Douglas Dynamics Offers Eight Consecutive Annual Dividend Hikes (PLOW)

By: Ned Piplovic,

With a history of consecutive annual dividend hikes every year since 2010, coupled with exceptional share-price appreciation over the past 12 months, Douglas Dynamics, Inc. (NYSE: PLOW) is instilling confidence in investors that its outsized returns will continue.

With a current forward dividend yield of 2.3%, the company’s yield is merely ordinary compared to the average of the entire market, but it is considerably above par when compared to the average yields of its peers in the Consumer Goods sector and the Auto Parts industry segment.

In addition to the streak of steady annual dividend hikes and above-average dividend yields, Douglas Dynamics has provided exceptional asset appreciation over the past several years. Over the past 12 months, the company’s share price advanced more than 50%, and it more than doubled over the past three years.

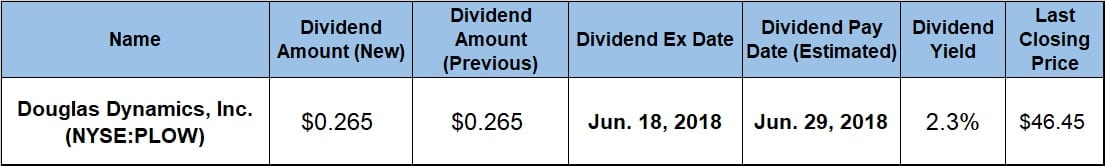

So, investors who are looking for an equity with strong asset appreciation and steady dividend income may want to consider Douglas Dynamics, Inc. as a possible fit for their investment strategy and portfolio. The company will distribute its next dividend on the June 29, 2018 pay date to all its shareholders of record prior to the June 18, 2018 ex-dividend date.

Douglas Dynamics, Inc. (NYSE:PLOWI)

Headquartered in Milwaukee, Wisconsin and founded in 1977, Douglas Dynamics, Inc. operates as a manufacturer and upfitter (or customizer) of commercial work truck attachments and equipment primarily in North America. The company operates through two main business segments — Work Truck Attachments and Work Truck Solutions. The Work Truck Attachments segment manufactures and sells snow and ice control attachments, including snowplows, sand and salt spreaders for light and heavy-duty trucks, as well as various related parts and accessories under seven different brand names. This segment also offers customized turnkey solutions to government agencies, such as the Department of Transportation. The Work Truck Solutions segment provides truck and vehicle after-market parts, equipment and racking for truck bodies under the DEJANA brand and its related sub-brands. Additionally, this segment manufactures storage solutions for trucks and vans, as well as cable pulling equipment for trucks.

Douglas Dynamics currently pays a $0.265 per share quarterly dividend, which is 10.4% higher than the $0.24 quarterly dividend from this time last year. On an annual basis, the current quarterly amount converts to $1.06 per year and a 2.3% forward dividend yield. Since beginning dividend payments in 2010, Douglas Dynamics has advanced its total annual dividend amount 45%, which translates to average annual dividend hikes of 4.4% per year.

Interestingly, despite the eight years of consecutive annual hikes, the total annual dividend amount grew at a slower rate than the share price. As a result, the company’s yield has been suppressed and currently is more than 50% below its five-year average yield of 3.6%. However, even with the reduced yield, Douglas Dynamics still outperforms the 1.78% average yield of the overall Consumer Goods sector by nearly 30%, and the 1.33% average yield of all companies in the Car Parts industry segment by 72%. Even excluding all companies which pay no dividends, for a new average yield of 2.04%, PLOW’s current yield is still over 10% higher.

Douglas Dynamics’ share price has seen a remarkable run over the last decade, with no major pullbacks and minimal volatility in that time. The stock began to increase more sharply in 2014, and over the past 24 months, has really accelerated upward. The 52-week low of $30.15 was reached early in the trailing 12-month period on June 16, 2017. After that early bottom, the share price has continued its ascent and gained nearly 60% to reach an all-time high of $48.10 on June 6, 2018. Shares pulled back slightly on June 8 to close at $46.45, 54% above the June 2017 low and about 50% higher than one year earlier. This price was nearly 250% higher than it was five years ago.

Suffice it to say that the outstanding share price growth and the steady string of annual dividend hikes combined to reward the company’s shareholders with a total return of nearly 60% just over the past 12 months. The investors that invested in Douglas Dynamics three years ago enjoyed about a 140% total return over that period. Furthermore, the company has rewarded its investors with an extraordinary total return of 277% over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic