Flowers Foods Rewards Shareholders with 3.4% Dividend Yield (NYSE:FLO)

By: Ned Piplovic,

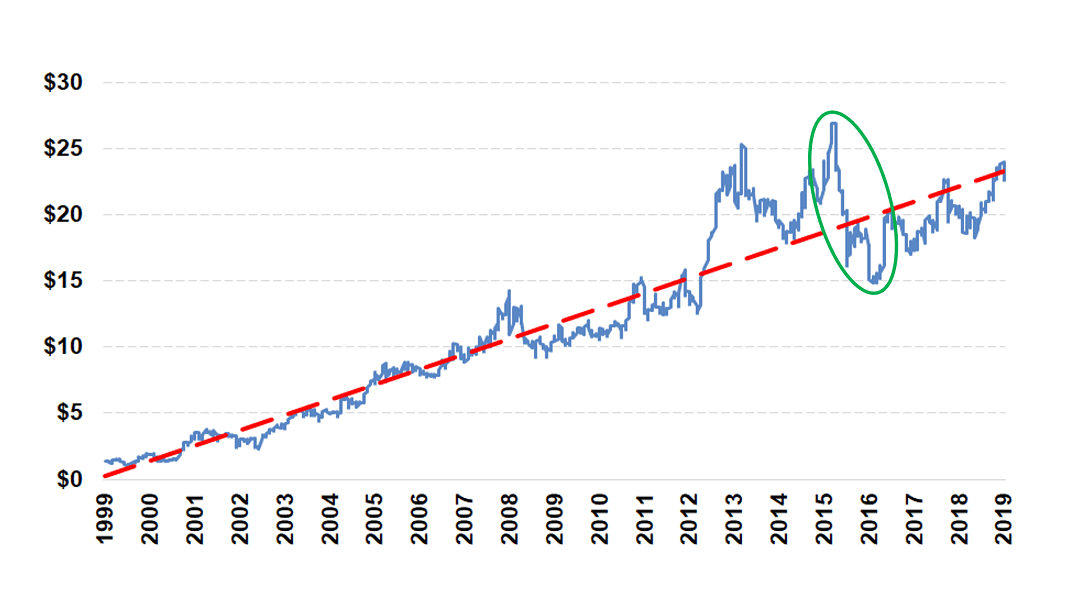

Despite some share price fluctuations over the past several years, Flowers Foods, Inc. (NYSE:FLO) supplemented its record of steadily rising dividend distributions with long-term asset appreciation to deliver robust total returns to its shareholders.

Since undergoing a reorganization and a name change in 2001, Flower Foods has increased its share price more than 15-fold, as well as enhanced its total annual dividend payout amount more than 11-fold. Just over the trailing 12 months, the company has delivered a double-digit-percentage share price growth.

Despite dropping more than 7% over the past year because of strong asset appreciation, Flowers Foods’ current Dividend Yield is still one of the highest yields among the company’s peers in the Processed & Packaged Goods industry segment. Excluding B&G Foods, Inc. (NYSE:BGS) because its current double-digit-percentage dividend yield is a function of a 65% share price drop, Flowers Foods current 3.34% dividend yield is just marginally lower than the 3.6% yields of two of its major competitors — General Mills, Inc. (NYSE:GIS) and the Kellogg Company (NYSE:K).

As always, investors interested in the Flower Foods stock must complete their own due diligence. Even a brief analysis will reveal a potential source of concern regarding Flowers Foods’ to continue its streak of consecutive annual dividend hikes. The company’s current dividend payout ratio of 86% is significantly higher than the 50% level generally considered by investors as the upper limit of the sustainable range.

The current payout ratio indicates that Flowers Foods presently uses most of its earnings to cover the dividend distributions. An occasional payout ratio spike might not be overly concerning. However, the company’s five-year ratio average is also high at 82%. This average suggests that Flowers Foods has been funneling most of its earnings into dividend distributions for several years.

However, closer examination of the company’s share price graph below reveals a 45% share price drop in late 2015 and the first half of 2016, which followed an earnings decline during the same time frame. A significant payout ratio increase is generally a warning sign of potential dividend cuts. However, Flowers Foods’ response to this payout ratio increase could be interpreted as a positive for income-seeking investors.

Instead of cutting its dividend in response to the payout ratio increase, Flowers Foods has continued to pay its dividends, as well as maintained its policy of annual dividend hikes. The continuously rising annual dividends despite the earnings decline indicate that the company is committed to maintaining the dividend income flow to its shareholders.

Investors must conduct their own detailed stock analysis to understand the current financial and operational status of Flowers Foods. However, a 15-year record of consecutive annual dividend boosts and a stock that appears to be on a steady uptrend might be enough to at least put the Flowers Foods’ stock on the investor’s watch list.

Investors must conduct their own detailed stock analysis to understand the current financial and operational status of Flowers Foods. However, a 15-year record of consecutive annual dividend boosts and a stock that appears to be on a steady uptrend might be enough to at least put the Flowers Foods’ stock on the investor’s watch list.

However, investors confident that the stock has strong foundations to continue delivering robust total returns or investors that do not want to miss any dividend income at an above-average dividend yield rate might consider acting soon.

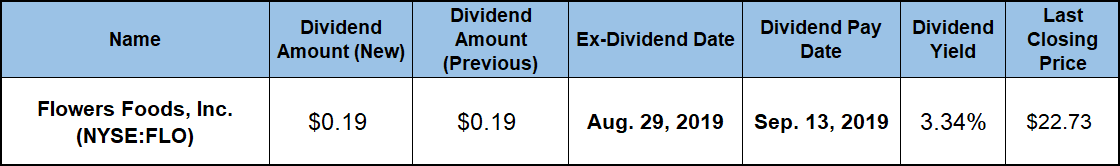

The company’s next ex-dividend date is coming up quickly. To secure eligibility for the next round of dividend distributions, investors must be able to claim stock ownership before the Aug. 29 ex-dividend date. Flowers Foods will distribute the next instalment of dividend payouts to all eligible shareholders on the September 13, 2019, pay date.

Flowers Foods, Inc. (NYSE: FLO)

Headquartered in Thomasville, Georgia, and founded in 1919 as Flowers Industries, the company changed its name to Flowers Foods, Inc. in 2001. The company produces and markets bakery products in the United States through two business segments — Direct Store Delivery (DSD) and Warehouse Delivery. The DSD segment produces and markets fresh breads, buns, rolls, tortillas and snack cakes. This segment offers its products primarily under the Nature’s Own, Wonder, Cobblestone Bread Company, Tastykake and Dave’s Killer Bread brand names. The company operates 39 bakeries in this segment and sells its products through a network of independent distributors to retail and foodservice customers. The Warehouse Delivery segment produces snack cakes, frozen breads and rolls for national retail, foodservice, and vending customers through a network of warehouse channels. This segment markets its products under the Mrs. Freshley’s, Alpine Valley Bread and European Bakers brand names. Additionally, this segment also sells products under franchised and licensed trademarks, such as Sunbeam, Bunny and Sara Lee.

The company’s current $0.19 quarterly dividend is 5.6% higher than the $0.18 distribution in the same period last year. This current quarterly payout amount is equivalent to a $0.76 annualized distribution and a 3.34% forward dividend yield. While slightly lower than the 3.6% yield from one year ago, the current yield is still 2.6% higher than the company’s own 3.26% five-year dividend yield average.

Furthermore, the current 3.26% dividend yield is also 65% higher than the 2.03% average yield of the entire Consumer Goods sector, as well as 86% above the 1.8% average yield of the companies in the Processed & Packaged Goods market segment. Furthermore, as one of the top yields in that segment, Flowers Foods’ current dividend yield also outperformed the 2.83% simple average yield of the segment’s only dividend-paying companies by 18%.

Since the name change and reorganization in 2001, Flower Foods has boosted its annual dividend payout every year. Over that period, the company has enhanced its annual distribution amount more than 11-fold, which corresponds to an average growth rate of 16.5% per year. Additionally, Flowers Foods managed to maintain a dividend growth rate of nearly 10% over the last five years.

The company’s shareholders enjoyed the combined benefits of rising dividend income and asset appreciation with a total return on investment of 14.3% just over the trailing 12 months. While the share price pullback in 2015 and 2016 limited the five-year total return to just 34%, the three-year total return was significantly better at 65%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic