Eaton Vance Corporation Offers Two Decades of Annual Dividend Hikes (EV)

By: Ned Piplovic,

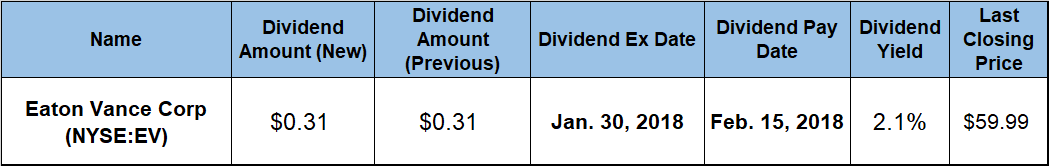

The Eaton Vance Corporation has rewarded its shareholders with 20 years of annual dividend hikes at double-digit annual growth rates and currently offers a 2.1% dividend yield.

The company’s share price continued its steep uptrend that began in January 2016 and gained more than 30% over the past 12 months. Unfortunately, that rapid share price growth resulted in yield reduction by more than 20% versus the company’s own 2.9% average yield over the past five years.

The company will pay its next dividend distribution on February 15, 2018, to all its shareholders prior to the January 30, 2018, ex-dividend date.

Eaton Vance Corporation (NYSE:EV)

Founded in 1944 and headquartered in Boston, Massachusetts, the Eaton Vance Corporation creates, markets and manages investment funds in the United States. Additionally, the company provides investment management and counseling services to institutions and individuals. The company provides investment advisory or administration services to approximately 150 funds and more than 1,000 separately managed individual and institutional accounts, as well as participates in approximately 40 retail-managed account broker/dealer programs. Eaton Vance conducts its operations through five principal investment affiliates — Eaton Vance Management, Parametric, Hexavest, Calvert and Atlanta Capital. Each affiliate offers customers a specific range of investment products and services.

The company’s current $0.31 quarterly dividend distribution is 10.7% above the $0.28 payout from the same period one year earlier. This current quarterly distribution yields 2.1% and converts to a $1.24 annual payout per share. The company started paying dividends in 1990 and has enhanced its annual dividend distribution amount at an average growth rate of 16% per year over the past two decades. The result of this high compounded annual growth is that the annualized dividend distribution for 2018 is more than 19-fold higher than it was two decades earlier.

The share price fell 2.9% at the onset of the current trailing 12-months period from $43.04 on January 11, 2017 to its 52-week low of $41.80 on February 1, 2017. After bottoming out at the beginning of February, the share price ascended with moderate volatility for the reminder of 2017 and into early January 2018. On October 10, 2017, the share price broke above the $50.00 and continued to rise well above its previous all-time high of $50.03 from October 2007.

The share price continued to rise and closed on January 11, 2018, just barely below the $60 mark, at $59.99. The stock reached its 24th new all-time high since crossing above $50 on October 10, 2017. The $59.99 closing price from January 11, 2018, marked a 39.4% share price growth over the trailing 12-month period. Additionally, that share price was 43.5% higher than the 52-week low from February 1, 2017, and 72% higher than it was five years earlier.

While the rapid growth of the company’s share price suppressed the dividend yield to 2.1%, the shareholders enjoyed a 40.3% total return on investment over the past year. The three-year total return was only slightly higher at just below 60%, but the total return over the last five years came in just shy of 95%.

The company reduced its dividend payout ratio almost 23% from the 62% average ratio over the past five years to the current 48% dividend payout ratio. With this payout ratio level, the company has room to continue supporting dividend hikes for the foreseeable future at the current rate — approximately 10% per year. Alternatively, the company could decide to enhance its annual dividend boosts closer to the 20-year average annual growth rate of 16% to keep pace with the rapidly rising share price.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic