Genuine Parts Company Offers Annual Dividend Hikes for More Than Six Decades (GPC)

By: Ned Piplovic,

Genuine Parts Company (NYSE:GPC) has been offereing its shareholders annual dividend hikes for more than six decades and currently offers a 3.2% dividend yield that outperforms the industry averages.

As a component of the S&P 500 Index with a market capitalization that exceeds $3 billion and at least 25 years of consecutive annual dividend hikes, the Genuine Parts Company is designated along with 50 other companies as a Dividend Aristocrat. Additionally, because GPC’s current streak of consecutive annual dividend hikes exceeds 50 years, the company is also in an even more exclusive group of just a dozen companies afforded the Dividend Kings designation. Even within that most exclusive group, GPC, with the Procter & Gamble Company (NYSE:PG) and the Dover Corporation (NYSE:DOV), is one of only three companies with more than 60 consecutive years of dividend hikes.

While flat over the past year and up less than 20% over the past five years, the company’s share price has more than doubled since its nearly 50% drop in the aftermath of the 2008 financial crisis and is right back at its long-term growth trend average.

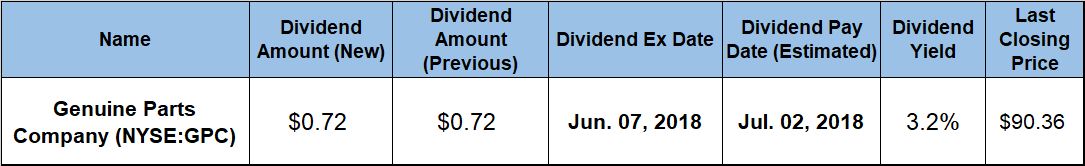

Fears of interest rate hikes and rumors about tariff retaliations caused the share price to drop nearly 20% in February and March 2018. However, with new indications that the tariff situation on automotive products might improve for U.S.-based manufacturers and distributors, GPC’s share price might bounce back and resume its steady rise. The Genuine Parts Company will distribute its next dividend payments on the July 2, 2018, pay date to all its shareholders of record prior to the company’s next ex-dividend date on June 7, 2018.

Genuine Parts Company (NYSE:GPC)

Headquartered in Atlanta, Georgia, and founded in 1928, the Genuine Parts Company distributes automotive replacement parts through its network of 1,100 NAPA Auto Parts stores. Additionally, the company distributes industrial replacement parts, office furniture, general office and school supplies, technology products, wires and cables, connectivity solutions, insulating and conductive materials and specialty coated materials to original equipment manufacturers. The company distributes its products in the United States, Canada, Mexico, Australis, New Zealand, France, the United Kingdom, Germany and Poland. Currently, the company operates 57 automotive parts distribution centers, 14 distribution and 43 service industrial replacement parts and related supplies centers, as well as 55 office furniture and supplies distribution centers.

The company’s share price entered the trailing 12-month period on a downtrend and continued to fall an additional 13% before bottoming out and closing at $80.48 on August 15, 2017. After the 52-week low in mid-August 2017, the share price experienced some volatility but ultimately rose nearly 34% to reach its 52-week high of $107.58 on January 26, 2018.

After the January peak, the share price declined with the rest of the markets and dropped below $87 by the end of March 2018. Since that decline, the share price has regained some of its losses and closed on May 29, 2018, at $90.36, which was still 16% short of the January peak and 2.4% below its level from one year earlier. However, the $90.36 closing price was also 12.3% higher than the 52-week low from mid-August 2017 and 17% higher than it was five years ago.

The company’s current quarterly payout of $0.72 is 6.7% higher than the $0.675 dividend amount paid in July 2017. This new quarterly dividend amount converts to a $2.88 annualized distribution for 2018 and currently yields 3.2%. While aided slightly by the small share price decline, the current dividend yield is 18% higher than GPC’s 2.7% average yield over the past five years.

Additionally, the company’s current 3.2% yield is 61% above the average yield of the entire Services sector, nearly 130% higher than the 1.4% average yield of the Auto Parts Distributors industry segment and more than 50% higher than the average yield of just the dividend-paying companies in the segment. The company increased its total annual dividend three-fold over the past two decades, which corresponds to a 5.4% average annual growth rate.

Even with the slight share price decline over the past year, the company’s dividend distributions managed to overcome that decline and offered a total return of nearly 4% over the past 12 months. The total return over the past three years was slightly better at 6.4% and the total return over the past five years came in at nearly 28%.

Related Articles:

5 Best Dividend Aristocrats to Buy Now

The Dividend Aristocrats Investing Strategy and Stocks List

The Best Dividend Aristocrats ETFs

Why Invest in the Dividend Aristocrats?

The S&P 500 Dividend Aristocrats — Everything You Need to Know

What are the Dividend Aristocrats?

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic