Energy Sector Stocks Yield at Least 5% and Deliver Rising Dividends

By: Ned Piplovic,

Whether driven by new economic policies or other factors, economic growth increases energy demand and these four investments could provide handsome returns.

Federal Reserve Chair Janet Yellen stated that she expects the Fed’s benchmark interest rate to rise several times in 2017 on a positive economic outlook. Forecasts call for rates rising to 3% by 2019, so investors who also expect strong economic growth should consider buying selected energy stocks that would benefit from these conditions.

Some experts expect that if President Trump and Congress pass anticipated tax reform and reduce onerous business regulations, the U.S. economy will experience a major revival. The most recent data for Mark Skousen’s Gross Output (GO) measure of economic activity indicates a potential uptick in economic activity for 2017.

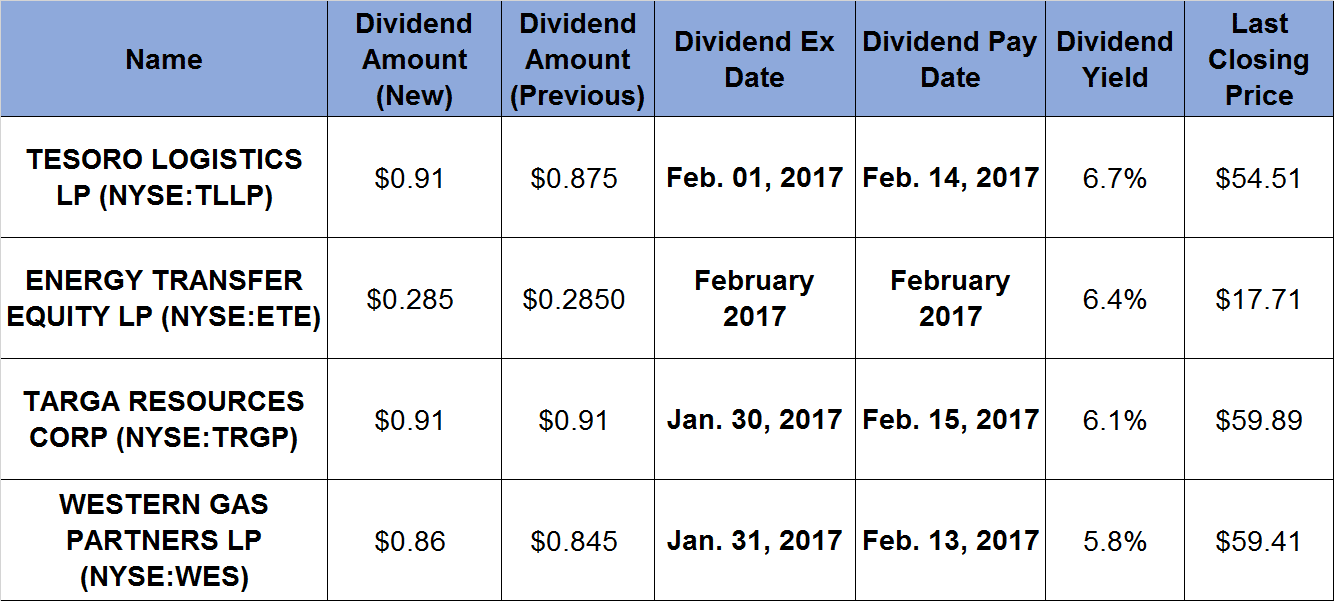

In addition to the potential benefit from economic growth, all of the following energy stocks offer at least a 5% dividend yield, increasing dividends for at least the last five years and a steady capital appreciation during the last year.

Tesoro Logistics LP (NYSE:TLLP)

Tesoro Logistics provides transport and storage services for oil and natural gas. The company owns and operates a network of oil and natural gas pipelines, natural gas processing complexes and a fractionation facility.

The most recently announced quarterly dividend of $0.91 is 3.9% higher than the previous dividend payout. Since its formation in 2011, the company has increased the quarterly dividend every quarter by at least 3.6%. The current annualized dividend of $3.64 translates to a 6.7% dividend yield, which is 36% higher than the 4.9% average over the last five years.

The company’s stock lost half of its value between an all-time high in July 2014 and the most recent 52-week low of $38.18 on February 11, 2016. Since the February low, its share price has increased 55% to close at $54.51 on January 19, 2017, just two days after reaching a new 52-week high of $54.93.

Energy Transfer Equity LP (NYSE:ETE)

Energy Transfer Equity is one of the largest and most diversified master limited partnerships in the United States. The company specializes in transportation and storage of crude oil, refined products and natural gas.

Its annual dividend yields 6.4% and its $1.14 payout for 2016 was almost 12% higher than the 2015 dividend. The company increased dividend payouts every year since inception. Its dividend payout rose more than six-fold over the last 10 years.

From the all-time high in June 2015, the company’s stock lost almost 90% of its value and reached a 52-week low of just $4.00 on February 8, 2016. However, after that low the share price rose quickly and doubled in a little more than a month. ETE’s share price tripled by the end of April and reached $18.00 by early September.

After that rapid rise, ETE’s share price endured a mild correction and declined almost 24% in two months, before resuming its ascent toward a new 52-week high of $20.05 on January 6, 2017. Despite quadrupling in one year and losing almost 12% since the 52-week high two weeks ago, there might be room for Energy Transfer’s share price to increase further and provide an opportunity to reap double-digit percentage returns.

Targa Resources Corp. (NYSE:TRGP)

Targa Resources Corp. provides fractionating, treating, transporting, storing and other related services for the natural gas, crude oil and refined petroleum industry.

Since starting to pay dividends in 2011, the company has paid an increasing annual dividend every year. Paid quarterly, the current annual dividend of $3.64 translates to a 6.1% dividend yield.

Stocks of many companies in the oil business lost significant value in 2015 when the price of crude oil dropped from more than $100 per barrel to less than $50 per barrel. Targa’s share price decreased almost 90%. However, the company’s share price has recovered to a near-peak level over the last year.

Since the 52-week low of $14.55 on February 11, 2016, its share price increased 340% throughout the year and reached a new 52-week high of $64.14 during trading on January 19, 2017. Its share price closed that day 6.6% lower at $59.89, which is still 312% higher than the 52-week low.

Western Gas Partners LP (NYSE:WES)

Western Gas Partners, LP is a master limited partnership formed to process, treat and transport crude oil, natural gas and natural gas liquids.

Founded in 1971, the company was acquired by Anadarko Petroleum Corporation (NYSE: APC) in June 2006. Western Gas Partners resumed paying dividends in 2008, and increased the annual dividend by at least 13% every year since then.

The partnership’s quarterly dividend of $0.86 converts to a $3.44 annual dividend and a 5.8% dividend yield. The current yield is 16% higher than the average five-year dividend yield.

Its share price increased steadily over the last year. From a 52-week low of $25.40 on February 11, 2016, its share price rose 143% by Jan. 5 to reach a new 52-week high. In the two weeks since the 52-week high, the share-price fluctuated a little and closed on Jan. 19 at $59.41, which is 3.7% lower than the 52-week high. However, the most recent share price is still 134% higher than the 52-week low from February.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily.

To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic