EnLink Midstream Partners Pays 8.5% Dividend Yield (ENLK)

By: Ned Piplovic,

EnLink Midstream Partners LP, (NYSE:ENLK) – a Dallas-based energy services providers – rewards its unitholders with an 8.5% dividend yield and a unit price growth that pushed the one-year total return above 25%.

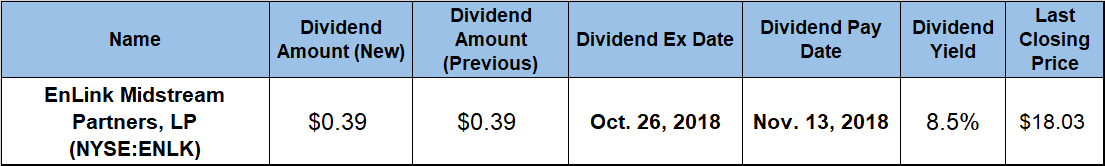

While EnLink did not boost its total annual distribution in the past two years, the partnership hiked its annual payout six out of the past eight years and 11 times in the past 15 years. The partnership’s next dividend distribution will occur on the November 13, 2018, pay date. All unitholders of record prior to the October 26, 2018, ex-dividend date will receive the declared $0.39 distribution per unit.

This will most likely be the partnership’s final distribution. The General Partner (GP) – EnLink Midstream, LLC (NYSE: ENLC) – announced on Monday merger plans in which the GP will acquire all outstanding common units of the MLP that are not already owned by the GP. In this process, current owners of MLP’s common units will be offered 1.15 common units of the new pro forma company.

The new legal entity will have market capitalization in excess of $13 billion and aims to simplify the organizational structure, which should result in substantial cost savings. More importantly for income-seeking investors, this merger should provide low double-digit growth of distributable cash flow per unit over the next three years, as well as sustainable distribution growth of at least 5 percent per year through 2021.

ENLK’s unit price is currently at the same level as the analysts’ average target price. However, ENLC’s current unit price has almost 20% room on the upside before it will reach its consensus target, which could be revised upward if Wall Street analysts agree with the projected cost savings and operational efficiency estimates of the new company after the merger is completed. As the Boards of Directors and Conflicts of both ENLC and ENLK already approved the merger, the company expects to complete all transaction and complete the merger in the first quarter of 2019.

EnLink Midstream Partners, LP (NYSE:ENLK)

Headquartered in Dallas, Texas and founded in 1992, EnLink Midstream Partners is a Master Limited Partnership (MLP) that provides midstream energy services, such as gathering, transmission, processing, fractionation, storage, condensate stabilization, brine and marketing to producers of crude oil, natural gas and derivatives. The company operates through five business segments – Crude and Condensate, Texas, Oklahoma, Louisiana and Corporate segments. EnLink operates processing plants that remove natural gas liquids (NGLs) from natural gas stream and fractionates NGLs into purity products, such as ethane, propane, butane and natural gasoline. The company operates approximately 11,000 miles of pipelines, 20 natural gas processing plants, 7 fractionators, barge and rail terminals, product storage facilities, brine disposal wells and a crude oil trucking fleet. Formerly known as Crosstex Energy LP, the company changed its name to EnLink Midstream Partners, LP in March 2014.

ENLK’s unit price entered the trailing 12-months on an uptrend that began in April 2017, but reversed direction in late-January 2018. By the time it reached its 52-week low of $13.04 on March 27, 2018, the unit price fell 18% below its price at the beginning of the trailing 12-month period. However, after bottoming out in late March, the unit price rose 47% and reached its new 52-week high of $19.17 on September 7, 2018. Following the September peak, the unit price pulled back 5% and closed on October 19, 2018, at $18.03. This closing price was 13.5% higher than it was one year earlier and more than 38% above the 52-week low from March 2018.

The company’s current $0.39 quarterly dividend distribution is the same as it has been for the past 13 quarters. This quarterly distribution is equivalent to a $1.56 annualized payout and an 8.5% dividend yield. This current yield is 82% higher than the company’s own 8% average dividend yield over the past five years.

In addition to outperforming its own dividend yield, the company’s current 8.5% yield is 265% above the 2.37% average dividend yield of the entire Basic Materials sector and nearly triple the 2.93% average yield of all companies in the Independent Oil & Gas industry segment. Furthermore, the current 8.5% dividend yield is also nearly 60% higher than the 5.48% simple average yield of the segment’s dividend-paying companies.

While the distribution remained flat over the past three years, the company hiked its distribution for six consecutive years prior to that. Even with three years of flat distributions, the company enhanced its annual payout more than six-fold since 2010. This increase corresponds to an average growth rate of 25.7% per year.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic