Eli Lilly Resumes Annual Dividend Boosts, Raises Payout Four Consecutive Years (LLY)

By: Ned Piplovic,

After suspending its dividend boosts in 2010 and paying the same $1.96 annual dividend for six consecutive years, Eli Lilly and Company (NYSE:LLY) resumed its annual dividend hikes in 2015 and advanced its payout each of the past four consecutive years.

Prior to suspending its dividend boosts, the company has rewarded its shareholders with more than two decades of consecutive annual dividend increases. While the company did miss five consecutive years of dividend hikes, Eli Lilly managed to avoid dividend cuts for more than two decades.

The graph of the company’s share price over the past five years indicates a relatively steady uptrend. However, a closer look at shorter time frames, such as the trailing 12 months, reveals a significantly higher degree of volatility. The share price suffered a substantial loss during the overall market sell-off in February 2018 but has recovered all those losses. Technical indicators now are hinting that the share price might have more room to continue its current uptrend over the near term.

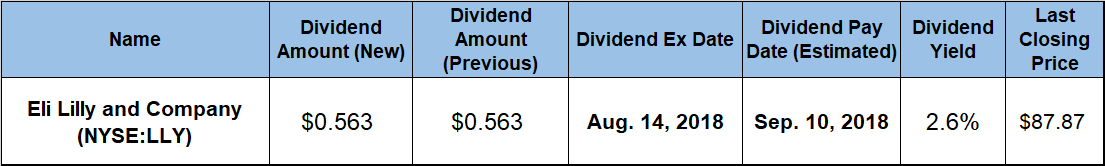

Inquisitive investors, whose own research indicates similar signals, should be mindful to buy shares by the company’s next ex-dividend date of Aug. 14 to be eligible for its the next round of dividend distributions on Sept. 10.

Eli Lilly and Company (NYSE: LLY)

Founded in 1876 and headquartered in Indianapolis, Indiana, Eli Lilly and Company develops, manufactures and markets pharmaceutical products through two segments – Human Pharmaceutical Products and Animal Health Products. The company offers products to treat diabetes, osteoporosis, human growth hormone deficiency, pediatric growth conditions and diverse types of cancer.

Additionally, the company makes products for treatment of depression, anxiety, fibromyalgia and chronic pain. Eli Lilly provides additional products for treatment of various disorders, such as schizophrenia, attention-deficit hyperactivity disorders (ADHD), obsessive-compulsive disorder (OCD), bulimia nervosa and panic disorders. The company’s animal health portfolio includes various vaccines, cattle feed additives, protein supplements for cows, leanness and performance enhancers for swine and cattle, antibiotics, anticoccidial agents for poultry, as well as chewable tablets that kill fleas and prevent flea infestations and heartworm diseases. As of March 31, 2018, the company had more than 38,000 employees spread across research facilities in six countries and manufacturing facilities in eight countries. The company also conducted clinical research in 55 countries and marketed its products in 120 countries around the world.

The current $0.563 quarterly dividend distribution is 8.3% higher than the $0.52 quarterly dividend distribution from the same period last year. This new quarterly dividend amount corresponds to a $2.25 annualized dividend and a 2.6% forward dividend yield, which is in line with Eli Lilly’s average yield over the past five years and slightly higher than industry averages. Compared to the 0.66% average yield of the overall Healthcare sector, the company’s current yield is nearly four-fold higher. Evaluating the company’s current 2.6% dividend yield against the 2.1% simple average yield of all the companies in the Major Drug Manufacturers industry segment is more equitable. However, Eli Lilly’s current dividend yield still is approximately 22% higher.

Since resuming annual dividend boosts in 2015, the company has increased its total annual dividend amount by 15%, which converts to an average growth rate of 3.5% per year. However, even with five years of flat dividend payouts, the company advanced its annual payout amount nearly three-fold over the past two decades, which corresponds to a 5.3% average annual growth rate.

Through some moderate volatility, the share price gained almost 7% between the beginning of the trailing 12 months and its 52-week high on December 13, 2018. However, in less than two weeks between Jan. 29 and Feb. 8, the share price dropped more than 15% and hit its 52-week low of $ 74.21, which was almost 10% below the $82.28 starting price from July 2017. Fortunately, the share price reversed direction immediately, recovered all its losses and closed on July 9 at $87.87, which was 6.8% higher than it was one year earlier and just $0.02 below the peak price from mid-December 2017. Additionally, the July 9 closing price was nearly 75% higher than it was five years earlier.

Because the share price traded sideways and fluctuated mostly in the $75 to $85 range since 2015, the 10.4% total return on shareholders’ investment over the past 12 month and the 9.1% total return over the past three years remained meager. However, long-term shareholders enjoyed a much higher total return rate of 94% and nearly doubled their investment over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic