Dividend Aristocrat VF Corporation Rewards Shareholders with Long-Term Rising Dividends and Capital Gains (VFC)

By: Ned Piplovic,

The VF Corporation (NYSE:VFC) — a manufacturer of outdoor, work and active apparel and a dividend aristocrat stock — continued rewarding its shareholders with rising dividend income distributions and long-term capital gains.

With just one correction of more than 35% that occurred from mid-2015 to the beginning of 2017, the company’s share price advanced nearly six-fold over the past decade. Notwithstanding the 2015 to 2017 correction and a brief dip in late 2018, the share price rose over the past decade with minimal volatility.

In addition to the long term asset appreciation, the VF Corporation has distributed a dividend to its shareholders for nearly eight decades, which includes the current streak of 46 consecutive annual hikes. With a streak of more than 25 consecutive annual hikes, a market capitalization in excess of $3 billion and the inclusion in the S&P 500 Index, the VF Corporation earned a Dividend Aristocrat title shared by just 56 other companies.

While the company’s current yield and asset appreciation rate are modest, the long-term total returns with minimal volatility make this stock worthy of consideration for inclusion in any investment portfolio. The company’s current dividend payout ratio of 50% is still within the range considered sustainable by most investors. Additionally, the current payout ratio is substantially lower than the company’s own 67% payout ratio average over the past five years.

The company’s current dividend distributions are well covered by earnings. Therefore, the VF Corporation should be able to support easily future dividend hikes and maintain its Dividend Aristocrat designation. With just a few additional annual dividend hikes, the company could even trade its Dividend Aristocrat label for the even more exclusive Dividend King title, which is currently bestowed to just 13 S&P 500 companies that have increased their annual dividend payouts for at least 50 consecutive years.

VF Corporation (NYSE:VFC)

Originally established in Reading, Pennsylvania, as the Reading Glove and Mitten Manufacturing Company in 1899, the VF Corporation operates as a manufacturer of outdoor, work and active apparel. In May 2019, the VF Corporation spun off its jeans business segment into a separate corporate entity — Kontoor Brands, Inc. (NYSE:KTB) — which remains headquartered in Greensboro, North Carolina, and focuses on design, manufacturing, marketing and distribution of apparel primarily under the Rock & Republic, Wrangler and Lee brands. Kontoor Brands also took over the VF Outlet business segment. The VF Corporation continues its own operation by focusing on its remaining three business segment — Active, Outdoor and Work. After divesting its jeans business, the VF corporation still owns nearly 30 different brands including North Face, Vans, Timberland and Kipling. Furthermore, through its JanSport and Eastpak brands, the company controls more than half of the U.S. market for backpacks and backpack accessories. With Kontoor Brands remaining in the company’s current Greensboro facility, the VF Corporation announced that it will move its corporate offices to Denver. The company will move into a temporary location during 2019 while renovation on the new permanent location are underway. The VF corporation plans to complete renovation and move to the new location in Denver’s lower downtown area in early 2020.

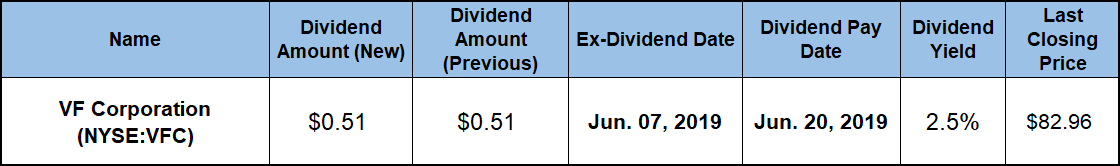

The upcoming $0.51 quarterly payout marks an 11% increase over the $0.46 quarterly payout from the same period last year. This new quarterly dividend amount converts to a $2.04 annual distribution and currently yields 2.5%, which is 8.3% higher than the VF Corporation’s own 2.27% average dividend yield over the past five years. Furthermore, the company’s current yield also is 18.2% higher than the 2.08% simple average yield of the entire Consumer Goods sector. Also, the VF Corporation’s current yield is in line with the 2.5% average yield of all 57 companies that currently meet the Dividend Aristocrat designation requirements.

To maintain its dividend yield level, the company’s dividend hikes had to match the share price growth over an extended period. Just over the past two decades, the VF Corporation advanced its total annual dividend amount nearly 10-fold. This advancement pace corresponds to an average growth rate of 12% per year. The VF Corporation will distribute its next round of dividend distributions on June 20, 2019, to all its shareholders of record prior to the upcoming June 7, 2019, ex-dividend date.

Riding the uptrend since a correction end in January 2017, the share price gained more than 16% in the first 60 days of the trailing 12-month period. However, after reaching its 52-week high of $90.67 on August 10, 2018, the share price pulled back slightly before dropping 30% during the overall market correction in the fourth quarter to its 52-week low of $63.39 on December 24, 2018.

However, following the 52-week low, the share price embarked on a recovery trend and closed on June 3, 2019, at $82.96. This closing price was 6.2% higher than it was one year earlier, nearly 31% above the 52-week low on Christmas Eve, and 43% higher than it was five years ago.

The dividend income added a few points to the 6.2% share price gain for a total return of 9.7% over the trailing 12 months. Even with the pullback from 2015 to 2017, the company delivered a total return of 48% over the past three years, as well as a 51% total return over the last five years.

Related Articles:

5 Best Dividend Aristocrats to Buy Now

The Dividend Aristocrats Investing Strategy and Stocks List

The Best Dividend Aristocrats ETFs

Why Invest in the Dividend Aristocrats?

The S&P 500 Dividend Aristocrats — Everything You Need to Know

What are the Dividend Aristocrats?

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic