Compass Minerals International Rewards Shareholders with 4.4% Dividend Yield (CMP)

By: Ned Piplovic,

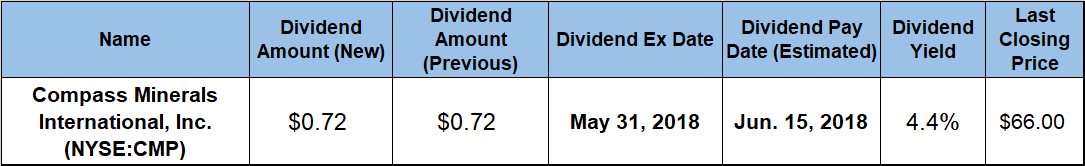

Compass Minerals International, Inc. (NYSE: CMP) has raised its annual dividend payout every year since initiating dividend distributions in 2004, and currently offers a 4.4% dividend yield.

After seeing its share price decline over the past five years, Compass has leveled off and returned to some degree of share price stability over the last year or so, currently trading at levels that are breakeven with prices seen one year ago. While that return might not be noteworthy compared to the sector averages of some of the company’s peers, it shows Compass is moving in the right direction, and is significantly better than its losing track record over the last three and five years, respectively.

Any investor whose own research indicates that this equity might be a good addition to their investment portfolio may want to act before the company’s next ex-dividend date on May 31, 2018. Acquiring shares by this date will ensure eligibility for the upcoming dividend payment scheduled for the June 15, 2018 pay date.

Compass Minerals International, Inc. (NYSE:CMP)

Headquartered in Overland Park, Kansas and founded in 1993 as the Salt Holdings Corporation, Compass Minerals International, Inc. produces and sells salt, as well as specialty plant nutrition and chemical products primarily in the United States, Canada, Brazil and the United Kingdom. The company’s Salt segment offers sodium chloride and magnesium chloride, including rock salt, mechanically and solar evaporated salt, brine and flake magnesium chloride products. This segment provides products used as a de-icer for roadways and other applications. Additionally, the Plant Nutrition North America segment offers sulfate of potash specialty fertilizers in various grades, specialty plant nutrition solution-based products and chemical solutions and turf products used by the turf and ornamental markets, as well as for blends used on golf course greens. The Plant Nutrition South America segment offers similar products like its North American counterpart, but for the South American market.

Founded as the Salt Holdings Corporation, the company changed its name to Compass Minerals International, Inc. when it became a publicly traded company on the New York Stock Exchange in 2003.

Compass paid its first quarterly dividend in March 2004, less than 10 months after going public. Since 2004, the company has enhanced its annual dividend distribution at an average growth rate of 8.3% per year. Over the past 14 years of consecutive annual dividend boosts, the company has advanced its total annual dividend amount more than three-fold.

The current $0.72 quarterly dividend payout amount converts to a $2.88 annualized distribution and a 4.4% dividend yield. This current dividend yield is nearly 30% higher than the company’s own five-year average of 3.4%. In addition, Compass Minerals’ current dividend yield is 95% higher than the 2.25% overall average yield of the entire Basic Materials sector and 160% higher than the 1.66% simple average yield of all the companies in the Synthetic Materials market segment. As the highest yield in this market segment, CMP’s current yield is more than double the 2% average yield of only the segment’s dividend-paying companies.

As indicated above, the company broke its five-year share price decline in the last 12 months and traded sideways around the $67 level for the first half of the trailing 12-month period. After six month of sideways trading, the share price rose over 15% between late November 2017 and its 52-week peak price of $76.65 on January 3, 2018.

Unfortunately, market volatility affected CMP’s stock and the share price dropped to its 52-week low of $56.50 by March 2, 2018. However, the share price recovered half of its losses since bottoming out at the end of March and closed on May 23, 2018 at $66. This closing price was just about equal with the price from one-year earlier and 12% above 52-week low in late March.

Total returns over the past three and five years, respectively, have been losses in excess of 10%, Over the last year, Compass Minerals has basically reversed this record and provided a positive total return when factoring in the strong dividend payments.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic