Global Net Lease Offers Shareholders 10% Dividend Yield (GNL)

By: Ned Piplovic,

Featured Image Source: Company Website

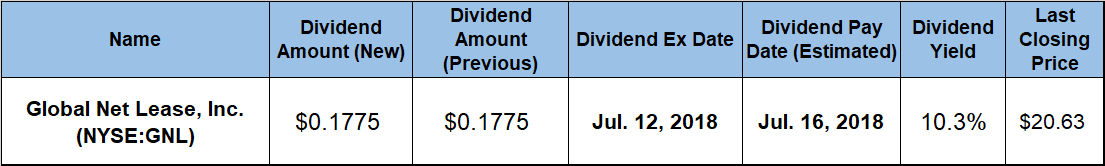

Global Net Lease, Inc. (NYSE:GNL) has been paying a steady monthly dividend since it started dividend distributions in July 2015 and currently offers its shareholders a 10.3% dividend yield.

While the trust has not boosted its dividend amount since it started paying dividends in mid-2015, Global Net Lease has paid the consistent $0.1775 monthly distribution over the past 39 consecutive periods. However, the REIT’s share price slow decline since June 2015 has maintained a high dividend yield.

The share price bottomed out in February 2018, which marked a 43% decline from the 2015 initial public offering (IPO) price. However, since reaching its low in February 2018, the share price has been on a rising trend and recent technical indicators hint at a possible continuation of the recent uptrend, at least over the near term.

The main draw of this equity is its high dividend yield. The share price has not shown any indication of a sharp rise. Therefore, investors interested in the noteworthy monthly dividend income distributions should complete their own research and decide whether this equity would be a good fit with their current investment strategy.

The trust will distribute its next dividend on the July 16, 2018, pay date to all the shareholders of record prior to the July 12, 2018, ex-dividend date.

Global Net Lease, Inc. (NYSE:GNL)

Based in New York, New York and founded in 2015, Global Net Lease, Inc. is a publicly-traded real estate investment trust (REIT) that focuses on acquiring and managing a globally-diversified portfolio of strategically-located commercial real estate properties. The company focuses on operating leasable space in the United States (49%) and six countries in Europe that have the strongest sovereign debt rating – the United Kingdom (22%), Germany (9%), the Netherlands (7%), Finland (6%) France (5%) and Luxembourg (2%). The REIT’s total portfolio comprises 327 facilities with nearly 24 million square feet of leasable space with a current occupancy rate of 99.5%. These facilities support more than 100 tenants across more than 40 different industries. The majority of the REIT’s assets – 58% – are office facilities, 19% are industrial buildings, 14% support distribution operations and 9% are retail locations. The Unites States General Services Administration, the FedEx Corporation (NYSE:FDX) and Amec Foster Wheeler plc (NYSE:AMFW) are the REITs top three clients, each occupying 5% of the trust’s total leasable space.

As already indicated, the trust has been distributing a flat $0.1775 monthly dividend payout for more than three years. This monthly payout amount is equivalent to a $2.13 annual dividend payout and a 10.3% forward dividend yield. This current yield is almost 240% higher than the 3.06% average yield of the entire Financials sector and more than twice the nearly 5% simple average yield of all the GLT’s peers in the Office and Industrial REIT segments.

As a continuation of the downtrend that started in June 2015, the share price started the current trailing 12-month period from its 52-week high of $22.59. From there, the share price continued to decline and dropped almost 31% before it bottomed out on February 28, 2018 at its 52-week low of $15.64, which was also the all-time low since the REITs IPO price in June 2015. However, the share price reversed trend after its February low and recovered 70% of its losses since the July 2017 high to close on July 3, 2018 at $20.63. This closing price was still 8.7% short of the 52-week high from one year ago but almost 32% above the 52-week low from February 2018.

Most importantly, after lingering below the 200-day Moving Average (MA) for more than a year, the 50-day MA reversed direction and is moving higher. The 50-day MA moved from 16.5% below the 200-day MA in mid-April 2018, to being virtually even on July 3, 2018. Additionally, the share price has remained above both the 50-day and the 200-day MA since June 18, 2018. The share price continued to rise and is currently 6.4% above both moving averages. These technical indicators hint that the share price might have more upside over the near term.

While a rising dividend will decrease the dividend yield, the combined benefit could reward shareholders with higher total return than the 2.7% and 3.1% total return rates over the past 12 months and three years, respectively.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic