Five Income-paying Artificial Intelligence Investments to Purchase

By: Paul Dykewicz,

Five income-paying artificial intelligence investments to purchase offer the potential for powerful upside from three technology funds, one software industry giant and a provider of advanced security products.

The five income-paying artificial intelligence investments to purchase have been climbing in 2023 as technology stocks rebound from a 30%-plus plunge in 2022. Investors who can tolerate volatility may want to tap these technology equities in pursuit of potent performance.

Bear in mind that governments may start to regulate artificial intelligence and affect the independence of companies to do what their management teams want. Technology entrepreneur Elon Musk, the owner and CEO of Twitter, Inc. (NYSE: TWTR), CEO of Tesla Inc. (NASDAQ: TSLA) and founder and CEO of privately held SpaceX, said on a recent podcast with presidential candidate Robert F. Kennedy Jr. that China is planning to initiate the regulation of artificial intelligence.

Despite headwinds of inflation, the Fed’s tight money policies and a brewing banking crisis after several recent financial institution failures, the technology-tilted NASDAQ Composite has soared about 25.53% year to date, as of June 9. Investors who are reluctant to purchase artificial intelligence stocks may prefer using a fund consisting of many equities to reduce risk.

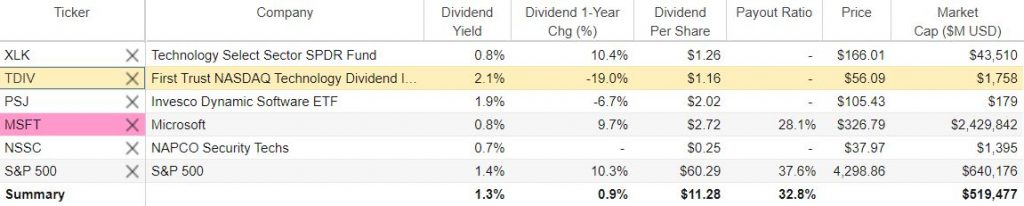

Courtesy of www.StockRover.com. Learn about Stock Rover by clicking here.

XLK Ranks as One of Five Income-paying Artificial Intelligence Investments to Purchase

A strong advocate of technology funds and stocks so far in 2023 has been Mark Skousen, PhD, an economist who serves as a Presidential Fellow at Chapman University and heads the Forecasts & Strategies investment newsletter. Skousen, who is a descendant of founding father, diplomat and inventor Benjamin Franklin, also is a seasoned forecaster who recommended Technology Select Sector SPDR Fund (NYSE: XLK) in Forecasts & Strategies. That fund has jumped 33.04% so far in 2023 through June 8.

Mark Skousen, head of Forecasts & Strategies, meets with Paul Dykewicz.

Professor Picks One of Five Income-paying Artificial Intelligence Investments to Purchase

Technology Select Sector SPDR Fund offers a current dividend yield of 0.8%. Professor Skousen shared its secret: the fund’s holdings are heavily weighted toward some of the most successful technology stocks so far in 2023: Microsoft (NASDAQ: MSFT), climbing 36.19%; Apple (NASDAQ: AAPL), soaring 39.34%; NVIDIA (NASDAQ: NVDA), zooming 163.57%; Broadcom (NASDAQ: AVGO), gaining 42.73%; and Salesforce (NASDAQ: CRM), up 58.03%.

Skousen, who also heads the TNT Trader advisory service that recommends both stocks and options, instructed his followers to take a profit on May 25 of 323.96% by selling call options in Nvidia Corp. that he recommended on May 2. The stock rose 34% in just a few months during the time Skousen recommended it, while the options sold in parts at varying levels to produce an average gain during the same time of 196%.

TDIV Tapped as One of Five Income-paying Artificial Intelligence Investments to Purchase

A broad-based fund with a decent dividend yield that offers some exposure to artificial intelligence is First Trust NASDAQ Technology Dividend Index (TDIV). The ETF tries to track the Nasdaq Technology Dividend Index, which is composed of technology and telecommunications companies, said Bob Carlson, a pension fund chairman who heads the Retirement Watch investment newsletter.

Bob Carlson, head of Retirement Watch, meets with Paul Dykewicz.

TDIV recently had 94 holdings, and its 10 largest positions accounted for 59% of its assets. The biggest weightings recently were Microsoft (NASDAQ:MSFT), Apple (NASDAQ: AAPL), Intel (NASDAQ: INTC), Broadcom (NASDAQ: AGVO) and IBM (NYSE: IBM). Roughly 13% of the fund is invested in communication services, while the rest fit into the technology sector.

The fund lost 22.12% in 2022 but is up 17.61% so far in 2023, 10.10% during the past three months and 4.53% in the last 12 months. The stock’s dividend yield hovers near 2.1%.

Chart courtesy of www.stockcharts.com

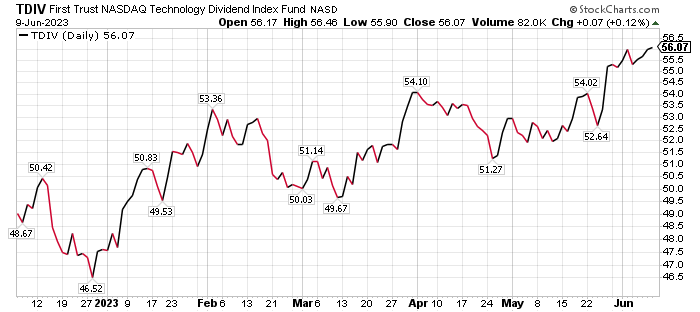

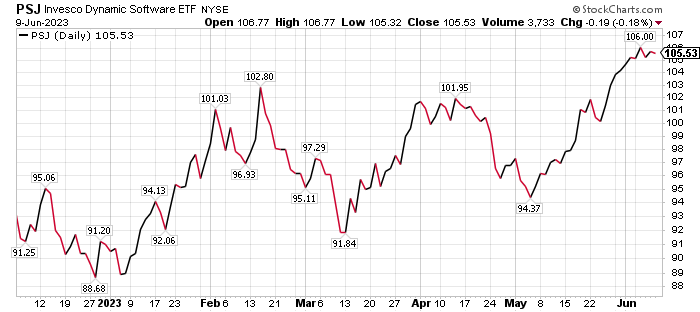

PSJ Picked Among Five Income-paying Artificial Intelligence Investments to Purchase

A third fund that offers exposure to artificial intelligence is Invesco Dynamic Software (PSJ), which tracks the Dynamic Software Intellidex Index. PSJ consists of approximately 30 companies engaged in businesses related to software applications, systems and information services.

The index is updated quarterly to incorporate factors such as price momentum, earnings momentum, quality, management action and value. The fund’s turnover ratio is more than 200%, Carlson continued.

About 49% of the fund is in its 10 largest positions. Top holdings recently were Electronic Arts (NASDAQ: EA), Forinet (NASDAQ: FTNT), Activision Blizzard (NASDAQ: AITI), Cadence Design Systems (NASDAQ: CDNS) and The Trade Desk (NASDAQ: TTD).

PSJ lost 27.73% in 2022 but is up 17.61% so far in 2023, 8.95% in the last 12 months, 9.99% in the past three months and 9.92% in last one month. The fund also offers a current dividend yield of 1.9%.

Chart courtesy of www.stockcharts.com

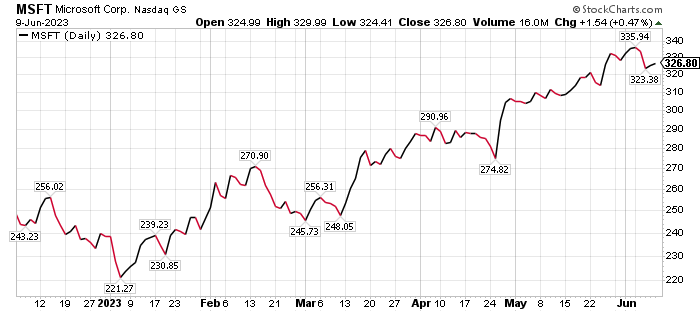

Five Income-Paying Artificial Intelligence Investments to Purchase Include MSFT

Microsoft (NASDAQ: MSFT), an income-paying software development company in Redmond, Washington, is engaged in artificial intelligence and has leaped nearly 40% so far this year. The company reported better-than-expected results for its fiscal third quarter, especially in its Microsoft Cloud business, according to Chicago-based investment firm William Blair & Co. Third-quarter revenue for Microsoft finished $1.8 billion ahead of consensus estimates.

The company’s fiscal fourth-quarter revenue guidance came in roughly $640 million ahead of consensus estimates, after adjusting for currency headwinds, according to William Blair. Income investors may appreciate Microsoft paying a dividend yield of 0.82%.

Even though Microsoft Azure — a cloud platform of more than 200 products and cloud services — is expected to keep decelerating to mid-20% growth in the fourth quarter, demand for AI infrastructure is proving to be a growth tailwind. AI has boosted the company’s Azure results and outlook, William Blair wrote in a recent research note.

“Azure growth of 31% was one percentage point ahead of guidance,” according to William Blair. “Nonetheless, this represented a deceleration from second-quarter growth of 38% due to continued pressure from customers looking to reduce consumption and optimize costs.”

Despite increased scrutiny on spending and lower cloud consumption related to weaker macro activity — conditions expected to persist in the near term — Microsoft showing robust momentum for its OpenAI Azure Services offering, which grew to 2,500 customers in the third quarter, when its growth quarter-over-quarter rose 10 times, according to William Blair.

Chart courtesy of www.stockcharts.com

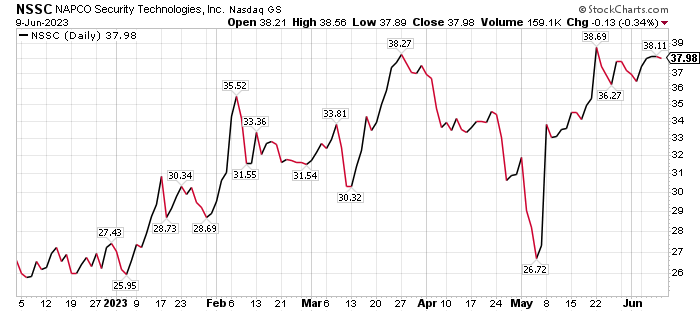

NAPCO Is One of Five Income-paying Artificial Intelligence Investments to Purchase

Napco Security Technologies (NASDAQ: NSSC) is an Amityville, New York-based manufacturer of security products, featuring advanced technologies for intrusion, fire, video, wireless, access control and door-locking systems. Its products are sold and installed by tens of thousands of security professionals worldwide to serve commercial, industrial, institutional, residential and government applications.

The company has a heritage of developing innovative technology and reliable security solutions for the professional security community, including StarLink Universal Wireless Intrusion & Commercial Fire Communicators and new StarLink Connect Radios with Universal Full Up/Download for major brands. Napco Security also offers Gemini Security & Fire Systems and the NAPCO Commercial Platform of 24V Addressable/Conventional/Wireless Systems and Firewolf Fire Panels & Devices.

“When the Federal Reserve stops ratcheting up interest rates, I would expect strong growth stories to continue to profit,” said Michell Connell, who heads the Dallas-based Portia Capital Management. The company’s five-year revenue growth has been 10.45% per year and its five-year earnings growth rate has averaged 28% or more every year, Connell continued.

“EPS growth rate is expected to increase exponentially more than 100% this year,” Connell commented. “That’s well ahead of the industry average expected growth rate of 22%.”

The company is a “strong cash generator,” Connell concluded.

Michelle Connell heads Portia Capital Management.

For the last three to five years, Napco Security’s annualized growth rate has topped 20%. In contrast, the industry average has only been about 5 to 6%, Connell commented.

Napco Security initiated a dividend when it reported results on May 8. While the dividend yield is less than 1%, it’s a start, Connell counseled.

The company’s outlook appears “strong,” Connell opined. Since 2023 began, earnings expectations for the company have risen.

“While the stock is up over 20% YTD, it could return another 20-25% over the next 12-18 months, Connell told me. “However, given its high-octane performance, it can also provide swift downdrafts. The stock has declined more than 60% at certain points. In addition, there is a high short interest of 14%. It makes me cautious in the near-term.”

Chart courtesy of www.stockcharts.com

Avoid overpaying by dollar-cost averaging and purchasing shares amid pullbacks, Connell counseled.

Michelle Connell heads Portia Capital Management.

Even though investors have flocked to AI funds and stocks in early 2023, Connell cautioned to avoid overpaying potentially inflated valuations. To guard against such missteps, investors should consider dollar-cost averaging and buying shares amid pullbacks, Connell counseled.

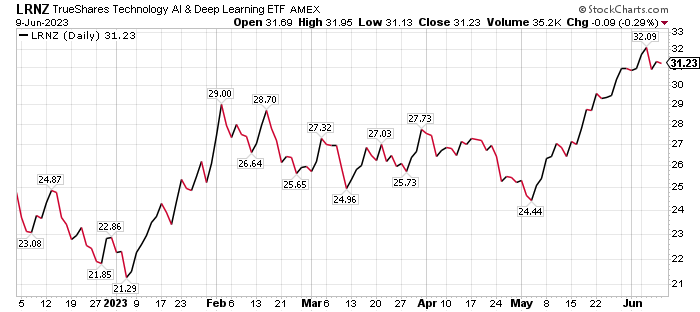

Woods Praises Alternative to Five Income-paying Artificial Intelligence Investments to Purchase

The non-dividend-paying TrueShares Technology, AI & Deep Learning ETF (LRNZ) is the easiest way to gain a broad allocation to some of the best stocks in the AI space, said Jim Woods, who heads the Intelligence Report investment newsletter and the Bullseye Stock Trader advisory service that offers both stock and option recommendations. As an actively managed exchange-traded fund, LRNZ centers its portfolio of global stocks focused on the development and use of AI and deep learning technologies. The fund holds 20-30 mostly large-cap stocks at a time, all of which either derive at least half of their revenue from AI or have a competitive advantage in the technology.

“When a tech wave like this is roaring into shore, it behooves investors to jump on it early, and LRNZ is the way to do it,” Woods told me.

Paul Dykewicz meets with Jim Woods, head of Bullseye Stock Trader.

AI technology is receiving buzz, while investment interest in the category keeps momentum. LRNZ holdings fit into one of three categories. The first is secular growth, consisting of stocks the fund managers use as a buy-and-hold strategy. This category is expected to have the greatest number of holdings. The second category, cyclical growth businesses, identifies shares that ideally can be bought at the bottom of a cycle and sold at their peak. Finally, there are initial public offering (IPO) positions, which are built over several months after a company goes public.

LRNZ contains primarily U.S. stocks, which consist of more than 99% of its holdings. Roughly 72% of its assets are in technology services, with additional smaller holdings in electronics, health technology and retail trade. Top current holdings include NVIDIA Corp (NASDAQ: NDVA), Advanced Micro Devices, Inc. (NASDAQ: AMD), Snowflake, Inc. (NYSE: SNOW), Schrodinger, Inc. (NASDAQ: SDGR), Mobileye Global, Inc. (NASDAQ: MBLY), SentinelOne, Inc. (NYSE: S) and Samsara, Inc. (NYSE: IOT).

Chart courtesy of StockCharts.com.

By the market’s close on June 8, LRNZ had jumped 18.19% in the last month, 20.36% in the past three months and an impressive 36.85% year to date (YTD). The fund also has a current expense ratio of 0.69%.

Woods has amassed a quick track record of success in recommending profitable stock and option trades in artificial intelligence companies. For example, Woods recently reaped rewards from the rapid rise of C3.ai Inc. (NYSE: AI) and Rambus Inc. (NASDAQ: RMBS). He produced a 167.20% gain on AI July 21 $25 call options in just 31 days. Woods also achieved an 83.10% profit in RMBS Aug. 18 $50 call options in only 13 days. Both recommendations came in his High Velocity Options trading service. That service only recommends options aimed at producing quick profits.

For most of 2023, stocks in the technology, and particularly, the mega-cap technology sector, have seen the lion’s share of money flows, Woods wrote in the June 9 issue of his weekly Intelligence Report hotline. This week, those money flows went from technology to sectors such as energy and small caps, Woods continued.

“Money always flows to where it’s treated best; however, what we also know is that markets are a forward-looking pricing machine,” Woods wrote. “The move into sectors such as small caps and energy suggests that the market thinks the economy is going to continue to grow, and that there will be widespread upside in the market and not just a concentration of money going into mega-cap tech.”

Until the past couple of weeks, markets were largely pricing in lackluster economic growth — not a recession, but slow growth, Woods wrote. Treasury yields and the dollar have declined on the idea of a dovish Fed pivot that pushed money into super-cap tech stocks, while most sectors and stocks went nowhere or declined, he added.

Russia’s February 2022 Invasion of Ukraine Finally Draws a Counteroffensive

Russia’s invasion of Ukraine led to a new catastrophe on June 6 with an explosion causing heavy damage to the Kakhovka Hydroelectric Power Plant dam, forcing emergency evacuations to sections of the country’s southern region near the port city of Kherson. Ukraine President Volodymyr Zelensky and other officials posted photos and videos showing a massive surge of water flowing from the damaged structure, putting thousands of residents downstream at risk. Ukrainian leaders blame damage to the dam on Russia. However, Russia is accusing Ukrainians of causing the explosion at the dam.

Observers indicated the dam and the road across it provide a possible line of attack for Ukrainian forces seeking ways to keep Russian forces off-balance. Military experts told the BBC it is highly likely that Russian forces, which controlled the dam, opted to blow it up, blocking a possible Ukrainian military operation.

During a 24-hour period stretching into Friday, June 2, Ukrainian military officials said Russia had carried out 62 missile strikes and 15 air strikes. In defense of its own land, Ukraine rebuffed more than a dozen ground assaults that day, those officials added.

Despite Russia’s sustained attacks against Ukraine using both drones and missiles, at least a couple of buildings in Moscow were struck by drones on May 30 to mark the first such incursion on Russia’s capital since President Vladimir Putin ordered troops to invade its much smaller neighbor in February 2022. Despite Putin calling Russia’s attack against Ukraine a “special military operation,” the United Nations has reported that its investigations of the invasion have found evidence of “war crimes.”

The five income-paying artificial intelligence investments to purchase provide investors with a path to profit.

Paul Dykewicz, www.pauldykewicz.com, is an award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal omf Commerce, Crain Communications, Seeking Alpha, Guru Focus and other publications and websites. Paul can be followed on Twitter @PaulDykewicz, and is the editor and a columnist at StockInvestor.com and DividendInvestor.com. He also serves as editorial director of Eagle Financial Publications in Washington, D.C. In that role, he edits monthly investment newsletters, time-sensitive trading alerts, free weekly e-letters and other reports. Previously, Paul served as business editor and a columnist at Baltimore’s Daily Record newspaper and as a reporter at the Baltimore Business Journal. Plus, Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many other sports figures. To buy signed and specially dedicated copies, call 202-677-4457.

Connect with Paul Dykewicz

Connect with Paul Dykewicz