Four Liquified Natural Gas Investments to Purchase for Income Amid Sanctions Aimed at Putin

By: Paul Dykewicz,

Four liquified natural gas investments to purchase for income should shine amid economic sanctions imposed against Russia by many of its customers protesting President Vladimir Putin’s dogged attack of Ukraine that has drawn international outrage from countries seeking to pressure the aggressor to withdraw its forces.

The four liquified natural gas (LNG) investments to purchase appear to be potential beneficiaries of Russia’s invasion that has led many European countries to restrict or outright ban importing Russia’s energy products to avoid funding Putin’s war against neighboring Ukraine. In addition, the four liquified natural gas investments to purchase seem to be seeking to replace the flow of Russia’s oil and LNG products at least partially.

The 27-nation European Union (EU), the United Kingdom, the United States, Canada, Japan, South Korea, Australia and other countries placed economic sanctions on Russia in a direct response to Putin ordering his troops to use heavy weapons and deadly force against thousands of Ukrainian civilians. Putin’s military forces have caused so much mayhem and thousands of civilian deaths in Ukraine that its President Volodymyr Zelenskyy and many other world leaders have described as “war crimes.”

Four Liquified Natural Gas Investments to Purchase May Find New Opportunities to Serve Europe

Global demand is climbing for liquified natural gas (LNG) to replace what Russia had been supplying to Europe. In 2021, Russia provided 40% of the natural gas consumed in the EU.

“This is a staggering statistic,” Bryan Perry wrote in the May 2022 issue of his Cash Machine investment newsletter.

Paul Dykewicz interviews Bryan Perry, whose investment advisory services include

Quick Income Trader, Hi-Tech Trader, Breakout Profits Alert and Premium Income.

Four Liquified Natural Gas Investments to Purchase for Income as America’s LNG Exports Rise

The United States is exporting record amounts of LNG as nations rapidly convert to gas-burning utilities from less environmentally friendly coal-fired plants. The burning of natural gas to produce energy causes fewer emissions of nearly all kinds of air pollution and carbon dioxide (CO2) than using coal or petroleum products to provide an equal amount of energy, according to the U.S. Energy Information Agency (EIA).

“U.S. exports of liquefied natural gas (LNG) set a record high in 2021, averaging 9.7 billion cubic feet per day (Bcf/d),” reported the latest edition of the EIA’s Natural Gas Monthly. “U.S. LNG exports increased by 50% from 2020. The increase in U.S. LNG exports was driven by rising demand in both Europe and Asia, particularly China, and by expanding U.S. liquefaction capacity. In 2021, liquefaction at the six U.S. LNG export terminals averaged 102% of nameplate (or nominal) capacity and 89% of peak capacity, according to our estimates.”

Nominal capacity specifies the amount of LNG produced in a calendar year under normal operating conditions, based on the engineering design of a facility. With U.S. LNG production at near capacity, prices should remain high as the supply/demand equation strongly favors producers and shippers of LNG to foreign buyers.

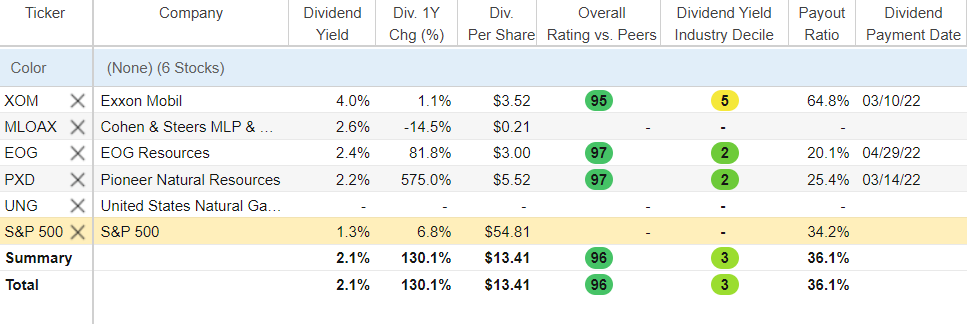

Chart generated using Stock Rover. Activate your 2-week free trial now.

Five Liquified Natural Gas Investments to Buy as Europe Seeks New Suppliers

The United States committed on March 25 to boost LNG shipments to Europe to help reduce or remove dependence on Russia. The Biden administration is proposing to send up to 15 billion cubic meters (bcm) to Europe, but that amount is only about 10% of the 150 bcm Europe used in 2021.

U.S. LNG capacity has grown quickly since America’s 48 contiguous states first began exporting the energy source in February 2016. In 2019, the United States became the world’s third-largest LNG exporter, trailing Australia and Qatar. Once the new LNG liquefaction units Sabine Pass and Calcasieu Pass in Louisiana are put into service by the end of 2022, the United States will have the world’s largest LNG export capacity.

The United States, United Kingdom, European Union, Canada, Japan, South Korea, Australia and other countries placed economic sanctions on Russia to try to compel Putin to stop his invasion and bring his troops home. However, Putin’s persistence has led to stinging criticism of him from U.S. President Joe Biden, U.K. Prime Minister Boris Johnson and other leaders for brutally bombing civilian targets such as hospitals, schools, residential buildings and cultural sites. Biden said publicly on April 12 for the first time that Putin was committing “genocide,” after previously citing evidence that Russia’s leader was perpetrating war crimes against Ukrainian civilians since he launched his invasion on Feb. 24.

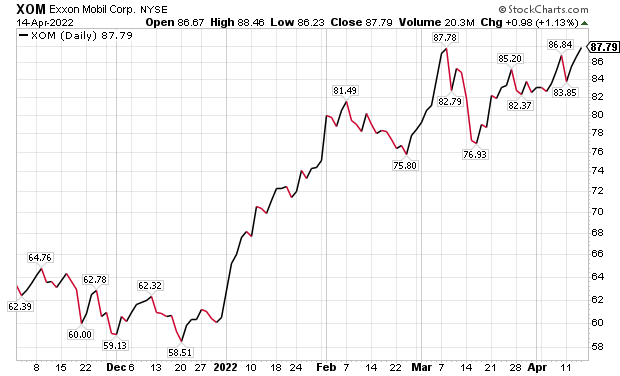

Perry Picks Exxon Mobil as One of Four Liquified Natural Gas Investments to Purchase for Income

A recommendation that Perry has included in his Cash Machine newsletter since July 2021 offers exposure to the LNG opportunity. Irving, Texas-based Exxon Mobil Corp. (NYSE: XOM) ranks as the world’s second-largest supplier of natural gas, pays a 4.9% dividend yield and already has jumped more than 57.5% since Perry began recommending it during July 2021 in his newsletter’s Safe Haven Portfolio.

Germany is among the European countries that needs time to prepare to transition fully from importing oil and LNG from Russia, but it is seeking alternative producers that include the United States. Europe is looking at LNG as its main energy substitute, with a plan to trim Russian energy imports by two-thirds in 2022.

However, prices in general are climbing sharply as the Consumer Price Index (CPI) rose at an annualized 8.5% in March, compared to a year ago, to mark the fastest annual jump since December 1981. The increase was one-tenth of a percentage point above what had been expected.

Chart courtesy of www.stockcharts.com

Pension Head Names Fund Among Four Liquified Natural Gas Investments to Purchase for Income

A good way to tap the LNG trend is to invest in energy service companies, advised Bob Carlson, a pension fund chairman who also leads the Retirement Watch investment newsletter. Investment opportunities exist with companies that provide the pipelines, storage facilities and other infrastructure used to supply the world with natural gas and other energy sources, he added.

“One of the attractive qualities of these investments is that their revenues are independent of the prices of the commodities,” Carlson counseled. “The firms charge fees for their services, and the fees often are adjusted for inflation. Their revenues and earnings depend on the volume of commodities passing through their facilities, not the price of the commodity.”

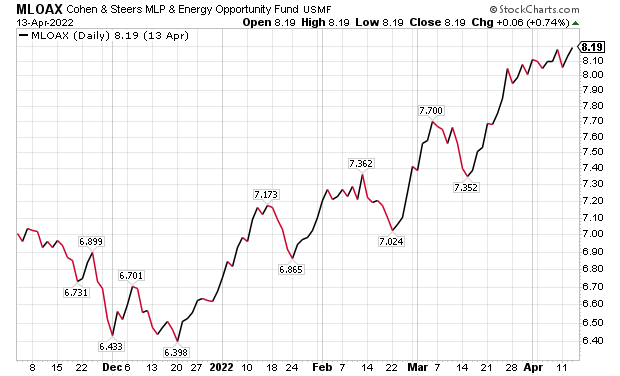

A diversified way to invest in the growing demand for LNG energy is Cohen & Steers MLP & Energy Opportunity Fund (MLOAX). This open-end mutual fund invests primarily in energy master limited partnerships and in former partnerships that have converted to corporations. These “leading” energy service companies provide total returns, aided by current income and price appreciation, through investments in energy-related master limited partnerships (MLPs) and securities of industry companies. Those businesses are expected to derive at least 50% of their revenues or operating income from exploration, production, gathering, transportation, processing, storage, refining, distribution or marketing of natural gas, crude oil and other energy resources.

Chart courtesy of www.stockcharts.com

Cohen & Steers Fund Joins List of Four Liquified Natural Gas Investments to Purchase for Income

The Cohen & Steers MLP & Energy Opportunity Fund recently held 53 positions and had 50% of the fund in the 10 largest positions. Top holdings of the fund were Enbridge (NYSE: ENB), Cheniere Energy (NYSEAMERICAN: LNG), Williams Companies (NYSE: WMB), TC Energy (NYSE: TRP) and Energy Transfer (NYSE: ET).

The fund has notched strong returns since April 2020. It is up 23.13% so far in 2022, 11.07% in the last month and 41.75% in the past year, while offering a dividend yield of 2.6%.

Bob Carlson, head of Retirement Watch, speaks with columnist Paul Dykewicz.

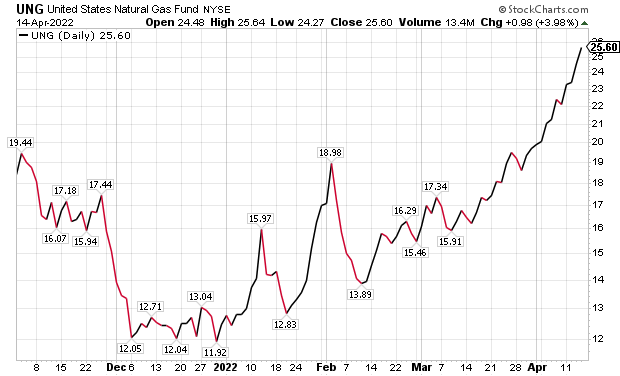

Carlson’s second LNG recommendation is non-dividend-paying ETF United States Natural Gas (UNG). The fund invests in natural gas futures contracts and related contracts on natural gas prices. The contracts are collaterized with cash and treasury securities.

Chart courtesy of www.stockcharts.com

The fund has zoomed 55.43% in the last month, 104.96% for the year to date and 165.84 in the past year.

Connell Chooses Two of Four Liquified Natural Gas Investments to Purchase for Income

U.S. LNG inventory is currently 17% below its 5-year average for this time of year, said Michelle Connell, CFA, president and owner of Portia Capital Management, of Dallas, Texas. The biggest issue for the U.S. LNG industry is that production of the energy source has never been profitable on its own but is a byproduct of oil production, she added.

“There isn’t enough oil being produced,” Connell said. “Currently, only 11.6 million barrels/day are being produced. Pre-pandemic, we produced 13 million barrels/day.”

Instead of investing to increase capacity, oil companies have been focusing on raising their dividend payments, Connell continued. If they pivot, these companies face a backlash from investors who could sell their shares, Connell added.

“Their market value could get crushed,” Connell said.

Michelle Connell, CEO, Portia Capital Management

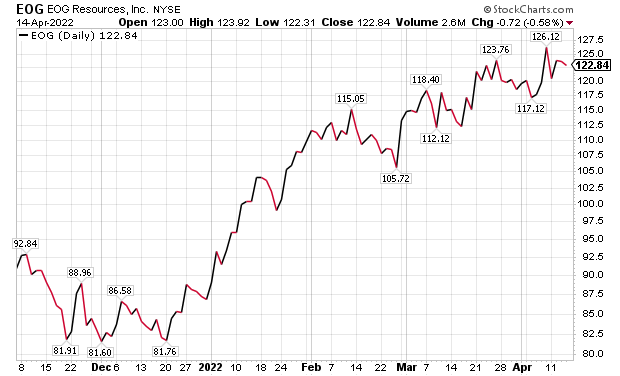

EOG Resources Gains Place With Four Liquified Natural Gas Investments to Purchase for Income

Even if the oil companies started to invest more into production, it will take six to eight months at a minimum to increase their oil and LNG production, Connell counseled. Most recently, the production of oil via shale created the largest share of the America’s natural gas reserves, Connell continued.

Unfortunately for advocates of increased output to meet rising demand, shale production has “decreased exponentially” since the pandemic began and the build-up of LNG reserves has declined, Connell explained.

However, Connell conveyed that she found two investments that produce substantial amounts of oil via shale, and thus considerable LNG. One of them is Houston-based EOG Resources Inc. (NYSE: EOG)

“The outstanding fourth-quarter results cap off a tremendous year for EOG — record earnings, record free cash flow and return of cash that places EOG among the leaders in our industry and across the broader market,” said Ezra Yacob, chief executive officer of EOG, in reporting those results. “Reflecting these results, we are continuing to deliver on our long-standing free cash flow priorities with another $1.00 per share special dividend while further strengthening the balance sheet.”

Chart courtesy of www.stockcharts.com

EOG Resources has amassed a market capitalization of $70 billion and offers a dividend yield of 4.7%. Among other financial metrics that Connell tracks, she pointed out that EOG has an earnings yield of 6.29%, an adjusted cash earnings yield of 11.19% and a five-year average return on investment of 13.73%.

The company’s reserves, as of year-end 2021, reached 3.22 billion barrels, with petroleum accounting for 51%, natural gas liquid contributing 22% and natural gas equaling 27%. Connell calculated a 12-to-18-month upside in the stock of 30-35%.

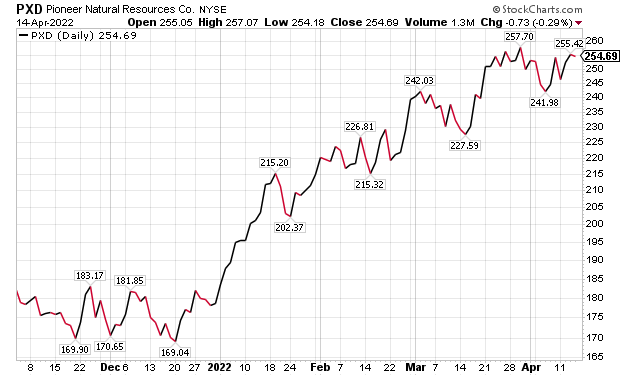

Pioneer Earns Berth Among Five Liquified Natural Gas Investments to Buy

Pioneer Natural Resources Co. (NYSE: PXD), a hydrocarbon exploration company headquartered in Irving, Texas, is the second LNG stock that Connell proposed for investment. The company has a market capitalization of $61.72 billion, offers a dividend yield of 4.2% and has never missed paying a dividend, she added.

In addition, Pioneer Natural Resources has produced an earnings yield of 3.25%, an adjusted cash earnings yield of 7.48% and a five-year average return on equity of 6.61%, Connell said. At the end of 2021, Pioneer Natural Resources had compiled 2.22 billion barrels of oil equivalent, with 44% of its proved reserves from petroleum, 30% from natural gas liquid and 16% from natural gas. Connell set a 12-to-18-month price target for the company of 35-40% upside from current levels.

Chart courtesy of www.stockcharts.com

Worldwide COVID-19 Cases Top 502 Million and Deaths Nearing 6.2 Million

COVID-19 cases worldwide topped 502 million for the first time on April 14, according to Johns Hopkins University. Meanwhile, the U.S. Centers for Disease Control and Prevention found that the BA.2 subvariant of the Omicron version of COVID-19 caused 86% of new COVID-19 cases in the United States last week.

COVID-19 cases and deaths have been rising slightly in the United States during recent days, cautioned Anthony Fauci, M.D., director of the National Institute of Allergy and Infectious Diseases. Dr. Fauci said America “certainly” is seeing the start of a surge of new infections as mask-wearing requirements have eased and people increasing choose to travel.

As for China, Shanghai has become its hotspot for the Omicron variant of COVID-19 and most of its 25 million residents remain under lockdown. The rising incidence of COVID-19 in China have led to calling on members of its military and health care community to aid in the response. In fact, the Nomura financial securities firm estimated that as many as 45 cities in China were implementing either full or partial lockdowns as of April 14, affecting more than a quarter of the country’s population.

China Reports Its Highest Case Numbers Since 2022 When COVID-19 Originated in Wuhan

China is reporting its highest case numbers since the virus first became detected in its Wuhan region during 2020 when the global COVID-18 pandemic began. Young children with COVID-19 have been separated forcibly from their parents, fueling public dissent, as Chinese leaders try to stop the spread of a new, highly contagious subvariant of Omicron, BA.2. The variant also has been spreading a new wave of infections in Europe, where COVID cases are rising in countries such as Germany, the Netherlands and Switzerland.

COVID-19 cases across the globe have jumped by more than 2 million in just two days to hit 502,495,440. Worldwide COVID-19 deaths during the same time span have climbed nearly 9,000 to total 6,192,554 on April 14, according to Johns Hopkins University.

U.S. COVID-19 cases, as of April 14, hit 80,570,474, with deaths rising to 988,102. America has the dubious distinction as the country with the most COVID-19 cases and deaths.

As of April 14, 256,590,734 people, or 77.3% of the U.S. population, have obtained at least one dose of a COVID-19 vaccine, the CDC reported. Fully vaccinated people reached 218,707,476, or 65.9%, of the U.S. population, according to the CDC. In addition, 99.1 million people have received at least one booster dose of COVID-19 vaccine.

The four liquified natural gas investments to purchase for income offer the potential to serve international customers that Putin’s war has been driving away from Russia’s suppliers since his invasion of Ukraine and confirmed reports that thousands of civilians there have been killed by the soldiers he ordered into the country. As European countries seek to stop purchasing oil and natural gas from Russia to avoid funding its war with Ukraine, the four liquified natural gas investments to purchase for income seem poised to become alternative energy suppliers.

Connect with Paul Dykewicz

Connect with Paul Dykewicz