position in CenterPoint Energy’s stock before that ex-dividend date, will ensure eligibility for the next round of dividend distributions on the December 13, 2018, pay date.

CenterPoint Energy, Inc. (NYSE:CNP)

Founded in 1882 and based in Houston, Texas, CenterPoint Energy, Inc. is a domestic energy delivery company that includes electric transmission & distribution, natural gas distribution and energy services operations. As of September 2018, the company served more than five million metered customers primarily in Arkansas, Louisiana, Minnesota, Mississippi, Oklahoma and Texas. The company owned more than 30,000 miles of overhead distribution and transmission lines, 24,000 miles of underground distribution and transmission lines, as well as more than 230 substations. Additionally, the company also has a 54.1% limited partner interest in the Enable Midstream Partners master limited partnership (MLP) with the OGE Energy Corporation (NYSE:OGE). The MLP operates and develops natural gas and crude oil infrastructure assets.

The company’s current $0.2775 dividend payout for the last quarter of 2018 is 3.7% above the $0.2675 distribution amount from the same period last year. This current $0.2775 amount converts to a $1.11 annualized dividend distribution, which is equivalent to a 4% forward dividend yield at current share price levels. While slightly below the company’s own five-year average yield of 4.2%, CenterPoint Energy’s current dividend yield is nearly 60% higher than the 2.5% yield of the entire Utilities sector. Furthermore, the current yield has also outperformed the 3.4% simple average yield of all the companies in the Diversified Utilities industry segment by more than 17%, as well as bested the 3.89% average yield of the segment’s only dividend-paying companies by 2.6%.

While distributing dividends to its shareholders since 1922, the company managed to avoid annual dividend reductions over the past two decades and boosted its annual distribution amount 90% of the time. Since 2002, the company failed to raise its annual dividend only twice and distributed the same $0.40 annual payout for 2004 and 2005 as it did in 2003. However, since starting its current consecutive annual dividend hikes streak in 2006, the company has nearly tripled its total annual dividend amount, which corresponds to an average growth rate of 8.2% per year for the past 13 consecutive years.

After rising steadily for nearly two years, the company’s share price reversed direction in September 2017 and started declining. The share price passed through its 52-week high of $30.01 on November 30, 2017 before declining 17% on its way to the 52-week low of $24.92 on April 26, 2018. However, after bottoming out in late April 2018, the share price reversed direction again and jumped on its current uptrend. By the end of trading on November 6, 2018, the share price recovered nearly 60% of its losses and closed at $27.80. This closing price was still 6.5% lower than it was one year earlier but 11.6% higher than the 52-week low from April 2018 and 11% higher than it was five years ago.

Unfortunately, the company’s above-average dividend yield was not sufficient to offset the share price decline in the first half of the trailing 12 months. The company delivered to its shareholders a 2.4% total loss over the past 12 months. Additionally, a share price drop of more than 37% in 2015 limited the five-year total return to slightly less than 35%. However, the shareprice and dividend payouts growth over the past three years, delivered a 66% total return on shareholders’ investment.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic