Five Dividend-paying Trucking Stocks to Purchase for a Post-Pandemic Rebound

By: Paul Dykewicz,

Five dividend-paying trucking stocks to purchase for a post-pandemic rebound provide investors with a path to pursue income and capital appreciation fueled by a new $1.9 trillion federal stimulus and increased COVID-19 vaccinations.

The five dividend-paying trucking stocks to buy offer an alternative to the high-flying technology and Bitcoin-related investments that had been soaring in recent months until a recent pullback. Tight capacity, rising demand for transportation and improving macroeconomic conditions will fuel trucking stocks, according to BoA Global Research.

Catalysts for trucking stocks include “very strong” manufacturing activity, the expanding economy reopening and rising commodity prices, said Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets. All of that should be good for freight trucking, as well as freight rail, Carlson opined.

Five Dividend-paying Trucking Stocks to Purchase for a Post-Pandemic Rebound Include Choice of Pension Fund Chief

Many investors anticipated these changes and most industrial and related stocks now are selling at comparitively high prices, Carlson continued. Additional stock gains must come from companies outperforming their revenue or profit margin expectations or from investors becoming willing to pay higher valuations for the stocks, he added.

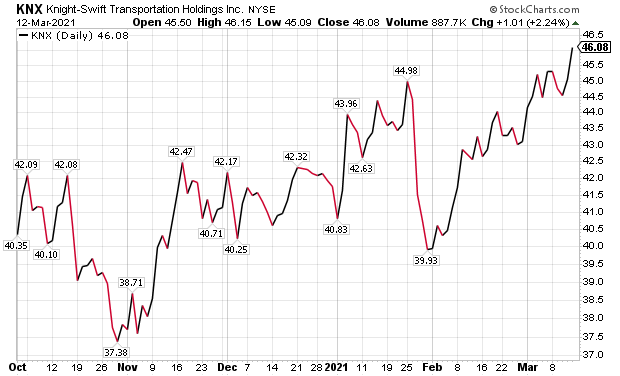

“An exception might be Knight-Swift Transportation Holdings Inc. (NYSE:KNX),” said Carlson, who also leads the Retirement Watch investment newsletter. “While the stock is up about 42% in the last 12 months, it lags behind most others in the sector and trades at a lower valuation. This is despite positive comments from the company about expectations for coming quarters.”

Chart courtesy of www.stockcharts.com

Modest Valuation Helps Knight-Swift Transportation Join Five Dividend-paying Trucking Stocks to Purchase

Knight-Swift Transportation, of Phoenix, Arizona, is the fifth-largest trucking company in the United States and offers a current dividend yield of 0.71%, while trading for a price-to-earnings (P/E) ratio of 18.8. It has a modest valuation compared to the S&P 500 P/E Ratio of 44.1 and the trucking sector’s P/E of 30.5.

“Potential problems for KNX and other companies in the sector are more competition from freight rail, high wages and shortages of qualified drivers,” Carlson said. “Given the potential headwinds, it is best to invest in the sector with a quality company trading at a below-average valuations.”

Pension fund and Retirement Watch leader Bob Carlson answers questions from Paul Dykewicz prior to COVID-19-related social distancing.

Five Dividend-paying Trucking Stocks to Purchase Include JBHT, SNDR and WERN

Rising demand for trucking services that exceeded expectations largely led BoA Global Research to put buy recommendations on five of the top seven trucking stocks to buy. One of them is Carlson’s favorite: Knight-Swift Transportation (KNX).

Trucking stocks are well positioned for a strong “cyclical recovery,” according to BoA Global Research. February storms reduced the first-quarter earnings estimates of the five stocks 12% on average but BoA Global Research boosted 2021 and 2022 price targets for them due to improved pricing and demand for their services.

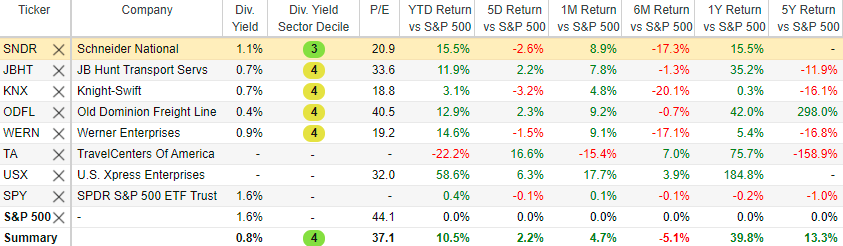

Source: Stock Rover. Click here to sign up for a free, two-week trial for Stock Rover charts and analytics.

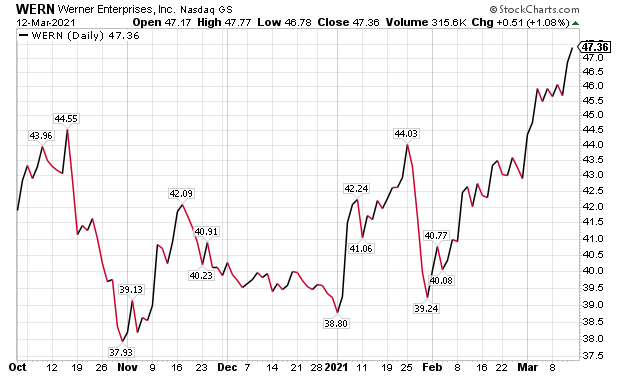

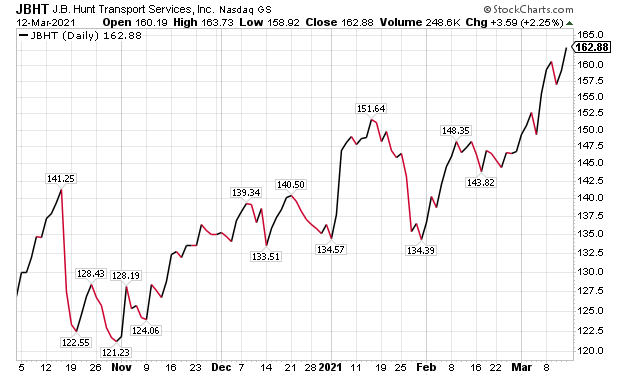

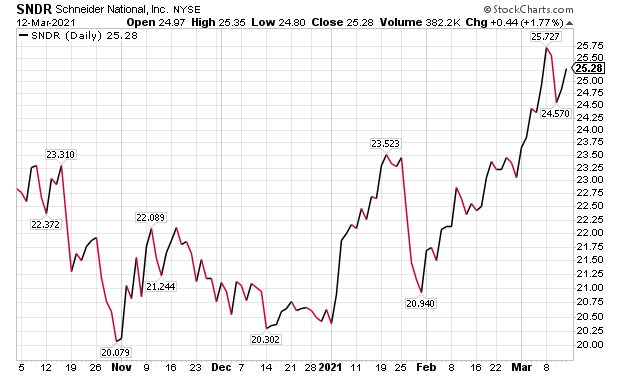

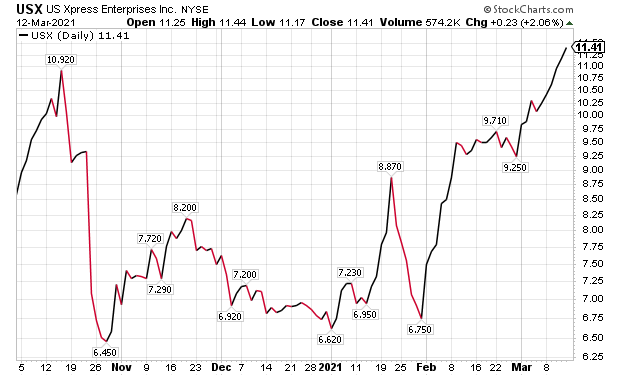

Three other dividend-paying trucking stocks to buy feature truckload and intermodal companies Werner Enterprises (NASDAQ:WERN), J.B. Hunt Transport Services (NASDAQ:JBHT) and Schneider National (NYSE:SNDR), which BoA Global Research elevated from buy to neutral. The investment firm further gave U.S. Xpress (USX) a double upgrade from underperform to buy.

Chart courtesy of www.stockcharts.com

Chart courtesy of www.stockcharts.com

Chart courtesy of www.stockcharts.com

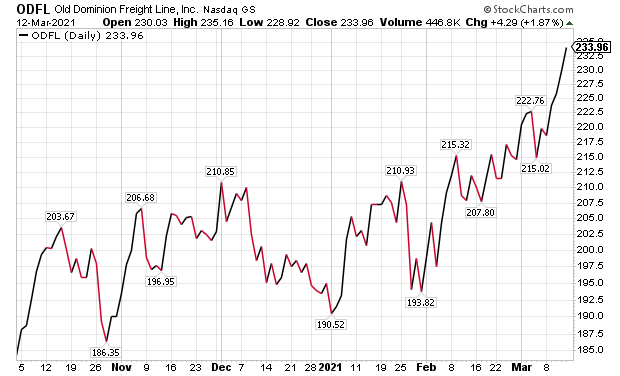

Old Dominion Freight Line Joins Five Dividend-paying Trucking Stocks to Purchase

“In terms of pure freight carriers, we were lucky enough to get Old Dominion Freight Line Inc. (NASDAQ:ODFL) on our screen under $70 several years ago,” said Hilary Kramer, a money manager who leads the GameChangers and Value Authority advisory services and hosts the nationally aired “Millionaire Maker” radio program. “Looking at it now, it’s a great argument for the longevity of road transport… and there’s still long-term upside left to capture.”

Chart courtesy of www.StockCharts.com

“The rigs must roll,” Kramer said. “My favorite trucking theme is actually the companies that run the rest stops that capture so much driver spending along the road. Unfortunately, most of the big chains are privately held and one of the best — Service Properties Trust (NYSE:SVC) — has diluted its core service center holdings with too many hotels and retail properties to qualify as a pure play now. That’s a real shame, especially since hospitality occupancy rates went off a cliff last year, taking what was once a solid dividend with them for the foreseeable future.”

Paul Dykewicz conducts a pre-COVID-19 interview with Hilary Kramer, whose premium advisory services include IPO Edge, 2-Day Trader, Turbo Trader and Inner Circle.

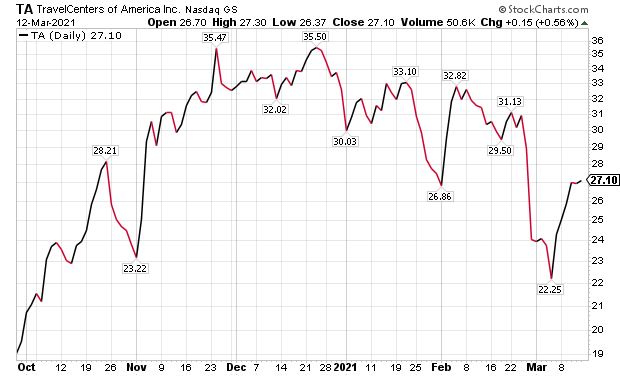

TravelCenters of America Is Money Manager’s Alternative to Five Dividend-paying Trucking Stocks to Purchase

Until SVC can shake off the hotel-related blues and hit the road again, the best investment alternative in the sector is TravelCenters of America Inc. (NYSE:TA), which doesn’t own the truck stops but manages the operations, Kramer said. Kramer voiced support for investing in TravelCenters of America, but confided she misses the dividends that SVC paid out from the rents it collected.

Chart courtesy of www.StockCharts.com

Seven Top Trucking Stocks to Buy Feature Five New Upgrades

BoA Global Research boosted its price objectives: on KNX to $52 from $46 and hiked its 2021 earnings per share (EPS) estimate to 15x from 13.5x; on WERN to $52 from $44 and increased its 2021 EPS estimate to 16x from 14x; on JBHT to $171 from $151 and raised 2021 EPS estimates to 27.5x from 24.5x; and on SNDR to $28 from $24 and jacked up its 2021 EPS estimate to 17.5x from 15x.

The price objective of double-upgrade stock USX zoomed 60% to $12 from $7.50 on 2021 BoA EPS estimates of 12x from 8x.

Chart courtesy of www.stockcharts.com

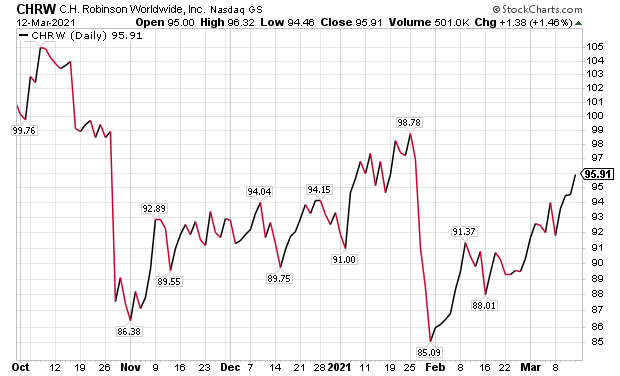

However, BoA Global Research cut its 2021 EPS price objective to $100 from $106 for Eden Prairie, Minnesota-based C.H. Robinson (NYSE:CHRW), a provider of multimodal transportation services and third-party logistics. The investment firm left its EPS estimate for CHRW unchanged at 23.5x.

Chart courtesy of www.stockcharts.com

Trucking Stocks Trade Near Bottom of Range, While Rates Show Near-term Jump

BoA Global Research’s proprietary bi-weekly BofA Truck Shipper Survey Demand Indicator took an unseasonal uptick to 69 from 67.5 to mark its second consecutive rise after falling in eight of 10 prior surveys from its September post-COVID peak. The unusual first-quarter uptick highlights the tight freight market, enhanced by near-term pressure from weather disruptions — driving an additional near-term restocking surge — and continued impacts from West Coast port congestion disrupting supply chains to cause a two-week backlog.

All those factors are driving freight rates near all-time peaks, according to BoA Global Research. Spot rates are now up 53% on average since May 2020’s trough, with flow-through to contract rates — which usually lag spot rates by six months — now materializing, the investment firm added.

The upgrades come roughly four months after BoA downgraded trucking stocks in November amid rapidly rising capacity concerns that subsequently have been somewhat built into outlooks and allayed. BoA forecasts truckload carriers to benefit from the cyclical forces of tight capacity and improving economic conditions to lift forward earnings multiples of their more richly valued transport peers, the Rails, to low-20s, and less than load (LTL) freight to 30x-plus in which the transportation of products or goods does not require a full truckload due to carrying smaller parcels.

Five Dividend-paying Trucking Stocks to Purchase Positioned for Strong ’21 Cyclical Recovery

With inventory replenishment expected to continue through the summer and consumer demand showing no signs of slowing, BoA forecasts trucking companies to benefit. The upbeat backdrop is supported by BoA economists raising their ’21 and ’22 U.S. gross domestic product (GDP) growth forecasts to a range of 5-6.5% from 4.5-6%, aided by the $1.9 trillion federal stimulus package and COVID-19 vaccine deployments.

The backlog at ports and depressed inventory levels means that the current tightness in freight capacity is likely to persist at least through the middle of this year and potentially through 2021, according to BoA. Extension of unemployment benefits, as well as driver schools operating at half capacity to allow for social distancing, likely will cause the current driver shortage to remain for an extended period, BoA concluded.

Of the 45,000 drivers who were suspended in 2020 from the launch of the national Commercial Driver’s License (CDL) Drug & Alcohol Clearinghouse in January 2020, 34,000 did not complete the return-to-work program to account for roughly 0.7% of the entire North American driver pool. The diminished driver supply is fueling concerns that the current shortage is a structural, rather than temporary shift, according to BoA.

It mirrors the BofA Truckload Capacity indicator, which remains at one of the lowest levels in the survey’s history, despite Class 8 net orders scaling above 40,000. That total is more than 2x the 20,000 replacement rate for the fourth consecutive month during February 2021.

COVID-19 Vaccinations and Precautions Rev Up Engines for Five Dividend-paying Trucking Stocks to Purchase

COVID-19 vaccinations and precautions are helping to reduce the number of cases and deaths in the United States, but the overall toll has mounted. The Food and Drug Administration (FDA) recently approved a third COVID-19 vaccine, lifting hope that a sense of normalcy may return later in 2021 if the virus can be corralled.

Total COVID-19 cases have reached a devastating 29,336,578 and caused 532,312 deaths in the United States, among 118,910,684 cases and 2,635,546 deaths worldwide, as of March 12, Johns Hopkins University reported. America has the grim reality of suffering the most cases and deaths of any country.

The five dividend-paying trucking stocks to purchase give investors a chance to acquire shares in companies that seem ready to hit the road for the long haul as America’s economic might is restored. Valuations already are on the rise, but time remains to choose the most promising picks that still seem to have the drive to climb further.

Connect with Paul Dykewicz

Connect with Paul Dykewicz