Enterprise Products Partners Offers 5.9% Dividend Yield (EPD)

By: Ned Piplovic,

Enterprise Products Partners L.P. (NYSE:EPD) offered its shareholders a total return of nearly 11% through a combination of 5.5% asset appreciation and a $1.67 total annual dividend payout over the past 12 months.

The current annualized dividend distribution converts to a 5.9% forward dividend yield. Enterprise Products Partners’ current streak of consecutive annual dividend hikes stretches back two decades.

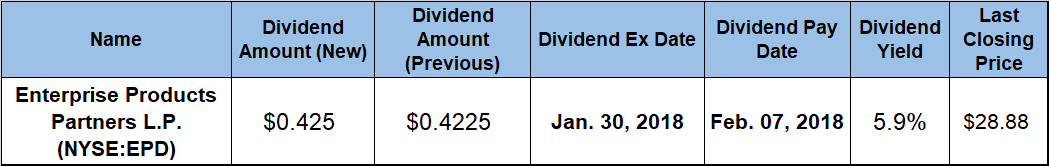

The company will distribute its next quarterly dividend distribution on February 7, 2018, to all its shareholders of record before the company’s next ex-dividend date: January 30, 2018.

Enterprise Products Partners L.P. (NYSE:EPD)

Founded in 1968 and based in Houston, Texas, Enterprise Products Partners L.P. provides midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals and refined oil products. The company operates through four business. The NGL Pipelines & Services segment offers natural gas processing and related NGL marketing services, operates approximately 20,000 miles of pipelines, 15 NGL fractionators and a liquefied petroleum gas and ethane export terminal. Additionally, the Crude Oil Pipelines & Services segment operates approximately 5,400 miles of crude oil pipelines, crude oil storage and marine terminals located in Oklahoma and Texas, as well as a fleet of 440 tractor-trailer tank trucks. Furthermore, the Natural Gas Pipelines & Services segment operates another 20,000 miles of natural gas pipelines in Colorado, Louisiana, New Mexico, Texas and Wyoming. The Petrochemical & Refined Products Services segment operates propylene fractionation and related operations, including approximately 700 miles of pipelines, a butane isomerization complex and octane enhancement production facilities. Additionally, the segment operates approximately 4,500 miles of refined products pipelines.

The company enhanced its quarterly dividend distribution 0.6% from the previous period’s $0.4225 to the current $0.425 quarterly payout. This new quarterly distribution yields 5.9% and converts to a $1.70 annualized distribution. Enterprise Products Partners’ current 5.9% yield is more than 11% higher the company’s own 5.3% average yield over the past five years.

However, the company’s dividend performance over the long term is even more impressive. The company started distributing dividends to its shareholders in 1998 and has boosted its annual dividend amount every year since then. Over that period, the company enhanced its annual distribution at an average growth rate of 8.7% per year. After compounding at that rate for 20 consecutive years, the $1.70 annualized dividend payout for 2018 is 430% higher than the $0.32 annualized amount from 1998.

In addition to improving its dividend output, the company’s dividend and its current yield outperformed the average industry yields. Enterprise Products Partners’ current 5.9% dividend yield is 38% higher than the 4.26% average yield of the company’s dividend-paying peers in the Independent Oil & Gas industry segment and almost triple the 2.08% average yields of the entire Basic Materials sector.

The share price jumped a quick 9% during the first two weeks of the current trailing 12-month period and rose from $27.38 on January 12, 2017, to its 52-week high of $29.86 by January 26, 2017. After peaking early in the trailing 12-month period, the share price reversed trend and declined steadily for the next 10 months, lost 20% and reached its 52-week low of $23.89 on November 29, 2017.

After the November bottom, the share price rose sharply. Between its 52-week low in November 2017 and the $27.38 closing price on January 12, 2018, the share price soared almost 21% and regained almost 85% of its losses over the previous 10 months in just 35 trading days. The $27.38 closing price on January 12, 2018, is just 3.3% short of the 52-week high from January 2017 and 5.5% higher than it was one year earlier.

Dividend increases and decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic