Genesis Energy Offers Investors 10% Dividend Yield (GEL)

By: Ned Piplovic,

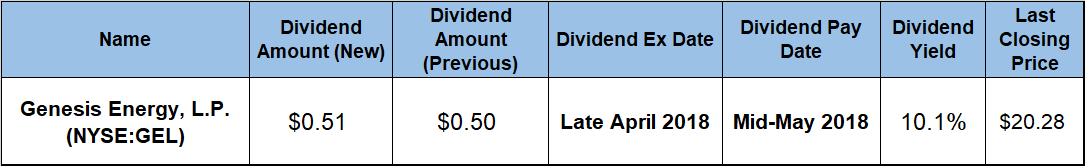

Genesis Energy, L.P. (NYSE:GEL) cut its dividend in the last quarter of 2017 for the first time in more than a decade, but it immediately hiked its quarterly payout again for the first quarter of 2018 and the company currently offers a dividend yield of more than 10%.

The company’s share price fell 40% over the past 12 months. However, that share price decline and the rising dividend payouts drove the yield 67% higher during the same period. The company announced few new revenue commitments and that the performance of its recently acquired soda ash operation continues to exceed expectations, which will provide significant contributions to the company’s bottom line in 2018. Therefore, the company seems well-positioned for potential growth, which make the current share price decline an opportunity for investors to pick up an income-generating equity at a substantial discount.

Based on the previous years’ timelines, the company should declare its upcoming dividends around April 10, 2018. The projected quarterly payout amount for the next payout will most likely be 1 cent — or 2% — higher than the current $0.51 amount. Interested investors should be on the lookout for the announcement, which will also provide the exact ex-dividend date in late April 2018 and the pay date that should occur in mid-May 2018.

Genesis Energy, L.P. (NYSE:GEL)

Headquartered in Houston, Texas, and founded in 1996, Genesis Energy, L.P. operates in the midstream segment of the crude oil and natural gas industry. The company owns interests in approximately 1,500 miles of crude oil pipelines located offshore in the Gulf of Mexico, 10 refining operations, 200 trucks, 400 trailers and 523 railcars. It also has terminals totaling 4.6 million barrels of storage capacity in various locations along the Gulf Coast. GEL’s marine transportation segment owns and operates a fleet of 83 barges with a combined transportation capacity of nearly 3 million barrels and 43 push/tow boats.

The share price started the current one-year period from its 52-week high of $33.29 and declined 43.6% to reach its 52-week low of $18.78 on March 27, 2018. After bottoming out at the end of March 2018, the share price reversed direction and ascended to close at $20.28 on April 5, 2018. This closing price was still 39% lower than it was one year earlier but 8% higher than the 52-week low from seven trading days earlier.

Prior to cutting its dividend from a $0.7225 payout in the third quarter of 2017 to $0.50 per share in the last quarter of 2017, the company had boosted its dividend distribution amount for 48 consecutive quarters. However, immediately after breaking the streak, the company boosted its quarterly dividend distribution 2% to a $0.51 payout in the first quarter of 2018. This is consistent with the company’s strategy to increase the dividend distribution rate by at least $0.01 per quarter. Therefore, the upcoming quarterly dividend amount should be $0.52. If the remaining two quarterly dividends for 2018 follow the same rising payout strategy, the total annualized dividend amount for 2018 should be $2.10, which would be equivalent to a 10.4% dividend yield at the current share price.

While the share price drop resulted in a higher yield, even using the 52-week high share price from 12 months ago would generate a respectable 6.3% yield. Nevertheless, the company’s current 10.1% yield is 32.4% above the company’s own 7.6% five-year average yield. Additionally, Genesis Energy’s current yield exceeds the average yield of the entire Basic Materials sector by more than 300% and is 80% higher than the 5.6% simple average yield of the Oil & Gas Pipelines market segment. Moreover, excluding the companies that do not pay dividends raises the segment’s average yield of dividend-paying companies only to 8.84% and Genesis Energy’s current yield is still 14% higher.

Prior to the fourth-quarter 2017 dividend cut, the company reduced its annual dividend in 2003. Since the $0.15 total amount paid in 2003, the company has enhanced its total annual dividend payout nearly 14-fold by advancing its annual dividend at an average growth rate of 19% per year.

While investors willing to take a risk could act immediately, risk-averse investors could wait another quarter of two to make sure that the dividend payouts continue to rise every quarter and to see whether the share price will break its downward trend. As always, investors should perform their own research to confirm validity of any equity’s financial outlook and to determine whether the investment is a good fit with their own investment strategy.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic