Garmin Offers Shareholders 3.4% Dividend Yield (GRMN)

By: Ned Piplovic,

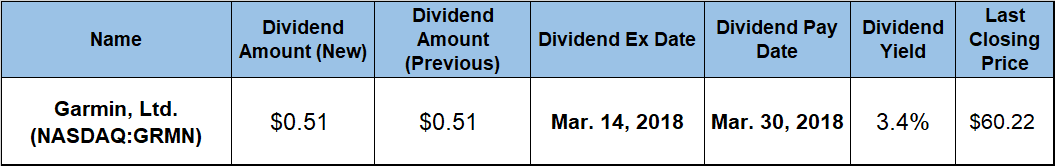

Garmin, Ltd. (NASDAQ: GRMN) is rewarding its shareholders with a 3.4% forward dividend yield generated by the annualized dividend payout of more than $2.00 per share.

In addition to its significant dividend income and an above-average yield, Garmin’s has a total return on shareholder investment of nearly 20% over the past 12 months, thanks in part to share price appreciation. The company’s share price has been rising at a steady pace over the past two years and technical indicators show no signs of trend reversal at this time.

Garmin’s next ex-dividend date will be on March 14, 2018 and the company will distribute the next quarterly dividend to its shareholders two weeks later on March 30, 2018.

Garmin Ltd. (NASDAQ:GRMN)

Based in Schaffhausen, Switzerland and founded in 1990, Garmin Ltd. designs, develops, manufactures, markets and distributes a range of navigation, communication and information devices through five segments — Auto, Aviation, Marine, Outdoor and Fitness. The company’s products include navigation devices, infotainment systems (entertainment and information consoles in automobiles), action cameras, aviation flight control and hazard avoidance, marine chartplotters and multi-function displays, outdoor handhelds and cycling computers. Additionally, the company provides mobile platforms for users to track and analyze their fitness and wellness data under the Garmin Connect and Garmin Connect Mobile brand names.

Garmin began distributing dividends to its shareholders back in 2003. The company started paying dividends more than once a year in 2011, and between 2010 and 2016, the annual payment was raised every year. However, Garmin did not hike the dividend payout in 2017, and the current $0.51 per share quarterly dividend is the same payout that Garmin distributed in every quarter of 2017.

However, historically, Garmin tends to boost its quarterly payout for the second quarter of the year. The company’s Board of Directors has already proposed a quarterly dividend hike to $0.53 per share — a 3.9% boost — based on company’s financial results for 2017. As things stand currently, the annualized dividend payout of $2.04 amounts to a yield of 3.4%. The current yield is almost 14% lower than the company’s own 3.9% average yield over the past five years. The reason for this decline is the double-digit-percentage share price growth over the past couple of years.

Despite declining against its own five-year yield average, Garmin’s current yield is still outperforming its industry peers. The 3.4% current yield is more than 170% above the 1.23% average yield of the entire Technology sector and 360% higher than the 0.73% average yield of all the companies in the Scientific & Technical Instruments market segment. Garmin’s current yield is the highest one in this market segment by a significant margin. It is 35% above the yield of its nearest competitor and 180% higher than the average yield of only dividend-paying companies in the segment.

Complementing the robust dividend income is the company’s share price growth over the past two years. After a surprisingly strong performance in 2016, given all the turbulence that year, the share price dipped 5.7% to hit its 52-week low of $48.50. By mid-September, the price had recovered and had gained nearly 7%. After mid-September 2017, the share price shot up towards its 52-week high of $65.96 on Feb. 20 — a total gain of nearly 34% since the April 2017 low.

However, Garmin’s share price dropped 7.4% in a single trading day following the results call on February 21, 2018. This price drop was unexpected since the company’s 2017 year-end results had exceeded Wall Street’s revenue and net profit expectations. The company also proposed a dividend hike and issued an optimistic guidance for the next fiscal year. What happened, then? It appears that Garmin fell victim to its own success. The company has been exceeding expectations by a wide margin over the past couple of years and investors were expecting more. While the company’s current results did exceed expectations, it was by the smallest margin since the third quarter of 2015.

Garmin’s share price closed on February 27, 2018 at $60.22, which was 7.7% below the 52-week high from 10 days earlier, 23.7% above the April 2017 low and 16.7% higher than it was one year earlier. The combined benefit of the rising dividend income and asset appreciation generated a total return of nearly 20% over the past year, a 36% total return over the past three years and a 107% total return over the past five years.

———-

Motorola Solutions Inc. (NYSE:MSI)

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic