Dividend Aristocrat Cardinal Health Offers Investors Three Decades of Consecutive Annual Dividend Hikes (NYSE:CAH)

By: Ned Piplovic,

While the company’s share price has struggled recently, Cardinal Health, Inc. (NYSE:CAH) has continued to reward its shareholders with rising dividends and has even extended its streak of annual dividend hikes to 33 consecutive years.

As a component of the S&P 500 Index with a market capitalization of more than $3 billion, Cardinal Health’s current streak of more than 25 consecutive annual dividend hikes makes this stock a Dividend Aristocrat. Currently, only 57 companies qualify for the Dividend Aristocrat designation. With a current string of 33 consecutive annual dividend hikes, Cardinal Health has been a Dividend Aristocrat for several years. However, the company will have to continue delivering consecutive annual dividend hikes for another two decades before joining the even more exclusive group of Dividend Kings, which currently comprises only 13 companies.

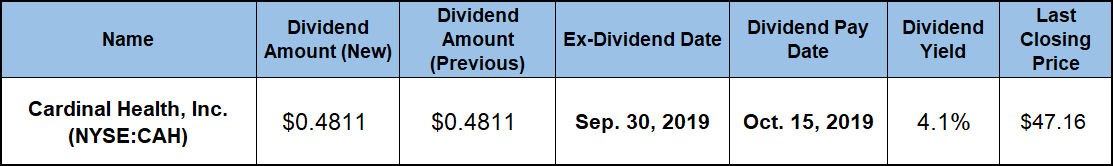

The company’s share has been declining recently due to shareholder and investor fears over consequences of a class action lawsuit. However, if the lawsuit ruling ends in the company’s favor, the share price might rebound quickly and the current share price pullback could offer new investors an opportunity to take a position at discounted rates. In addition to the potential for discounted rates, new investors can collect an above-average dividend income. However, to secure eligibility for the next round of dividend distributions, interested investors must claim stock ownership before the upcoming ex-dividend date on September 30, 2019. All eligible shareholders prior to that ex-dividend date will receive the next round of dividend distributions on the October 15, 2019, pay date.

Cardinal Health, Inc. (NYSE:CAH)

Headquartered in Dublin, Ohio and founded in 1979, Cardinal Health, Inc. operates as an integrated health care services and products company. The company provides customized solutions for hospitals, health care systems, pharmacies, ambulatory surgery centers, clinical laboratories and physician’s offices through two primary business segments — Medical and Pharmaceutical.

The Medical segment manufactures, sources and distributes medical, surgical and laboratory products under the Cardinal Health brand. Additionally, this segment also provides incontinence, wound care, enteral feeding, urology, operating room supply, electrode, needle, syringe and other disposable surgical products. Furthermore, the Medical segment distributes a range of national brand products, including medical, surgical and laboratory products, as well as provides supply chain services and solutions to hospitals, ambulatory surgery centers, clinical laboratories and other health care providers.

Alternatively, the Pharmaceutical segment distributes branded and generic pharmaceutical, specialty pharmaceutical, as well as over-the-counter health care and consumer products. The segment also provides services to pharmaceutical manufacturers and health care providers for specialty pharmaceutical products. Additionally, the Pharmaceutical segment equips nuclear pharmacies and radiopharmaceutical manufacturing facilities and offers pharmacy management services and provides medication therapy management and patient outcomes services to hospitals, other health care providers and payers. This segment also repackages generic pharmaceuticals and over-the-counter health care products.

Cardinal Health began distributing dividends in 1983. Just a few years after initiating the dividend payouts, Cardinal Health began its current streak of 33 consecutive annual dividend hikes. The most recent of Cardinal Health’s annual dividend hikes occurred for the July 2018 dividend distribution and increased the quarterly payout 1% from $0.4763 to the current $0.4811 distribution amount. This new and higher payout corresponds to a $1.9244 annualized distribution and a 4.1% forward dividend yield. A share price decline has also boosted the current yield nearly 50% above the company’s own 2.78% average dividend yield over the last five years.

In addition to outperforming its own five-year yield average, Cardinal Health’s current yield is substantially higher than the company’s sector and industry peers. Compared to the Health Care sector’s typically low average yield of 0.52%, Cardinal Health’s current yield is nearly seven-fold higher. The Medical Instruments & Supplies industry segment’s simple average yield of 0.37% is even lower than the sector average, which makes Cardinal Health’s current yield more than 10 times higher. Excluding the companies that do not pay any dividends from the calculation increases the average yield to 1.2%. However, boosted by the share price pullback, Cardinal Health’s current yield is still 240% higher than the 1.2% yield average of the Medical Instruments & Supplies segment’s only dividend-paying companies.

Over the past two decades of consecutive annual dividend hikes, Cardinal Health has enhanced its annual dividend payout amount more than 28-fold. This advancement pace corresponds to an average growth rate of 18.2% per year since 1999. While growth rates tend to diminish as the payout amount increases, Cardinal Health still managed to deliver an average annual dividend growth rate of nearly 12% over the past decade. Furthermore, even over the last five years, the average annual growth rate is still almost 9% per year.

Cardinal Health should be able to maintain its streak of annual dividend hikes. The current dividend payout ratio of 42% indicated that the company currently distributes just a little more than two-fifths of its earnings as dividends. Additionally, the current ratio is below the 50% level generally deemed as the upper limit of sustainable dividend payout ratio levels. Therefore, the dividend payouts are well covered by the earnings and should be safe from cuts in the near future. Furthermore, Cardinal Health improved its earnings over the last few years. This dropped the dividend payout ratio from a 79% unsustainable five-year average to a currently sustainable level below 50%.

Despite rising payouts and a steady streak of annual dividend hikes, the company’s share price declined more than the dividend income payouts and delivered a 26% total loss to current Cardinal Health shareholders over the last five years. Over the trailing 12 months, the share price pulled back 12.5%. However, the dividend income managed to offset some of those losses and reduce the total loss over the trailing 12 months to just 9%.

Even a small share price improvement could return total returns to the positive side. Prior to beginning its decline due to fears over the current lawsuit outcome in mid-2015, Cardinal Health’s share price had nearly tripled over the preceding five years.

Related Articles:

5 Best Dividend Aristocrats to Buy Now

The Dividend Aristocrats Investing Strategy and Stocks List

The Best Dividend Aristocrats ETFs

Why Invest in the Dividend Aristocrats?

The S&P 500 Dividend Aristocrats — Everything You Need to Know

What are the Dividend Aristocrats?

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic