IBM Corporation Offers Shareholders 4.7% Dividend Yield (IBM)

By: Ned Piplovic,

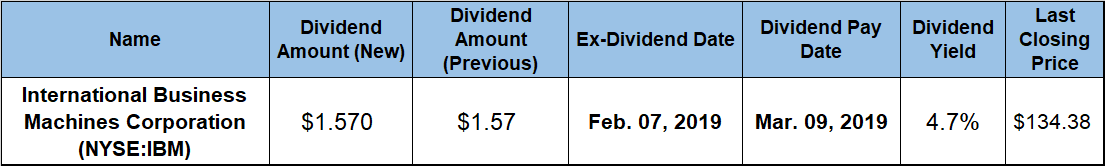

While boosting its annual dividend payout every year for two decades, the International Business Machines Corporation (NYSE:IBM) currently offers its shareholders significant income distributions with a dividend yield of 4.7%.

In addition to the steady annual dividend growth, the company’s recent share-price pullback contributed to a 9.3% dividend yield increase from 4.3% to the current 4.7% level in the last six months. Currently down almost 20% from one year ago, IBM’s share price fell more than 30% from its all-time high of more than $213 in 2013. However, IBM has a strong record of long-term share-price growth that matches its record of boosting dividend annually for two decades.

Since divesting its personal computer business in 2005 to refocus its core business on cloud storage, Artificial Intelligence (AI) and data analytics, IBM has gone through a significant transformation and is working on establishing itself as a leader in the highly competitive information technology (IT) services sector.

The current share price drop of nearly 20% over the past 12 months is hopefully just a temporary paper loss for existing long-term shareholders. Therefore, if IBM’s current initiatives bear fruit, the current price drop might be an opportunity for new investors to take a position in the IBM stock at discounted rates. In the meantime, investors can collect a steady dividend income with a 4.7% yield on their investments. To claim eligibility for the next round of dividend distributions on the company’s March 9, 2018, pay date, investors must become a shareholder of record before the February 7, 2019, ex-dividend date.

International Business Machines Corporation(NYSE:IBM)

Headquartered in Armonk, New York, and formed in 1911 as the Computing-Tabulating-Recording Company, the International Business Machines Corporation assumed its current name in 1924 and operates as an integrated technology and services company worldwide. The company’s Cognitive Solutions segment offers Watson – a cognitive computing platform that interacts in natural language, processes big data and learns from interactions with people and computers. In addition to Watson, this segment also offers data analytics solutions and transaction processing software that runs mission-critical systems in banking, airlines and retail industries. The company’s Global Business Services segment offers business consulting services, application management services for packaged software applications, as well as finance, procurement, talent engagement and industry-specific business process outsourcing services.

Additionally, the Technology Services & Cloud Platforms segment provides cloud and outsourcing services, as well as technical support and integration software solutions. The company’s Systems segment offers servers, data storage products and the z/OS enterprise operating system. IBM’s Global Financing segment provides lease, installment payment plans, loan financing services and short-term working capital financing to suppliers, distributors and resellers, as well as remanufacturing and remarketing services.

The company’s $1.57 upcoming quarterly dividend is equivalent to a $6.28 annualized distribution amount and corresponds to the 4.7% forward dividend yield. IBM managed a 3.6% average dividend yield over the past five years. Therefore, the current 4.7% dividend yield is 29% higher than the company’s own five-year average.

In addition to outpacing its own average yield over the past five years, IBM’s current dividend yield also outperforms the average yields of the company’s industry peers. IBM’s current 4.7% yield is 280% above the 1.2% average yield of the entire Technology sector. This dividend yield disparity is understandable because most technology companies funnel bulk of their earnings back into product research and development. Just a small portion of companies in the Technology sector even offer dividend distributions to their shareholders. Generally, only well-established and mature technology companies generate enough earnings to distribute note-worthy dividend income payments.

Additionally, even within the Diversified Computer Systems industry segment, IBM’s current dividend yield is 146% higher than the segment’s 1.9% current dividend yield average. As the highest dividend yield in the Diversified Computer Systems segment, IBM’s current yield is 22% above the segment’s 3.18% simple yield average and nearly 60% ahead of Hewlett Packard Enterprise Company’s (NYSE:HPE) 2.93% dividend yield, which is the second-highest yield in the sector.

IBM has enhanced its total annual dividend distribution amount more than 13-fold since embarking on its current consecutive streak of annual dividend hikes 20 years ago. The average dividend growth rate over the past two decades is 14.6% per year. Even the more recent annual dividend growth rates are at double-digit percentage levels. IBM Managed to maintain a 12.7% annual growth rate over the past decade and an 11% growth rate over the past five years.

The company’s share price decline nullified all dividend benefits and delivered a total loss of more than 14% over the past 12 months. However, the total return on shareholders’ investment exceeded 23% for the current three-year period.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic