Halliburton Company Offers 4% Dividend Yield (NYSE:HAL)

By: Ned Piplovic,

Assisted by a share price pullback, the Halliburton Company (NYSE:HAL) offers a steady dividend income and a 4% Dividend Yield.

The share price pullback that began in January 2018 drove the advancement of the current dividend yield. However, the company has been paying dividends for more than six decades. In addition to a long record of dividend payouts, Halliburton has managed to avoid cutting its annual dividend payout over the past two decades. Additionally, during that 20-year period, the company has tripled its annual dividend distribution amount, which corresponds to an average growth rate of 5.4% per year over the past two decades.

Furthermore, the company’s current dividend yield is higher than the yield averages of its industry peers. While the dividend yield looks favorable, investors must note Halliburton’s current dividend payout ratio of nearly 60%. At this level, the payout ratio has spiked above the 50% upper limit generally considered sustainable.

Additional payout ratio increases should raise concerns regarding whether the company will be able to sustain its current dividend payout level. If the payout ratio remains significantly above the 50% level or begins approaching 100%, Halliburton will be forced to cut its dividend payout amount.

However, the 50% upper limit of the sustainable range applies to the overall markets. Certain sectors — generally more industrial sectors like the Basic Materials sector where Halliburton operates — can sustain slightly higher ratios without ill effects on the dividend distributions. Additionally, the current payout increase is a spike above the 38% ratio from last year. Furthermore, based on current analysts’ estimates, next year’s dividend payout ratio should return below 40%. Therefore, income investors should monitor the payout ratio over the next few periods to make sure that the ratio indeed returns to sustainable levels.

As with all investment decisions, investors must conduct their own stock analysis to confirm the compatibility of any potential equity investment with their overall portfolio strategy. While the current share price decline might persist a little longer, investors whose analysis indicates a likely price trend reversal might consider taking advantage of the currently discounted prices for taking a long position in Halliburton stock.

The Halliburton Company (NYSE:HAL)

Headquartered in Houston, Texas, and founded in 1919, the Halliburton Company provides a range of services and products to oil and natural gas companies worldwide. The company’s Completion and Production segment offers production enhancement services, including stimulation and sand control services, as well as cementing services, such as well, well casing and casing equipment bonding. Additionally, this segment also provides completion tools that offer downhole solutions and services, including well completion products and services, liner hanger and sand control systems. Furthermore, this segment offers oilfield completion, production and downstream water and process treatment chemicals and services, as well as electrical submersible pumps, progressive cavity pumps and artificial lift services.

The Drilling and Evaluation segment provides drilling fluid systems, performance additives, completion fluids, solids control, specialized testing equipment, waste management services, drilling systems and associated services. This segment also offers drill bits and services comprising roller cone rock bits, fixed cutter bits, hole enlargement, related downhole tools and services, as well as coring equipment and services. In addition, this segment provides integrated exploration, drilling, and production software, as well as related professional and data management services. Part of this segment’s offerings are also testing and subsea services, as well as project management, consulting, integrated asset management, well control and prevention services.

Dividends

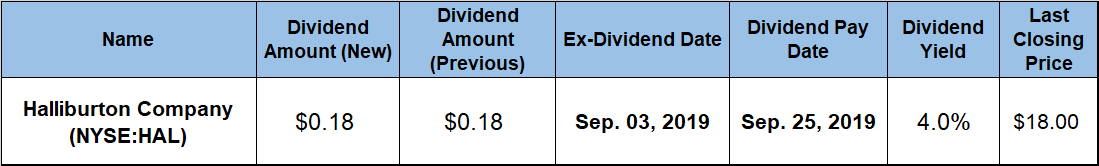

The current $0.18 quarterly dividend is the same amount which the company has been paying for the past four years. This $0.18 quarterly payout amount is equivalent to a $0.72 annualized distribution and a 4% forward dividend yield. While the share dividend payout amount has remained the same, the share price pullback pushed the current dividend yield 80% above the company’s own 2.21% average yield over the past five years.

In addition to outperforming its own five-year average, Halliburton’s current dividend yield is also nearly 50% above the 2.68% simple average yield of the entire Basic Materials sector. Additionally, Haliburton’s current yield is also more than double the 1.95% simple yield average of all the companies in the Oil & Gas Equipment & Services industry segment.

The company has boosted its annual dividend six times in the past two decades. However, half of those hikes occurred in the past seven years. Additionally, two-thirds of the dividend amount increase has occurred since 2012. Despite four years of flat annual dividend payouts, Halliburton doubled its annual dividend payout amount during the last seven years, which corresponds to an average dividend payout growth rate of 10.4% per year since 2012. Even with just one dividend boost since 2014, the company’s average annual dividend growth rate is still almost 4.9% over the last five years.

The company will distribute the next dividend installment to all its shareholders of record on the pay date scheduled for September 25.

While a rising dividend yield is desirable, the yield nearly doubled because of a share price reduction of more than 50% over the trailing 12 months. Therefore, existing shareholders lost significantly more from asset depreciation than they gained from dividend income distributions.

However, Halliburton has delivered strong financial results for 2018 and also has exceeded analysts’ earnings expectations over the last four consecutive quarters. Therefore, if Halliburton’s recovery continues, new investors that invest in the Halliburton stock now might be in a good position to reap the benefits of any share price recovery.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic