Entergy Corporation Rewarded Shareholders with One-Year Double-Digit Percentage Total Returns (ETR)

By: Ned Piplovic,

A balanced combination of dividend income and asset appreciation allowed the Entergy Corporation (NYSE: ETR) to reward shareholders with a total return of more than 10% over the past 12 months.

Since its most recent dividend cut in 1998, Entergy has raised its annual dividend payout in 15 of the past 20 years, and has hiked its annual dividend consecutively since 2015. The relative consistency of dividend hikes and the company’s steadily increasing, though moderately volatile, share price provided a total return of nearly 50% over the past five years.

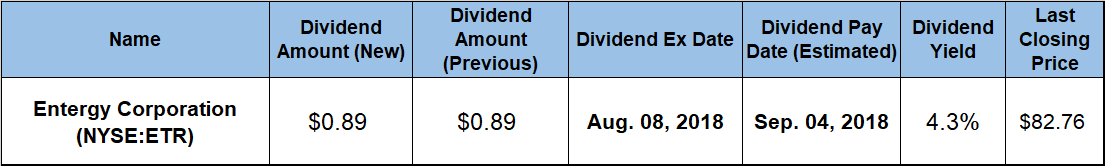

Entergy’s share price has exhibited stable growth over the past six months and technical indicators suggest that it still has room to grow. Investors interested in being a part of further double-digit annualized total returns should consider acquiring a stake before the company’s next ex-dividend date on August 8, 2018. Doing so will lock in eligibility for the next round of dividend distributions on the September 4, 2018, pay date.

Entergy Corporation (NYSE:ETR)

Formed in 1949 as the Middle South Utilities, Inc. and currently based in New Orleans, Louisiana, the Entergy Corporation produces and distributes electricity through two business segments. The Entergy Wholesale Commodities (EWC) segment owns and operates six nuclear power plant units in the northern United States and owns all or partial interest in several non-nuclear power plants. The electricity generated by nuclear power accounts for 30% of the company’s total electric generating capacity of approximately 30,000 megawatts (MW). In addition to nuclear power, Entergy generates electricity with natural gas, oil, coal, hydro and solar power sources. The company’s Utility segment generates, transmits and distributes electric power in a four-state service territory that includes portions of Arkansas, Mississippi, Texas and Louisiana, including the city of New Orleans. This segment owns and operates approximately 22,000 MW of generating capacity and 15,500 circuit miles of interconnected high-voltage transmission lines, as well as natural gas distribution businesses in New Orleans and Baton Rouge.

Entergy’s share price rose more than 14% at the beginning of the trailing 12 months before it peaked at $87.42 on November 14, 2017. However, the share price reversed direction, gave back all those gains by the end of January 2018 and continued to decline towards its 52-week low of $72.02 on February 8, 2018.

Between February and Aug. 2, ETR recovered nearly 70% of its recent losses and closed just 5.3% short of the November 2017 peak at $82.76 on Aug. 2. Additionally, the August 2, 2018 closing price was 8.1% higher than one year earlier, nearly 15% above the February low and 24% higher than it was five years ago.

The current $0.89 per share quarterly dividend is 2.3% above the $0.87 payout from the same period one year earlier. This new quarterly amount corresponds to a $3.56 annualized distribution and a 4.3% dividend yield. Despite the four consecutive years of hikes, dividend increases fell slightly behind the share price growth over the same period, and as a result, the current 4.3% yield is 2.2% lower than the company’s own 4.4% average yield over the past five years.

However, Entergy’s current yield is more than 70% higher than the average yield of the entire Utilities sector, as well as 73% above the simple average yield of all the companies in the Electric Utilities industry segment. Even compared to the 3.94% average yield of only dividend-paying companies in the Electric Utilities segment, Entergy’s current yield is still more than 9% higher.

The company’s dividend income provided one-third of the company’s 12.8% total returns over the past 12 months. Additionally, the asset appreciation and the rising dividend income combined to offer shareholders’ total returns of 31% over the past three years and total returns of 46% over the last five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic