Consolidated Water Boosts Quarterly Dividend 13%, Pays 2.7% Yield (CWCO)

By: Ned Piplovic,

The Consolidated Water Company Ltd. currently pays a 2.7% yield and it has boosted its quarterly dividend 13% for the first time after eight years of paying a flat annual dividend distribution.

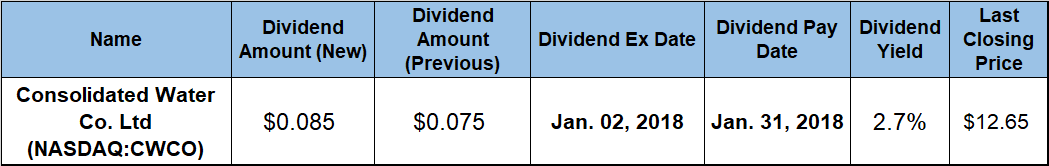

The company’s current 2.7% yield, combined with a double-digit-percentage share price growth, rewarded the company’s investors with a total return on investment of more than 20% over the last year. The company will pay its next dividend on January 31, 2018, to all its shareholders before the company’s next ex-dividend date, which will occur on January 2, 2018.

Consolidated Water Co. Ltd. (NASDAQ:CWCO)otorola Solutions Inc. (NASDAQ:CWCO)

Founded in 1973 and headquartered in Grand Cayman, the Cayman Islands, the Consolidated Water Company Ltd., develops and operates seawater desalination plants and water distribution systems in the Cayman Islands, The Bahamas, Belize, the British Virgin Islands and Indonesia. The company uses reverse osmosis technology to produce potable water from seawater and operates through three business segments –Retail, Bulk and Services. In addition to producing and supplying water to its residential, commercial and government customers, as well as potable water to government-owned distributors, the company also provides design, engineering, construction and management services for desalination plants and projects. Also, the company manufactures and services a range of water-related products, including reverse osmosis desalination equipment, membrane separation equipment, filtration equipment, piping systems, vessels and custom fabricated components.

The company hiked its quarterly dividend payout 13.3% from $0.075 in the previous period to the current $0.085 quarterly dividend distribution. This new quarterly amount converts to a $0.34 annualized dividend payout and a 2.7% dividend yield. The current yield is 3.4% higher than the company’s own 2.6% average yield over the past five years. Additionally, the company’s current yield exceeds the average 2.34% yield of the whole Utilities sector by 15%. Compared to the 0.67% average yield of the Foreign Utilities subsegment, Consolidated Water’s current yield is four times higher.

The current dividend boost is Consolidated Water’s first annual dividend increase since 2010. Between 2010 and 2017, the company has paid a flat $0.30 annual dividend for eight consecutive years. Prior to that eight-year streak of flat annual dividend payouts, the company boosted its annual dividend at an average rate of 12.8% per year for 11 consecutive years and enhanced its total annual dividend amount by 275% between 1999 and 2010.

The company’s share price started the current trailing 12-month period slowly, but advanced faster for most of the latter part of that period. Initially, the share price traded sideways and then fell more than 7% all in less than 60 days between December 20, 2016, and February 6, 2017, when the share price hit its 52-week low of $10.01.

After another month of sideways trading, the share price embarked on an a relatively steep uptrend and gained 36% between its February low and its new 52-week high of $13.60 on November 11, 2017. The share price closed on December 18, 2017, at $12.65, which was 17% higher than it was one year earlier, 26.4% higher than the 52-week low from February 2017 and 71% higher than it was five years ago.

Investors that are shy about investing directly in foreign utilities can gain exposure to this company by investing one of the exchange-traded funds (ETFs) that have Consolidated Water as one of their holdings. The three ETFs that have the highest exposure to Consolidated Water are PowerShares Water Resources Portfolio (NASDAQ:PHO) with a 13% share, PowerShares Global Water Portfolio (NASDAQ:PIO) with a 11% share and iShares Micro-Cap ETF (NYSE:GSSC) with a 6% share. The three ETFs have total returns ranging from 13.4% to 25.73% so far in 2017.

Dividend increases and decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic