FedEx Corporation Boosts Quarterly Dividend 30% (FDX)

By: Ned Piplovic,

FedEx Corporation (NYSE: FDX) is not known as a high-yield dividend payer, but that didn’t stop the company from announcing an upcoming 30% boost to its quarterly dividend.

When the package delivery organization determines it’s time to raise the annual dividend, it likes to do so in a big way. While 30% is a significant hike, FDX raised its annual dividend by twice that amount for the quarterly dividend payment exactly two years ago.

Over the past few years, FedEx’s share price has been increasing at a significant rate, which has suppressed the already small yield, representing only a tiny amount of the company’s total profits. However, FedEx’s financial results are strong enough that the company could reasonably consider increasing its dividend payout to achieve at least a 2% yield. FedEx’s main competitor, the United Parcel Service (NYSE:UPS), currently pays close to a 3% yield.

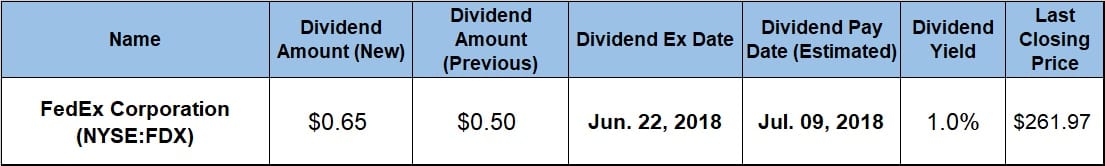

Most dividend income investors will likely skip over FedEx’s 1% yield and seek greater income returns elsewhere. However, the company does have a considerable track record, having hiked its annual payout every year since starting to pay dividends in 2002. The first 30% higher quarterly dividend will be paid to eligible investors on July 9, 2018, so interested investors may want to get on board prior to the upcoming ex-dividend date of June 22, 2018.

FedEx Corporation (NYSE:FDX)

Headquartered in Memphis, Tennessee and founded in 1971, the FedEx Corporation provides transportation, e-commerce and supply chain business services worldwide. The company’s FedEx Express segment provides freight shipping services, customs brokerage, ocean and air freight forwarding services, assistance with the customs trade partnership against terrorism (CTPAT) program, customs clearance services and freight tracking information tools. The TNT Express segment provides international express transportation, small package ground delivery, freight transportation services and business-to-consumer services. Additionally, the company’s FedEx Ground segment provides business and residential ground package delivery services and integrated supply chain management solutions. FedEx Freight offers less-than-truckload (LTL) freight and freight-shipping services. Additionally, FedEx Services provides various sale, marketing, information technology, technical support, billing and other back-office support services. Lastly, the FedEx Mobile segment offers a suite of solutions for tracking, rate quotes, digital printing, document creation, direct mail and other business services.

Since FedEx started paying dividends in 2002, the company’s current 30% hike (from $0.50 per share in the previous period to the upcoming $0.65 payout) is the third-highest on record. The increased quarterly dividend will translate to $2.60 on an annual basis and a 1.0% dividend yield. While this yield is, in a general sense, sub-par, it’s actually 65.4% higher than the company’s own 0.6% average yield over the past five years. Additionally, FedEx’s current yield is just about equal to the 1% simple average yield of the company’s peers and direct competitors in the Air Delivery & Freight Services industry segment.

If you dig into FedEx’s financials sufficiently, you find that there is more to this company’s dividend history than a stingy yield. Since 2002, FedEx’s total annual dividend distribution has increased 13-fold, an average of 18.6% per year.

Furthermore, while most companies with rising dividends see their growth rate diminish over time, FedEx’s 31.1% five-year average annual growth rate is higher than its average over the past 15 years. Its three-year average is even higher, at 36.7%. Also, the current dividend payout ratio here is merely 12%, which is very low for a mature, stable company. FedEx’s could easily double its payout ratio and still remain at the lower end of the sustainable payout range.

The other reason for the company’s low dividend yield is its steady asset appreciation. Over the past four decades since the initial public offering (IPO), FedEx’s share price has risen consistently, with only one period of major decline during the 2008 financial crisis.

In the trailing 12 months, FDX traded relatively flat between June and December 2017, reaching a 52-week low of $203.13 on Aug. 11. Shares then climbed 35% to $274.66 by mid-January 2018 before pulling back and trading around $240-$250 over the subsequent 90 days.

The share price started rising again at the beginning of May 2018 and closed on June 11, 2018 at $261.97. This closing price was 27% higher than it was one-year earlier, nearly 29% above the 52-week low and more than 170% higher than it was five years earlier. Factoring in continuing dividend income makes these amounts slightly higher.

In conclusion, FedEx is proof that even an outwardly unattractive dividend yield can have some strong roots and impressive growth potential. FDX may not be being gobbled up by income investors, but it is an income play well worth watching for the next few years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic