Four Dividend-Paying Home Furnishing Stocks to Buy Now During the COVID-19 Recovery

By: Paul Dykewicz,

Four dividend-paying home furnishing stocks to buy now during the COVID-19 recovery feature companies that provide household products for home decor, furnishings, water heaters, painting and other purposes.

The four dividend-paying home furnishing stocks to buy now amid the ongoing COVID-19 recovery offer investors a chance to capitalize on rising demand to upgrade homes as many people spend more time at their residences and less at offices during the global pandemic. All four home furnishing stocks to buy now are recommended by analysts at BoA Global Research or market watchers elsewhere who seek ways to profit from the “work from home” trend.

Interest in working from home long term is rising, according to series of surveys conducted by BoA in June 2020, September 2020, November 2020 and March 2021. The surveys assess the short-and-longer term consequences of the outbreak of the COVID-19 pandemic and on how consumers live, work, and spend their money.

Research Support Exists for Four Dividend-paying Home Furnishing Stocks to Buy Now

Roughly 44% of BoA survey participants currently are working most of their week at home, down slightly from 49% in late November 2020. In comparison, the U.S. Census Bureau estimates that roughly 5% of people in the United States worked from home prior to the COVID-19 outbreak.

Even though BoA predicts more Americans will return to the workplace in the coming months as vaccines roll out, a relatively higher portion of the population likely will keep working from home for at least part of each week. Employees who struggled to raise families, find quality and affordable daycare and hold down office jobs now may view a “work-from-home” option as preferable.

Another BoA research tool is its State of Furnishings Activity (SOFA) indicator, a proprietary way to gauge the outlook for consumer spending in home furnishings by using real-time metrics, such as aggregated credit/debit card data; consumer health and wealth indicators such as consumer confidence and credit; and housing metrics like home prices and homeowners’ equity. In March 2021, the BoA SOFA indicator reported a reading of 41.2 vs. a 28.3 forecast, way up from 9.6 in February 2020.

Among the three factors of the SOFA indicator and relative to BoA expectations, the spending component outperformed “materially” and improved consumer confidence led to upside in the health and wealth component. The housing component rose in fourth-quarter 2020 on strong home improvement spending. BoA forecast that spending on home furnishings would rise at least through the first half of 2021 but thereafter probably would do so at “decelerating levels.”

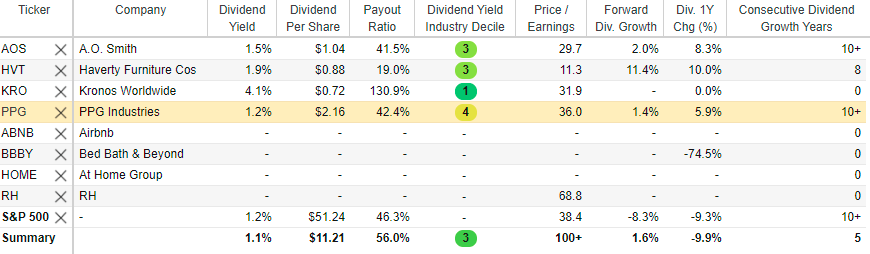

Source: Stock Rover. Click here to sign up for a free, two-week trial for Stock Rover charts and analytics.

Four Dividend-paying Home Furnishing Stocks to Buy Now include Haverty Furniture

Haverty Furniture Companies Inc. (NYSE:HVT), a dividend-paying specialty retailer of residential furniture and accessories, offers products such as sofa tables, sleepers, end tables, cocktail tables, accent pieces, display cabinets, wall decor and florals. The company operates primarily in the Southern and Midwestern U.S. All its activities are encompassed in its Merchandise division. The company derives the majority of its revenue from its upholstery products and, secondarily, from bedroom furniture.

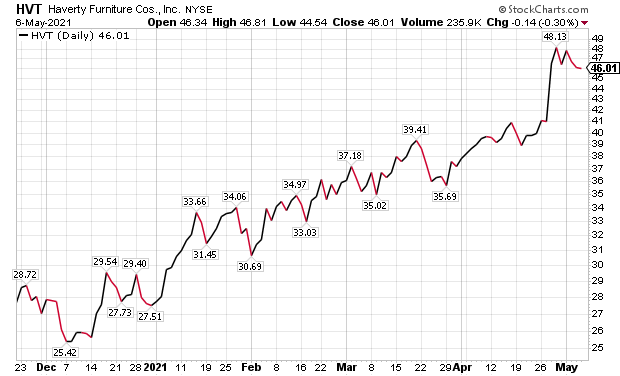

“One of the fastest-moving stocks in this space, and indeed in the entire market, is Haverty Furniture Companies (HVT),” said Jim Woods, editor Intelligence Report, Successful Investing and Bullseye Stock Trader. “Shares are up some 260% over the past 52 weeks, and nearly 70% year to date. And with earnings per share growth over 1,000% in its most-recent quarter, it’s no surprise the smart money is furnishing its holdings with HVT.”

The company also elevated Steven Burdette to become its president on March 1. Burdette had served as executive vice president of operations before succeeding Clarence Smith, who remained as chairman and chief executive officer. The move shows Haverty Furniture appears to have a succession plan.

First-quarter 2021 results released on April 27 indicated the company’s earnings per share (EPS) of $1.04 blew away its $0.09 results for the same quarter a year ago. Haverty Furniture’s first-quarter 2021 revenue of $236.5 million rose 24.14% ahead of revenue of $179.4 million for the first quarter of 2020.

Paul Dykewicz meets with Jim Woods before the COVID-19 crisis led to social-distancing measures.

Pension Fund Chirman Likes A.O. Smith as One of Four Dividend-paying Home Furnishing Stocks to Buy Now

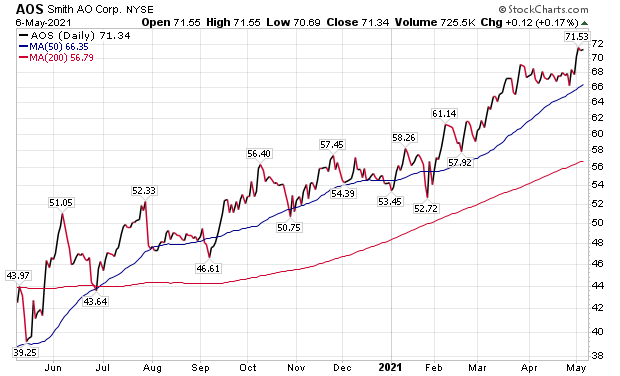

A conservative way to benefit from the trend to spend on home furnishings or related products to upgrade residences is to buy shares in Milwaukee-based A.O. Smith (NYSE:AOS), which primarily manufactures gas and electric water heaters. A proponent of the dividend-paying company is Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets.

Founded in 1874, A.O. Smith has increased its dividend during the last five years at an annual rate of 21% and has paid a cash dividend every year since 1940. In October 2020, A.O. Smith boosted its dividend for the 26th consecutive year to qualify as one of the Dividend Aristocrats, consisting of S&P 500 companies that must have a market capitalization of more than $3 billion and a record of raising annual dividend payout amounts for at least 25 consecutive years.

Chart courtesy of www.StockCharts.com

According to the company, in the past five years it has increased its dividend at a compound annual growth rate above 22%, said Carlson, who also leads the Retirement Watch investment newsletter.

Bob Carlson meets with Paul Dykewicz for an interview prior to COVID-19 social distancing becoming the norm.

Four Dividend-paying Home Furnishing Stocks to Buy Now Highlighted by Prominent Paint Company

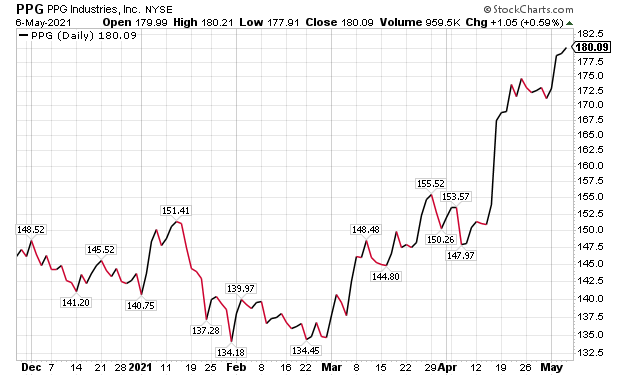

As for the best current paint stock to buy, Steve Byrne, an analyst with BofA Chemicals, chose Pittsburgh-based PPG Industries, Inc. (NYSE:PPG). He gave PPG a price objective of $160, since the company’s medium-term outlook and valuation appear relatively more attractive than underperform-rated and Cleveland-based competitor Sherwin-Williams Co. (NYSE:SHW), which received a $215 price objective from Byrne.

Chart courtesy of www.StockCharts.com

Although painting and wallpapering work received the second most votes by BoA survey respondents as a planned home improvement project, the poll participants’ interest in starting a new project have been decelerating since the first edition of the survey in June 2020. This could imply waning demand for the category.

PPG is a global supplier of paints, coatings and specialty materials to serve the home furnishings market. The company’s U.S. paint store business represents less than 15% of global sales and PPG is much more diversified both geographically and by end-market than its peer paint stock SHW.

PPG Earns Spot Among Four Dividend-paying Home Furnishing Stocks to Buy Now

PPG’s paint store business has little exposure to do-it-yourself customers, since its organic sales growth in 2020 dipped into the low-to-mid-single-digit percentages, Byrne wrote. Thus, he forecast a “meaningful improvement” in 2021.

The paint company has more cyclical exposure with auto coatings and industrial coatings as key end markets, along with the benefit from a “reopen thesis” on its auto refinish business that includes collision repair. Plus, PPG shares the paint aisle at Home Depot (NYSE:HD) with the Behr brand.

However, PPG aims to gain share from Home Depot’s efforts to grow its paint contractor business. Plus, PPG could be the best value for whatever growth is left in that business after 2020’s work-from-home movement boosted demand for painting projects that can create tough comparisons this year.

PPG’s dividend yield of 1.3% includes a quarterly distribution of $0.54, equivalent to an annualized payout of $2.16. With 49 consecutive years of dividend growth, the company is on the verge of qualifying among the Dividend Kings — an exclusive group of companies that have boosted their payouts for more than 50 consecutive years.

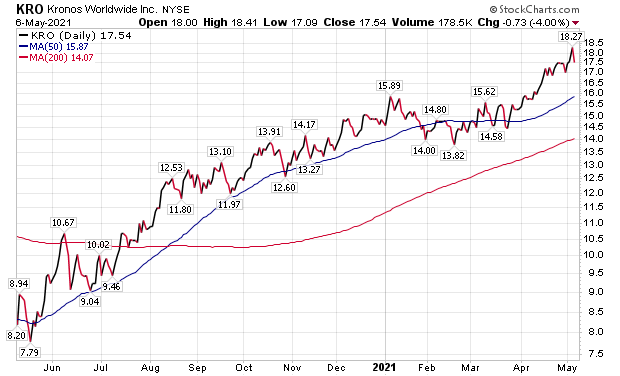

Four Dividend-paying Home Furnishing Stocks to Buy Now Include Kronos Worldwide

Dallas-based Kronos Worldwide Inc. (NYSE:KRO) is a producer and marketer of titanium dioxide (TiO2) pigments, a base industrial product that is used in a range of applications to provide whiteness, brightness and opacity. Kronos Worldwide and its distributors and agents sells and provides technical services for its products with sales in Europe and North America.

Hilary Kramer, who hosts the nationally aired “Millionaire Maker” radio program and heads the GameChangers and Value Authority advisory services, said she liked Kronos Worldwide as her preferred dividend-paying home furnishing stock because of its lofty dividend yield of 4.1%.

Paul Dykewicz conducts a pre-COVID-19 interview with Hilary Kramer, whose premium advisory services include IPO Edge, 2-Day Trader, Turbo Trader and Inner Circle.

Kronos Worldwide reported net income of $10.2 million, or $.09 per share, in the fourth quarter of 2020, compared to net income of $9.4 million, or $.08 per share, in the fourth quarter of 2019. For the full year of 2020, Kronos Worldwide produced net income of $63.9 million, or $.55 per share, compared to net income of $87.1 million, or $.75 per share for full-year 2019. The company reported it achieved higher net income in the fourth quarter of 2020, compared to fourth-quarter 2019, primarily due to higher income from operations resulting from rising sales volumes and lower production costs, partially offset by lower average TiO2 selling prices.

For full-year 2020, Kronous Worldwide reported lower net income, compared to full-year 2019, primarily due to lower income from operations resulting from the effects of lower sales volumes, lower average TiO2 selling prices and higher raw materials and other production costs. The results of operations for full-year 2020 were significantly impacted by the COVID-19 pandemic, specifically through sharply reduced demand for certain products due to the rapid contraction across the global economy in the second quarter, with demand strengthening throughout the second half of 2020. On the plus side, net sales of $414.9 million in fourth-quarter 2020 were $42.2 million, or 11%, higher than in the fourth quarter of 2019.

Chart courtesy of www.StockCharts.com

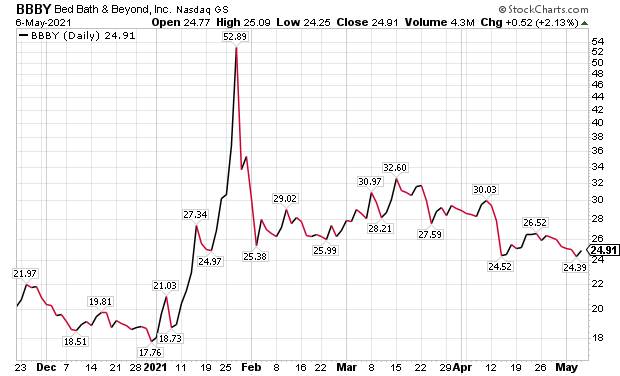

Four Dividend-paying Home Furnishing Stocks to Buy Now Exclude Non-Dividend-paying Bed Bath & Beyond

One of BoA’s non-dividend-paying home furnishing stock recommendations is Bed Bath & Beyond Inc. (NASDAQ: BBBY), an omnichannel domestic merchandise retailer headquartered in Union City, New Jersey. The company features many stores in the United States, Canada and Mexico. I have shopped at several the stores personally and found useful items that I purchased and now use.

As for investing in the company, BoA placed a price objective of $38 on the company based on a 6x enterprise value/ earnings before interest, taxes, depreciation and amortization (EBITDA) — using the investment firm’s 2022 estimates. Potential upside catalysts feature a better-than-expected economy and housing market, cost reductions and other factors. Risks include deterioration in demand from macro changes, a more intense promotional environment, reinvesting in the business to the point of eroding cost savings and a growing willingness of consumers to buy housewares online.

Chart courtesy of www.StockCharts.com

Bed Bath & Beyond (NASDAQ: BBBY), together with DoorDash (NYSE: DASH), announced on April 29 that Same Day Delivery services are now available in Canada, making it easier and more convenient to shop online for products from Bed Bath & Beyond and select Buy Buy BABY locations. Same Day Delivery follows the introduction last year of Buy-Online-Pickup-In-Store (BOPIS) and contactless Curbside Pickup services.

Four Dividend-paying Home Furnishing Stocks to Buy Now Use Innovation, as Do the Non-Dividend-paying Rivals

The new home delivery service of Bed Bath & Beyond will let customers shop for their favorite products online and have them delivered to their doorstep within hours of purchase. Same Day Delivery across Canada from Bed Bath & Beyond and Buy Buy BABY will be powered through DoorDash Drive — a white-label fulfillment platform to offer direct delivery to any business.

Through DoorDash Drive, Bed Bath & Beyond and Buy Buy BABY, customers will have access to same-day delivery service to 47 cities in nine provinces across Canada. The new purchasing method is intended as a simple and cost-effective way to shop from home.

“Omnichannel enables people to shop however they choose, is the future of retail and is more important than ever during these challenging times,” said Greg Dyer, vice president of store operations at Bed Bath & Beyond in Canada.

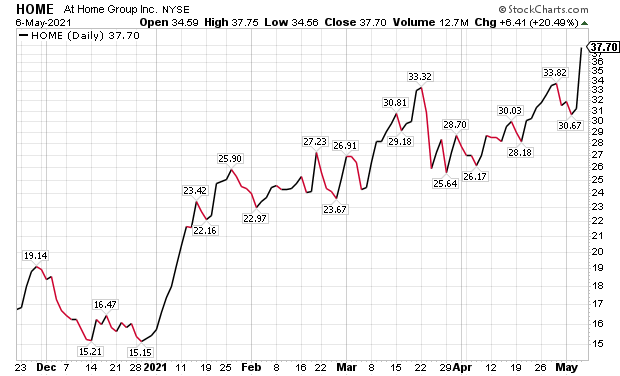

Home Décor Fuels a Non-Dividend-paying Home Furnishing Stock to Buy Now

Home Décor is the core product line of Plano, Texas-based At Home Group Inc. (NASDAQ:HOME), an operator of 225 stores in 40 states. Its average store is 110,000 square feet and each location offers 50,000 home products ranging from furniture, mirrors, rugs, art and housewares to tabletop, patio and seasonal décor.

At Home gained a price objective of $40 from BoA, based on 10x the investment firm’s 2022 estimated EV / EBITDA. BoA’s target multiple is below the average of 11x for its home furnishing peers.

Chart courtesy of www.StockCharts.com

“While we expect HOME to be a beneficiary of the invest-in-home trend, higher leverage, more competition at HOME’s price points and a less developed omni-channel platform warrant a discount to peers,” BoA wrote in a recent research note. “HOME has an opportunity to significantly grow its store base over the long-term as it is now in a stronger balance sheet position.”

Possible drivers of the stock are better-than-expected comparable results from increased advertising, greater-than-expected market share gains from traditional, higher-priced home furnishing retailers, as well as upside from consumers diverting demand into home furnishings. Potential pitfalls could be caused by low per-store staffing which could turn into a risk for inventory management and store growth, cash flows that are dependent on sale leasebacks and a continued industry shift to online sales that may not fully benefit HOME.

Money Manager Favors HOME as a Home Furnishing Stock to Buy

Kramer told me that At Home Group Inc. (NASDAQ:HOME) is a favorite for the indoor home products and it is unfathomable for many people who learn that this wasn’t even a $2 stock in the early stages of the pandemic. But for those who are convinced that the long-term view is bright, this is the kind of company that gets acquired sooner or later, especially if post-pandemic “cocooning” patterns become the norm in years to come, she added.

Mark Skousen, PhD, editor of the Forecasts & Strategies investment newsletter, recently recommended HOME to subscribers of his Home Run Trader advisory service. Skousen, who also leads the TNT Trader, Five Star Trader and Fast Money Alert advisory services, wrote that At HOME operates 226 superstores in 34 states and its size, efficiency, economy of scale and low prices allow it to dominate its fragmented competition.

The company ultimately plans to open 600 stores, with its leaders offering guidance of 15-20% annual store growth for the foreseeable future. Its management further has pursued key investments to move inventory through its distribution centers much faster than its competitors. Plus, At Home is a huge beneficiary of the red-hot residential real estate market, since most home buyers complement their purchase with new furnishings.

Mark Skousen, PhD, a descendant of Benjamin Franklin, meets with Paul Dykewicz in Philadelphia.

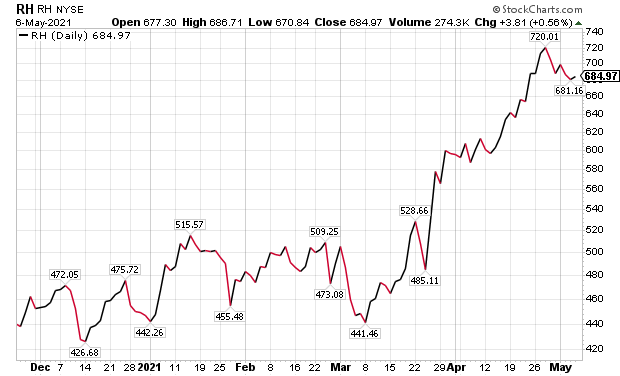

Luxury Furnishings Company Joins Non-Dividend-paying Home Furnishing Stocks to Buy

Corte Madera, California-based RH is a company that specializes in luxury furnishings and received a price objective of $650 from BoA. The investment firm described the company as well positioned to benefit from the re-opening of brick & mortar stores.

RH is rare company that describes itself as a curator of design, taste and style in the luxury lifestyle markets. It also rates as a BoA buy.

RH promotes its collections through its retail galleries across North America, its multiple Source Books and online at RH.com, RHModern.com, RHBabyandChild.com, RHTeen.com and Waterworks.com. The company’s management ambitiously has set a goal of building the world’s most comprehensive and compelling collection of luxury home furnishings.

Chart courtesy of www.StockCharts.com

BoA wrote that its $650 price objective on the stock is based on 18x EV/EBITDA, using its 2022 estimate. The valuation is above the five-year average multiple of 14x on a proven track record of consistently growing margins, as well as several large and long-term revenue opportunities that could deliver upside.

Possible catalysts to let RH top the $650 price objective include continued upside from RH’s gallery conversion strategy, international growth, operating leverage on sales growth, supply chain costs reductions and greater-than-expected share repurchases. Problems in reaching that price could emerge as a history of execution missteps, weakness in discretionary spending or a recession that may have an outsized impact on RH’s luxury brand.

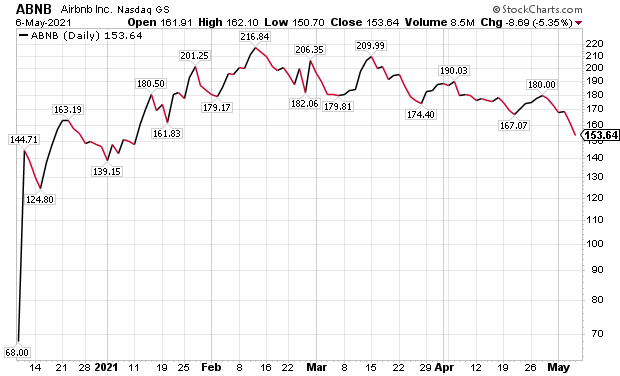

Kramer Puts Non-Dividend-paying Airbnb on List of Home Furnishing Stocks to Buy

Hilary Kramer offered a somewhat outside-the-box idea to invest in home furnishings by suggesting San Francisco-based Airbnb Inc. (NASDAQ:ABNB). The reason many people are so eager to redecorate their residential properties is to rent them out by the night, Kramer added.

Chart courtesy of www.StockCharts.com

The stock is up about 40% for her subscribers in a matter of months. Airbnb, created in 2007 when two Hosts welcomed three guests to their San Francisco home, has grown since then to 4 million Hosts who have welcomed more than 800 million guests in almost every country in the world.

The company’s favorable fourth-quarter results announced on Feb. 26 led Piper Sandler analyst Thomas Champion to raise his price target on the company to $198 from $182 per share. He based the hike on the quarterly results and forward estimate revisions stemming from his discounted cash flow (DCF) analysis. He further lifted first quarter and 2021 estimated revenue/EBITDA estimates that included a return to relative normalcy in 2021.

COVID-19 Does Not Halt Four Dividend-paying Home Furnishing Stocks to Buy Now

Progress with vaccination rollout in recent weeks aids optimism that new cases and deaths caused by the virus will slow after surge occurred in certain states. Further hope follow if efforts to vaccinate groups of people that have been wary thus far start to succeed.

Nonetheless, U.S. COVID-19 cases have reached 32,512,575 and led to 578,481 deaths, as of May 7. COVID-19 cases worldwide have zoomed to 153,977,028, while deaths have claimed 3,223,800, according to Johns Hopkins University. America has the dreaded distinction as the nation with the most COVID-19 cases and deaths.

The four dividend-paying home furnishings stocks to buy now provide investors with a handful of choices for profiting from the $1.9 trillion federal stimulus package, increased COVID-19 vaccine availability and the ongoing economic recovery. Those catalysts seem capable of building further momentum for the four dividend-paying home furnishings stocks to buy now.

Connect with Paul Dykewicz

Connect with Paul Dykewicz